Key Takeaways

- HOA reserve funds are the community’s savings account for major repairs, replacements, and future financial obligations—not for daily expenses.

- Strong HOA reserves are what separate a healthy community from one facing constant financial stress.

- Reserve funds protect property values, reduce financial burdens, and prevent the need for sudden special assessments.

- Common uses include roof replacement, major pool repairs, playground equipment replacement, and other large-scale projects that keep the community strong.

- A reserve study helps determine the amount of money needed to cover replacement costs and maintain a healthy reserve fund.

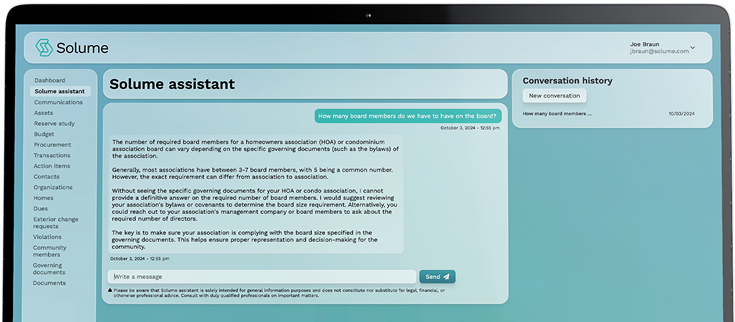

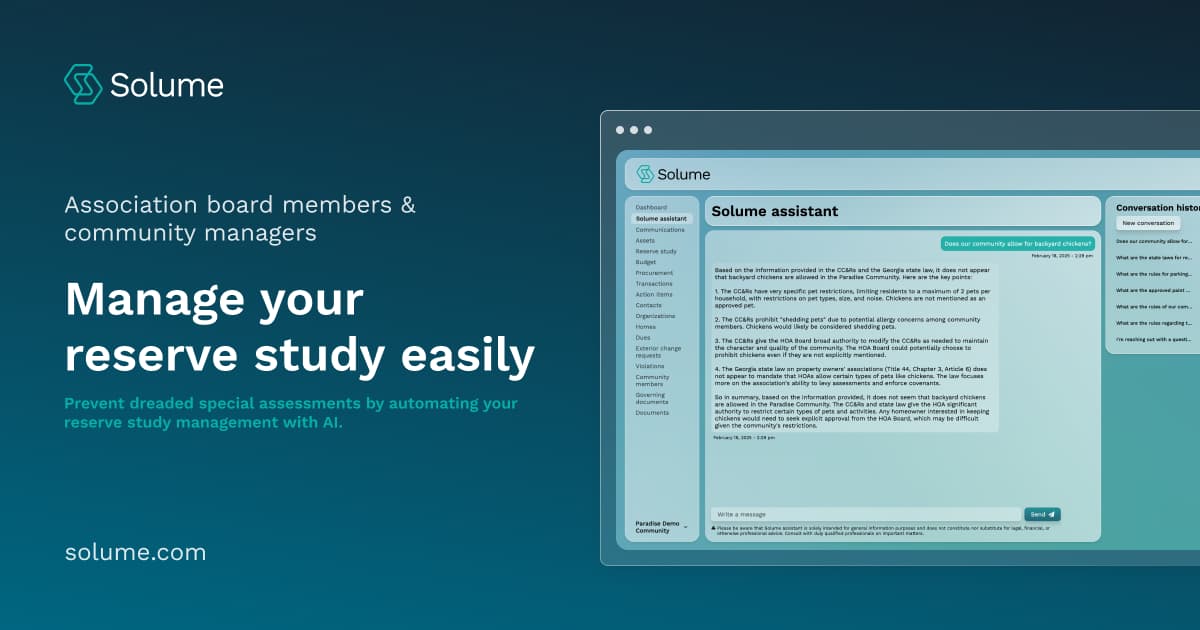

- Solume’s platform is the only all-in-one tool that lets Condo Associations and HOAs connect their reserve funding, budgets, and vendor procurement in real time—making complex financial planning simple enough for any HOA Board Member to manage.

Understanding HOA Reserve Funds and Their Intended Purpose

What Are HOA Reserve Funds?

Consider reserve funds as the obligatory savings account for your Condo Association or Homeowners Association, which will be used for the distant future. Unlike the operating fund, which will cover the daily running expenses such as paying for the utilities, landscaping, and janitors, the funds in the operating reserve will exclusively be used for replacement projects and major repairs. They are not for daily spending.

For example, repairing a sidewalk with cracks will come from the operating fund, but knowing that you will eventually have to replace all the sidewalks in the community, which significantly depends on the timeframe in which you do it, is a benefit from the reserve fund. The balance needs to protect the well-being of the community. This means that the money set aside as reserves serves as a guarantee to cover future expenses related to its liabilities.

Why Are HOA Reserve Funds Important?

When it comes to having well-managed reserve funds, it is a mandate that you have to take. It is just like planting an orchard, where you do not want to plant a tree for the purpose of having fruit in a week, but rather in the future, where the community will benefit greatly from it. This is an example of having a reserve fund and not having any. The resources set aside will greatly help address the issues of a broken roof, a cracking pool, and a crumbling parking lot without putting any strain on the members.

And if you’ve ever sat in a board meeting wondering how you’ll explain yet another unexpected assessment to your neighbors, you’re not alone. Many Condo Association or HOA Board Members have felt that pressure. Reserves exist to eliminate that anxiety by preparing for what everyone knows will eventually come.

- They preserve property values by maintaining shared spaces in a functional and attractive condition.

- They protect association members from sudden financial burdens when unexpected expenses arise.

- They prepare the community for future repairs, such as roof replacements, parking decks, or other structural upgrades.

When a reserve is underfunded, the board faces a decision akin to a crisis. They have no alternative but to borrow funds, imposing a disturbing special assessment on the owners, or rationing the minimal maintenance composition. None of these options offers good management. A well-funded reserve brings stability, confidence, and lasting stability for the community.

Common Uses of HOA Reserve Funds

Too many uninformed boards treat reserve funds like a pot of "extra money" that can be dipped into when the operating fund runs thin. That thinking is dangerous. Reserve funds are not leftovers or optional savings—they are earmarked for large-scale projects and the association’s assets that every member depends on. Typical uses of reserve funds include:

- Roof replacement or structural repairs for community buildings.

- Major renovations, such as repaving parking decks or upgrading elevators.

- Pool repairs, replacing pool pumps, or modernizing the community pool.

- Replacing playground equipment or resurfacing tennis and basketball courts.

- Covering insurance deductible payments when disasters strike.

- Funding major landscaping projects that go beyond routine lawn care.

- Addressing long-term wear and tear on community systems and shared spaces.

- Reserve funds also ensure that common areas like lobbies, clubhouses, and shared green spaces remain in good condition for every resident.

As a Condo Association or HOA Board Member, it’s your job to see the difference between wants and needs. Owners may want new pool furniture, but if the clubhouse roof is leaking, that amount of money should go toward a roof replacement first.

The Role of HOA Reserve Studies in Reserve Fund Planning

What Is an HOA Reserve Study?

A HOA Reserve Study is the roadmap. It's the data to ensure the community knows what's upcoming. Conducted by a reserve analyst or Reserve Specialist, it evaluates the useful life of every major component in the community. From structural elements like parking garages and windows, to mechanical systems like elevators and HVAC, the study outlines replacement costs and the timeline for future repairs.

It also calculates your reserve needs: how much must be contributed each year to maintain an adequate reserve. This isn’t guesswork. It’s data-driven, engineering-informed financial planning.

How Reserve Studies Benefit HOA Finances

A reserve study is one of the most valuable tools in financial management. It helps boards:

- Avoid funding crises and keep a healthy reserve fund.

- Prevent HOA Reserve Fund Is Underfunded scenarios that trigger special assessments.

- Boost lender confidence, since mortgage companies want assurance that the community won’t face insolvency.

- Improve resale values, because buyers look for communities with strong reserves and long-term stability.

Solume works with a network of Reserve Specialists nationwide. While the specialists provide the professional studies, Solume’s platform integrates those numbers into a dynamic dashboard, allowing boards to test multiple funding plans, forecast shortfalls, and know exactly how much money they’ll need years in advance. Read more here.

Best Practices for Managing HOA Reserve Funds

All Community Associations sustain the level of preservation for which they have allocated adequate funds, along with which, the reserve funds are the primary focus. Managing the finances of an association is not just about managing costs for the current period; it is also about securing the future. Key best practices include:

- Follow state laws and the association’s governing documents. Many states, like Florida and California, have strict reserve requirements.

- Conduct reserve studies on a regular basis. At least every 3–5 years, or more often for aging properties.

- Accurate planning of reserves also prevents sudden spikes in HOA dues, which can frustrate members and damage trust.

- Collaborate with Community Managers and consider a property management partner, but don’t outsource responsibility. One HOA client told us, “It’s crazy to me that the reserve study is one of the most important parts of managing a community, and more often than not, property management companies don’t pay any attention to them.” Even when a property manager is involved, the board must stay directly engaged in reserve planning.

- Plan for financial gaps. Use credit lines or temporary special assessments only if absolutely necessary.

- Consult a tax professional to understand your community's tax implications and protect the association’s financial health.

Solume’s Reserve Study and reserve fund management features allow boards to see projected replacement projects, align reserves with the operating fund, and keep every decision connected to real numbers. This is how a board stays in control instead of falling behind.

How HOA Reserve Funds Support the Community

When managed well, reserves provide more than cash on hand; they provide community stability, confidence, and clarity for both the board and the community. This isn’t about stockpiling funds with no purpose; it’s about giving every Condo Association or HOA Board Member the assurance that tomorrow’s obligations won’t become tomorrow’s crisis. Here’s how:

- They protect property values by funding necessary major repairs and, at times, larger routine maintenance. They protect property values by funding necessary major repairs, not necessarily regular maintenance, and routine upkeep that owners expect.

- They reduce financial burdens on association members by preventing surprise special assessments.

- They preserve community assets like the community pool, playgrounds, and parking decks.

- They ensure stability for the association’s reserve and its assets.

- They give transparency to members through tools like board updates, newsletters, or even a quick Facebook share.

Reserves are the glue holding everything together. Without them, cracks appear—sometimes literally. With them, every HOA Board Member knows they are doing their fiduciary duty to safeguard the future of their community.

To bring this home, think of reserves like a safety net at a circus. The acrobats perform with confidence because they know the net is there if they fall. Without reserves, every misstep is a disaster. With reserves, the show goes on, and the community thrives.

Strategic Insights and Next Steps for HOA Reserve Planning

So, what can HOA reserve funds be used for? Large repairs and replacements for your community’s long-term survival. They are not for daily expenses. They are for protecting roofs, pools, roads, and everything else that defines your community’s quality of life. Homeowners association reserve funds are not optional; they are the financial foundation of every long-term plan.

Solume is the only all-in-one platform that makes this process transparent, manageable, and accurate. By integrating your HOA reserve account with the operating fund, budgets, and vendor procurement, Solume ensures you always know the amount of money needed to meet your future financial obligations.

If you want to finally sleep again, get out from underneath heated budget meetings and the blame game when reserves fall short, Solume provides the tools boards need. It’s not just about managing numbers—it’s about protecting neighbors, preserving trust, and keeping the community strong.

If you want stability and foresight for your Condo Association or HOA Board Members, don’t wait until your HOA’s reserve fund is underfunded. Take control. Create a plan. And give your neighbors what they deserve: a community with strength, foresight, and resilience.

Learn more about how reserve funds work in our deep dive here.