Managing a homeowners association (HOA) or Condo Association is no small task. From budgeting to maintenance, the responsibilities can be overwhelming. Yet, one essential area often overlooked is the reserve study—a crucial tool for ensuring your HOA’s financial health. But did you know that laws governing reserve studies vary by state?

If you’re a Condo board member or part of a self-managed HOA, understanding these requirements isn’t just important—it’s mandatory. Let’s break it down for you, state by state, so you can stay compliant and secure your community’s future.

While this guide reflects the most accurate research as of January 2025, laws are updated regularly. Readers should consult each state’s written laws for the most current and accurate information.

What Is a Reserve Study, and Why Does It Matter?

A reserve study evaluates your HOA’s long-term maintenance needs and helps you plan for major repairs and replacements of common area components—from roofs to roads.

Think of it like a roadmap for your HOA’s financial planning. Without it, your association could face unexpected expenses, leading to higher dues or dreaded special assessments.

Why State Laws Matter

Each state sets its own requirements for reserve studies. Whether it’s how often you need one, what it should include, or if it’s required at all, these laws impact how you operate. Understanding and adhering to these laws can help avoid legal pitfalls and financial missteps.

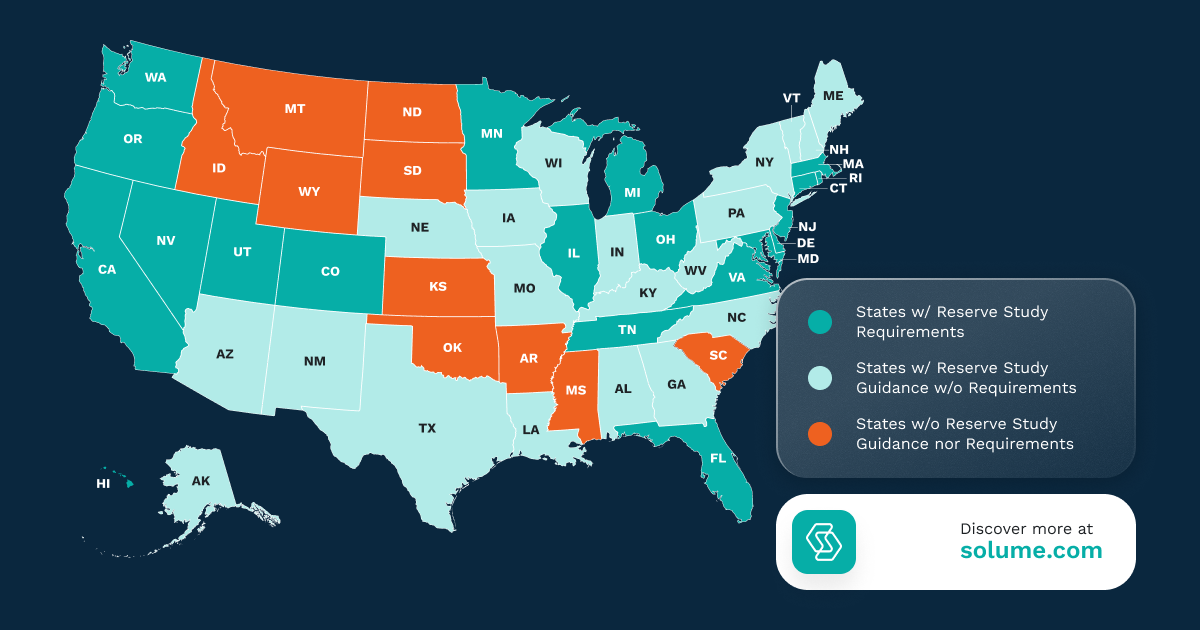

For quick reference, based on current legislation, the following states have laws requiring HOAs and condominium associations to conduct reserve studies:

- California: Associations must visually inspect major components every three years as part of a reserve study, with annual reviews and adjustments as necessary. We have written an extensive article on California HOA Reserve Study requirements.

- Colorado: Associations must prepare reserve studies for the portions of the community they maintain, repair, replace, and improve. We have written an extensive article on Colorado HOA Reserve Study requirements.

- Delaware: Condominium declarations must mandate the creation and maintenance of a fully funded repair and replacement reserve based on a current reserve study.

- Florida: Condominium associations are required to conduct structural integrity reserve studies by December 31, 2024, with annual budgets including reserve accounts for specific items. We have written an extensive guide covering Florida HOA reserve study requirements.

- Hawaii: Condominium budgets must include estimated replacement reserves based on a reserve study, which must be reviewed or updated at least every three years.

- Maryland: Condominium governing bodies must conduct a reserve study by October 1, 2023, if none was done after October 1, 2018, with updates every five years thereafter.

- Nevada: Associations are required to conduct reserve studies at least every five years, with annual reviews to assess sufficiency and necessary adjustments.

- New Jersey has significant requirements for structural inspections and reserve studies for certain residential buildings, particularly condominiums and cooperatives.

- Oregon: Associations are encouraged to prepare and maintain reserve studies for common property maintenance, repair, and replacement.

- Tennessee: Condominium boards that have conducted a reserve study on or after January 1, 2023, must update it within five years and continue to do so every five years thereafter.

- Utah: Associations are required to conduct reserve studies periodically, with reviews or updates at least every six years.

- Virginia: Associations must conduct a reserve study at least once every five years to determine the necessity and amount of reserves required to repair and replace common elements.

- Washington: Associations are encouraged to perform reserve studies every three years unless doing so would impose an unreasonable hardship, with annual updates. We have written an extensive guide covering Washington HOA reserve study requirements.

While we've highlighted 13 states that mandate reserve studies for HOAs and condominium associations, it's crucial to understand that each state's legislation has unique requirements and nuances.

These laws can vary significantly in terms of:

- Frequency of Studies: Some states require annual updates, while others may mandate studies every few years.

- Scope and Depth: The components that must be assessed and the level of detail required can differ.

- Funding Requirements: Certain states specify funding levels or methodologies based on the reserve study findings.

Reviewing the specific laws applicable to your state is essential to ensuring compliance and effective financial planning.

Below, we've provided detailed information for each state to help you navigate these requirements. It's important to note that states on the map below might be highlighted that have reserve-study laws, but that don't necessarily require that they be professionally conducted by an outside engineer or professional. Some states have reserve requirements that don't require a formal reserve study to be conducted.

Alabama

Reserve studies are not required by law in Alabama. However, conducting one regularly is strongly recommended to ensure financial stability.

Alaska

Alaska does not mandate reserve studies but encourages them for long-term financial planning.

Arizona

Arizona Revised Statutes § 33-1260 do not require HOAs or Condo associations to conduct reserve studies or maintain reserve funds. However, the law mandates disclosure of reserve funds and any reserve studies conducted during the resale of a condo unit or single-family lot.

Title 33 of the Arizona Revised Statutes (A.R.S.) encompasses property laws, including those governing condominiums and planned communities, commonly known as homeowners associations (HOAs).

Condominiums:

- Chapter 9 of Title 33 explicitly addresses condominiums. According to A.R.S. § 33-1201, this chapter applies to all condominiums created within Arizona, regardless of their creation date.

- While A.R.S. § 33-1243 allows condominium associations to adopt budgets that include reserves for common expenses, there is no statutory requirement to perform reserve studies or maintain specific reserve fund levels.

Planned Communities (HOAs):

- Chapter 16 of Title 33 pertains to planned communities. A.R.S. § 33-1802 defines a planned community as a real estate development where a nonprofit corporation or unincorporated association of owners is established to manage, maintain, or improve the property.

- Similarly, A.R.S. Title 33, Chapter 16, which governs planned communities, does not require HOAs to conduct reserve studies or maintain reserve funds.

While not legally mandated, conducting regular reserve studies is considered a best practice for associations to ensure financial preparedness for future capital expenditures.

Read more about Arizona's state requirements here.

Arkansas

Reserve studies are not legally required in Arkansas. However, conducting one is considered a best practice for maintaining an HOA's financial health.

California

California has one of the most stringent reserve study requirements for HOAs. Under California Civil Code § 5550, associations are mandated to conduct a reserve study every three years and review it annually. This ensures that HOAs effectively plan to maintain and replace major components, promoting financial health and stability within the community. The statute does not differentiate between HOAs and condominium associations; it broadly uses "common interest development" to encompass both.

Key Takeaways:

- Mandatory Reserve Studies: HOAs must perform reserve studies every three years, including a visual inspection of major components.

- Annual Review: Boards are required to review and update reserve studies annually to ensure sufficient reserves.

- Comprehensive Planning: Reserve studies must identify components requiring reserves, estimate costs, and provide a funding plan to meet future repair and replacement needs.

“(a) At least once every three years, the board shall cause to be conducted a reasonably competent and diligent visual inspection of the accessible areas of the major components that the association is obligated to repair, replace, restore, or maintain as part of a study of the reserve account requirements of the common interest development, if the current replacement value of the major components is equal to or greater than one-half of the gross budget of the association, excluding the association’s reserve account for that period. The board shall review this study, or cause it to be reviewed, annually and shall consider and implement necessary adjustments to the board’s analysis of the reserve account requirements as a result of that review.

(b) The study required by this section shall at a minimum include:

(1) Identification of the major components that the association is obligated to repair, replace, restore, or maintain that, as of the date of the study, have a remaining useful life of less than 30 years.

(2) Identification of the probable remaining useful life of the components identified in paragraph (1) as of the date of the study.

(3) An estimate of the cost of repair, replacement, restoration, or maintenance of the components identified in paragraph (1).

(4) An estimate of the total annual contribution necessary to defray the cost to repair, replace, restore, or maintain the components identified in paragraph (1) during and at the end of their useful life, after subtracting total reserve funds as of the date of the study.

(5) A reserve funding plan that indicates how the association plans to fund the contribution identified in paragraph (4) to meet the association’s obligation for the repair and replacement of all major components with an expected remaining life of 30 years or less, not including those components that the board has determined will not be replaced or repaired.”

We have written an extensive article on California HOA Reserve Study requirements.

Colorado

As of January 2025, Colorado law mandates that homeowners' associations (HOAs) and condominium associations conduct reserve studies to ensure adequate funding for the maintenance, repair, and replacement of common property elements. House Bill 22-1387, enacted in 2022, established this requirement, specifying that associations must perform reserve studies and maintain reserve funds accordingly.

Before this legislation, the Colorado Common Interest Ownership Act (CCIOA) required associations to adopt a policy addressing reserve studies, including details on when studies would be conducted and whether they were based on physical and financial analyses. However, conducting the reserve studies themselves was not mandatory.

With the enactment of HB22-1387, associations are now obligated to perform reserve studies to ensure proper financial planning for future capital expenditures. This legislative change underscores the importance of proactive maintenance and financial preparedness within common interest communities in Colorado.

It's important to note that while the law requires reserve studies, it does not specify their frequency. Industry best practices typically recommend updating reserve studies every three to five years to ensure they accurately reflect the association's assets' current condition and funding needs.

Read more about Colorado's specific laws here.

Connecticut

Connecticut has no statutory requirement for homeowners associations (HOAs) to conduct reserve studies, but the Connecticut Common Interest Ownership Act (CIOA) emphasizes the importance of financial transparency and prudent budgeting. Specifically, Connecticut General Statutes § 47-261e mandates that the executive board of an association must annually adopt a proposed budget, which includes:

- Statement of Reserves: A summary indicating the amount of any reserves.

- Calculation Basis: An explanation of the basis on which such reserves are calculated and funded.

Additionally, Connecticut General Statutes § 47-264 requires that resale certificates provided to prospective buyers disclose:

- Reserve Fund Balance: The total amount of any reserves for capital expenditures.

- Reserve Calculations: The basis on which such reserves are calculated.

While the law does not mandate the performance of reserve studies, these provisions highlight the necessity for associations to maintain and disclose reserve funds, ensuring financial preparedness for future capital expenditures. Regular reserve studies are considered a best practice for accurately assessing and planning for the maintenance, repair, and replacement of common property elements. Industry standards typically recommend updating reserve studies every three to five years to ensure they reflect the association's assets' current condition and funding needs.

Delaware

According to Delaware Uniform Common Interest Ownership Act (DUCIOA) Section 81-205, the declaration for a condominium or cooperative must include provisions that mandate the association to create and maintain a fully funded repair and replacement reserve based on a current reserve study.

Section 81-315 specifies that the association's budget must include a line item for repair and replacement reserve contributions. The minimum percentage of the budget allocated depends on the components and systems the association maintains.

Section 81-409 also requires that a resale certificate provided to a purchaser must include the most recent reserve study.

These provisions ensure that associations are financially prepared for future repairs and replacements of common elements.

Florida

In response to the tragic collapse of the Champlain Towers South in Surfside, Florida, in June 2021, the state has implemented significant legislative changes to enhance the safety and financial preparedness of condominium and cooperative associations. These measures are primarily encapsulated in Senate Bill 4-D (SB 4-D), enacted in May 2022, and its subsequent amendment, Senate Bill 154 (SB 154), passed in 2023.

Structural Integrity Reserve Study (SIRS) Requirements:

- Mandatory Reserve Studies: Associations managing buildings three stories or higher are now required to conduct a Structural Integrity Reserve Study (SIRS) every 10 years. The initial SIRS must be completed by December 31, 2024; subsequent studies are due every decade thereafter. Based on a visual inspection conducted by a licensed engineer or architect, this study assesses the reserve funds necessary for future major repairs and replacements of common areas.

- Reserve Funding Obligations: Effective January 1, 2025, associations are prohibited from waiving or reducing reserve funding for specific structural components identified in the SIRS. These components include roofs, load-bearing walls, foundations, fire protection systems, plumbing, electrical systems, waterproofing, windows, and any other item with a deferred maintenance expense or replacement cost exceeding $10,000.

Implications for Associations:

- Budgetary Adjustments: Associations must incorporate the SIRS's findings and funding recommendations into their annual budgets, ensuring that sufficient reserves are allocated to maintain and replace critical structural components. This may necessitate increased assessments or dues to meet the mandatory reserve funding levels.

- Enhanced Transparency and Reporting: The new legislation mandates greater financial reporting and reserve fund management transparency. Associations are required to provide unit owners with detailed financial reports, including reserve studies, and maintain these records for a minimum of 14 years.

Georgia

Georgia does not have laws requiring homeowners associations (HOAs) to conduct reserve studies. However, an HOA's governing documents, such as the Covenants, Conditions, and Restrictions (CC&Rs) and bylaws, may stipulate the need for a reserve study. Therefore, board members should review these documents to determine any specific requirements.

Hawaii

Hawaii mandates reserve studies under Hawaii Revised Statutes (HRS) § 514B-148, with updates required every three years. However, there is no equivalent requirement for non-condominium HOAs under HRS Chapter 421J.

- Mandatory Reserve Studies: Condominium associations in Hawaii are required to conduct reserve studies to assess the funds necessary for future repairs and replacements of common property elements.

- Triennial Updates: These reserve studies must be reviewed or updated at least once every three years to ensure they reflect the current condition and funding needs of the association's assets.

- Independent Review: If an independent reserve study preparer does not prepare the reserve study, it must be reviewed by one at least every three years. A managing agent with industry reserve study designations is not considered a conflict of interest for this purpose.

- Budget Integration: The reserve study's findings must be incorporated into the association's annual budget, detailing estimated replacement reserves, the basis for their computation, and the amount to be collected for the fiscal year.

- Funding Requirements: Associations are required to assess unit owners to fund a minimum of 50% of the estimated replacement reserves or 100% when using a cash flow plan. New associations are exempt from collecting estimated replacement reserves until the fiscal year begins after their first annual meeting.

The governing statute for non-condominium homeowners associations (HOAs), such as planned community associations, is HRS Chapter 421J. This chapter does not explicitly require reserve studies or specific reserve funding levels for these associations. However, it does emphasize the importance of sound financial management and may require associations to maintain adequate reserves as part of their fiduciary responsibilities.

Without a statutory mandate, non-condominium HOAs in Hawaii are encouraged to conduct regular reserve studies as a best practice. This proactive approach helps ensure financial preparedness for future maintenance, repairs, and replacements of common property elements, thereby promoting the association's long-term sustainability and financial health.

It's also essential for these associations to review their governing documents, such as bylaws and covenants, conditions, and restrictions (CC&Rs), as they may contain specific provisions regarding reserve studies and funding requirements. Adhering to these internal guidelines is crucial for compliance and effective community management.

In summary, while Hawaii law mandates reserve studies for condominium associations under HRS § 514B-148, there is no equivalent statutory requirement for non-condominium HOAs under HRS Chapter 421J. Nonetheless, regular reserve studies are recommended for all associations to ensure financial stability and proper maintenance of shared assets.

Idaho

Idaho law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Illinois

Under Illinois Condominium Property Act § 9(c), reserve studies are recommended but not mandatory. However, the Act emphasizes the importance of financial responsibility and planning, requiring associations to include provisions for reserve funds in their budgets. Associations must ensure their budgets adequately reflect future repair and replacement costs, even though conducting a formal reserve study is not explicitly mandated.

- Mandatory Reserve Accounts: Section 9(c)(2) of the Illinois Condominium Property Act requires condominium associations to establish and maintain reasonable reserves for capital expenditures and deferred maintenance.

- Reserve Studies Recommended: Although the Act does not mandate reserve studies, they are recommended as a best practice to determine appropriate reserve funding levels.

- Opt-Out Provision: Associations without a reserve requirement in their declaration may opt out of maintaining a reserve account by a two-thirds vote of the unit owners.

Indiana

Indiana law does not mandate reserve studies, but industry best practice suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Iowa

No law requires HOAs in Iowa to conduct reserve studies. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Kansas

Kansas law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Kentucky

Kentucky law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Louisiana

Louisiana law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Maine

Maine law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Maryland

The Maryland Condominium Act includes specific provisions to ensure proper reserve funding and financial planning for both homeowners associations (HOAs) and condominiums:

Reserve Study Timeline:

- If a condominium or HOA’s governing body conducted a reserve study on or after October 1, 2018, it must update it within five years of the initial date and every five years thereafter.

- If no reserve study was conducted on or after October 1, 2018, the governing body was required to complete one by October 1, 2023, with subsequent updates every five years.

Budget and Funding Requirements:

- Per Section 11-109.2, condominium and HOA councils are authorized to create and amend budgets, including reserve provisions, and to collect assessments from unit owners for common expenses.

- The annual budget must incorporate reserve levels funded according to the latest reserve study.

- If the most recent study is the first conducted, the governing body must achieve the recommended annual reserve funding level within three fiscal years.

Resale Certificate Disclosure:

- Section 11-135 requires that resale certificates disclose the current operating budget, including the reserve fund for repairs and replacements, or indicate if no reserve fund exists.

These provisions, outlined in the Maryland Condominium Act under Sections 11-109.2, 11-109.4, and 11-135, aim to ensure adequate reserves for future repairs and replacements, promoting financial stability and transparency within the community.

Massachusetts

Massachusetts law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Michigan

As of now, Michigan does not legally require condominiums or HOAs to conduct reserve studies. While state law mandates that condominium associations maintain a reserve fund for major repairs and replacements, it does not require a professional reserve study to be completed or updated on a legal timetable.

- Under the Michigan Condominium Act (MCL 559.205), associations must keep a reserve fund for major repairs and replacements of common elements.

- Administrative Rule R 559.511 sets a minimum standard that this reserve fund should equal at least 10% of the association’s annual budget, but this applies to having money in reserve, not requiring a formal reserve study.

So at this time, Michigan’s statute focuses on maintaining a reserve fund, not on mandating a reserve study. Boards often interpret the funding rule as a strong signal they need planning tools, but the law itself doesn’t mandate a study.

Minnesota

Minnesota law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Mississippi

Mississippi law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Missouri

Missouri law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Montana

No law imposes HOA reserve study requirements in Montana. However, an HOA’s governing documents may require one. As such, board members should check their CC&Rs and bylaws.

Nebraska

Nebraska law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Nevada

Nevada Revised Statutes §116.31152 require HOAs and Condos to conduct reserve studies at least once every five years and review them annually.

- NRS 116.3115: Associations are mandated to create and maintain adequate reserves, funded reasonably, to cover the repair, replacement, and restoration of major common elements.

- NRS 116.31152: The association’s executive board is required to:

- Conduct a reserve study at least once every five years.

- Annually review the reserve study to assess whether the reserves are sufficient.

- Make necessary adjustments to the funding plan to ensure adequate funding for the required reserves. Nevada Public Law

New Hampshire

No law imposes HOA reserve study requirements in Montana. However, an HOA’s governing documents may require one. As such, board members should check their CC&Rs and bylaws.

New Jersey

The New Jersey legislation mandating reserve studies for community associations is encapsulated in Senate Bill S2760, signed into law on January 8, 2024. This law amends the Planned Real Estate Development Full Disclosure Act, introducing comprehensive requirements for reserve studies and funding to ensure the proper maintenance and replacement of common area assets.

Key Provisions of Senate Bill S2760:

- Applicability: The law applies to all community associations in New Jersey with common area capital assets totaling $25,000 or more.

- Qualified Professionals: Reserve studies must be conducted by individuals who are either CAI-accredited Reserve Specialists, New Jersey-licensed engineers, or New Jersey-licensed architects

- Update Frequency: Associations are required to update their reserve studies at least once every five years. If an association's last reserve study is more than five years old as of January 8, 2024, or if no study has been conducted, a compliant study must be completed by January 8, 2025. Newly formed associations after January 8, 2024, have up to two years following the election of a majority of the executive board to perform their initial reserve study.

- Funding Plan: The reserve study must include a 30-year funding plan to address projected costs for maintenance and replacement of common area assets.

- Compliance Deadlines:

- Assessment Increases Over 10%: Associations requiring an assessment increase of more than 10% to comply with the 30-year funding plan have up to ten years or until the reserve account is projected to have a negative balance, whichever is shorter, to achieve compliance.

- Assessment Increases 10% or Less: If the necessary assessment increase is 10% or less, the association must comply within two years.

Non-compliance with these requirements may expose board members to personal liability, as they may not be protected under the typical 'business judgment rule.'

New Mexico

New Mexico law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

New York

In New York, the legal requirements for reserve funds and studies differ between condominiums and homeowners associations (HOAs):

Condominiums:

- Reserve Fund Establishment: In New York City, Local Law 70 of 1982, codified as Title 26, Chapter 8 of the New York City Administrative Code, mandates that sponsors of condominium conversions establish a reserve fund. This fund is designated exclusively for capital repairs, replacements, and improvements necessary for the health and safety of residents. The sponsor must transfer the fund to the condominium's board of managers within 30 days after the closing of a conversion pursuant to an offering plan.

- Funding Amount: The required amount for the reserve fund is determined based on a formula outlined in the Reserve Fund Law. Sponsors have two options:

- Full Funding: Contribute the entire reserve fund within 30 days after the first closing.

- Phased Funding: Fund the reserve over five years, starting with a mandatory initial contribution of at least 1% of the total price.

- Disclosure Requirements: Sponsors are required to disclose compliance with the Reserve Fund Law in the offering plan, as stipulated by the New York State Department of Law. Violations can lead to civil and criminal sanctions. New York Attorney General

Homeowners Associations (HOAs):

- Lack of Statutory Requirements: New York State does not have specific statutory requirements mandating HOAs to establish reserve funds or conduct reserve studies. The absence of such laws places the responsibility on individual HOAs to implement effective financial planning practices.

- Governing Documents: While state law does not mandate reserve funds for HOAs, an association's governing documents—such as bylaws or declarations—may include provisions requiring the establishment of reserve funds or the conduct of reserve studies. Board members should review these documents to determine their specific obligations.

North Carolina

In North Carolina, there is no statutory requirement for homeowners associations (HOAs) or condominium associations to conduct reserve studies. The North Carolina Planned Community Act does not mandate reserve studies or the establishment of reserve funds for HOAs. Similarly, the North Carolina Condominium Act does not require condominium associations to perform reserve studies. However, the Condominium Act does stipulate that the public offering statement must include a statement of the amount, or a statement that there is no amount, included in the budget as a reserve for repairs and replacement.

North Dakota

There is no law that imposes HOA reserve study requirements in North Dakota. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Ohio

Ohio law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Oklahoma

Oklahoma law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Oregon

Oregon's HOA reserve study requirements under Oregon Revised Statutes Section 94.595 emphasize proactive financial planning for community maintenance. These regulations mandate initial reserve studies, ongoing reviews, and comprehensive maintenance plans to promote financial stability and transparency within the community.

Key Points:

- Initial Reserve Study: Declarants must conduct an initial reserve study and prepare a maintenance plan.

- Annual Updates: HOAs are required to review and update reserve studies annually, accounting for current conditions, inflation, and investment returns.

- Funding Flexibility: Boards can adjust payment amounts and include additional reserve items as needed.

- Timelines: Reserve studies and maintenance plans must be completed within one year of adopting a resolution or petition.

Statutory Details:

“The declarant, on behalf of a homeowners association, shall:

(a) Conduct an initial reserve study as described in subsection (3) of this section;(b) Prepare an initial maintenance plan as described in subsection (4) of this section; and(c) Establish a reserve account as provided in subsection (2) of this section.”

The section further specifies:

“(a) The board of directors of the association shall annually determine the reserve account requirements by conducting a reserve study or reviewing and updating an existing study using the following information:

(A) The starting balance of the reserve account for the current fiscal year;(B) The estimated remaining useful life of each item for which reserves are or will be established, as of the date of the study or review;(C) The estimated cost of maintenance and repair and replacement at the end of the useful life of each item for which reserves are or will be established;(D) The rate of inflation during the current fiscal year; and(E) Returns on any invested reserves or investments.

(b) Subject to subsection (8) of this section, after review of the reserve study or reserve study update, the board of directors may, without any action by owners:

(A) Adjust the amount of payments as indicated by the study or update; and(B) Provide for other reserve items that the board of directors, in its discretion, may deem appropriate.

(c) The reserve study shall:

(A) Identify all items for which reserves are or will be established;(B) Include the estimated remaining useful life of each item, as of the date of the reserve study; and(C) Include for each item, as applicable, an estimated cost of maintenance and repair and replacement at the end of the item’s useful life.”

Additionally, “A reserve study and maintenance plan shall be completed within one year of adoption of the resolution or submission of the petition to the board of directors.”

Read more about Oregon's HOA Reserve Stuy Requirements.

Pennsylvania

Pennsylvania law does not mandate reserve studies but suggests them for financial health. However, an HOA’s governing documents might include such a requirement. Board members should review their CC&Rs and bylaws to determine if a reserve study is necessary.

Rhode Island

There is no law that imposes HOA reserve study requirements in Rhode Island. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

South Carolina

There is no law that imposes HOA reserve study requirements in South Carolina. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

South Dakota

There is no law that imposes HOA reserve study requirements in South Dakota. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Tennessee

In Tennessee, reserve study requirements are set to ensure the long-term financial health and safety of condominium communities. These guidelines mandate regular evaluations of the condition and maintenance needs of shared assets to uphold structural integrity and minimize unexpected expenses.

Key Takeaways:

- Mandatory Reserve Studies: Condominium boards must conduct a reserve study at least every five years.

- Initial Deadlines: If a reserve study was conducted on or after January 1, 2023, the next update is required within five years. If no reserve study was conducted by this date, the first study must be completed by January 1, 2024.

- Focus Areas: Reserve studies aim to evaluate the condition and plan for the repair and maintenance of essential common elements.

Tennessee laws under § 66-27-403 focus primarily on condominium associations, mandating reserve studies for these communities. As of now, there are no explicit statutory requirements for reserve studies or updates for homeowners associations (HOAs) in Tennessee, making the law distinct in its application.

However, HOAs are encouraged to adopt similar best practices for reserve studies to ensure financial preparedness and the maintenance of common areas.

Statutory Details (Verbatim):

According to Section 66-27-403:

"(a) If a condominium board has conducted a reserve study on or after January 1, 2023, it must update the study within five years and continue to do so every five years thereafter. The goal is to evaluate the condition and plan for the repair and maintenance of common elements essential to structural integrity and safety. If no reserve study has been conducted since January 1, 2023, the board must complete one by January 1, 2024, and update it every five years for the same purpose."

Texas

No law imposes HOA reserve study requirements in Texas. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Utah

Utah’s reserve study requirements (Section 57-8-7.5) ensure that homeowners associations (HOAs) and condominium communities maintain financial preparedness for the upkeep of shared assets. These laws promote long-term planning and transparency by requiring regular reserve fund analyses and updates.

Key Takeaways:

- Reserve Analysis Frequency: A reserve analysis must be conducted at least once every six years and updated or reviewed every three years.

- Flexibility in Execution: The management committee may conduct the analysis itself or hire a reliable organization or professional to perform it.

- Comprehensive Analysis: The reserve fund analysis must identify necessary components, estimate their remaining useful life, project repair and replacement costs, and outline a funding plan.

- Annual Communication: Associations must provide a summary of the most recent reserve analysis to unit owners annually and furnish the complete analysis upon request.

Statutory Details (Verbatim):

According to Section 57-8-7.5:

“(2) Except as otherwise provided in the declaration, a management committee shall:

(a) cause a reserve analysis to be conducted no less frequently than every six years; and(b) review and, if necessary, update a previously conducted reserve analysis no less frequently than every three years.

(3) The management committee may conduct a reserve analysis itself or may engage a reliable person or organization, as determined by the management committee, to conduct the reserve analysis.

(4) A reserve fund analysis shall include:

(a) a list of the components identified in the reserve analysis that will reasonably require reserve funds;(b) a statement of the probable remaining useful life, as of the date of the reserve analysis, of each component identified in the reserve analysis;(c) an estimate of the cost to repair, replace, or restore each component identified in the reserve analysis;(d) an estimate of the total annual contribution to a reserve fund necessary:

(i) to meet the cost to repair, replace, or restore each component identified in the reserve analysis during the component’s useful life and at the end of the component’s useful life; and(ii) to prepare for a shortfall in the general budget that the association or management committee may use reserve funds to cover; and

(e) a reserve funding plan that recommends how the association of unit owners may fund the annual contribution described in Subsection (4)(d).

(5) An association of unit owners shall:

(a) annually provide unit owners a summary of the most recent reserve analysis or update; and(b) provide a copy of the complete reserve analysis or update to a unit owner who requests a copy.”

Similar provisions exist under Section 57-8a-211 of the Utah Community Association Act.

Vermont

There is no law that imposes HOA reserve study requirements in Vermont. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Virginia

Virginia’s reserve study requirements for HOAs and condominium communities (Section 55.1-1965) focus on maintaining the structural integrity and financial health of shared assets. These laws emphasize periodic evaluations, adjustments, and transparency in budgeting to ensure adequate reserve funding.

Key Takeaways:

- Mandatory Reserve Studies: Executive boards must conduct reserve studies every five years to determine the necessary reserve amounts for repairing, replacing, and restoring capital components.

- Annual Review: Boards are required to annually review reserve study results to evaluate the adequacy of reserves and make necessary adjustments.

- Budget Inclusion: The association budget must detail the estimated replacement costs, remaining life, and accumulated cash reserves, along with a general statement on reserve fund procedures.

Statutory Details (Verbatim):

Section 55.1-1965 states:

"A. Except to the extent otherwise provided in the condominium instruments and unless the condominium instruments impose more stringent requirements, the executive organ shall:

- Conduct at least once every five years a study to determine the necessity and amount of reserves required to repair, replace and restore the capital components;

- Review the results of that study at least annually to determine if reserves are sufficient; and

- Make any adjustments the executive organ deems necessary to maintain reserves, as appropriate.

B. To the extent that the reserve study conducted in accordance with this section indicates a need to budget for reserves, the unit owners’ association budget shall include, without limitations:

- The current estimated replacement cost, estimated remaining life and estimated useful life of the capital components;

- As of the beginning of the fiscal year for which the budget is prepared, the current amount of accumulated cash reserves set aside, to repair, replace or restore the capital components and the amount of the expected contribution to the reserve fund for that fiscal year; and

- A general statement describing the procedures used for the estimation and accumulation of cash reserves pursuant to this section and the extent to which the unit owners’ association is funding its reserve obligations consistent with the study currently in effect.”

Washington

Washington's reserve study requirements are designed to ensure the financial stability and long-term maintenance of common-interest communities. These laws emphasize periodic evaluations, transparency in financial disclosures, and proactive planning for repairs and replacements.

Key Takeaways:

- Board Responsibilities: The board of directors has discretion over conducting and updating reserve studies and may hire professionals to assist (Section 64.34.388).

- Reserve Account: Associations are encouraged to establish a reserve account for significant maintenance and replacements anticipated within 30 years (Sections 64.34.380 and 64.38.065).

- Visual Inspections: Initial reserve studies must include a visual inspection by a reserve study professional, which must be updated annually. A visual site inspection must also be conducted at least every three years.

- Disclosure Requirements: Public offering statements must disclose the association's reserve study status. If no study exists, potential buyers must be warned of the risks associated with insufficient reserves (Section 64.34.410).

- Post-2018 Associations: Associations created after 2018 must conduct an initial reserve study by a professional, with annual updates and site inspections every three years, unless it causes undue hardship (Section 64.90.545).

Note: Some provisions under Washington’s HOA reserve study requirements, particularly those outlined in Sections 64.34.388 and 64.90.545, are applicable only until 2028. After this date, the state legislature has indicated that updated guidelines may replace these requirements, although details on the replacement provisions are currently pending. Associations should monitor updates to ensure compliance beyond 2028.

Statutory Details (Verbatim):

"The board of directors of an association has the responsibility to make decisions regarding the preparation and updating of a reserve study, exercising reasonable discretion. This includes determining whether to conduct or update a reserve study and whether to seek assistance from a reserve study professional (Section 64.34.388).

Sections 64.34.380 and 64.38.065 encourage associations to establish a reserve account to fund major maintenance, repair, and replacement of common elements, including those requiring work within the next 30 years. If an association has significant assets, it must prepare and update a reserve study, unless doing so would cause undue hardship. The initial study must be based on a visual inspection by a reserve study professional, with updates required annually. At least every three years, a reserve study update must include a visual site inspection.

A public offering statement must include the association’s current reserve study. If no study exists, the statement must warn potential buyers that this poses a risk, as insufficient reserves may lead to special assessments for major repairs (Section 64.34.410).

Any association created after 2018 must follow the rules for reserve studies, which require an initial study by a reserve study professional, based on a site inspection or a review of plans. Annual updates are required unless it causes undue hardship, with a site visit at least every three years (Section 64.90.545)."

West Virginia

No law imposes HOA reserve study requirements in West Virginia. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Wisconsin

No law imposes HOA reserve study requirements in Wisconsin. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

Wyoming

No law imposes HOA reserve study requirements in Wyoming. However, an HOA’s governing documents may require a reserve study. As such, board members should check their CC&Rs and bylaws.

How Solume Simplifies Compliance

At Solume, we understand that navigating state laws and financial planning can feel like navigating a complex maze. That’s why we’ve built a comprehensive platform to help HOAs and Condo associations stay on top of reserve studies, budgeting, and compliance. Our software gives you everything you need to manage your community confidently.

- Comprehensive Reserve Study Integration: Traditional reserve studies provide static reports that become obsolete when any changes occur. Solume transforms your reserve study into an interactive dashboard that stays accurate and actionable.

- Advanced Financial Tracking: Offers detailed tracking of reserve fund balances, contributions, and expenditures to provide a clear financial picture.

- Real-Time Projections: Generates dynamic forecasts for future expenses, helping your HOA plan for long-term financial health.

- Customizable Reserve Funding Plans: Tailors reserve strategies to meet your HOA’s unique needs and legal requirements.

- Solume Assistant: An intelligent feature that interprets your HOA’s governing documents (CC&Rs and bylaws) and aligns them with state and federal regulations to guide compliance.

- Automated Compliance Alerts: Notify you of approaching deadlines for reserve study items to be conducted or other critical compliance tasks.

- Enhanced Budget Management: Simplifies annual budget preparation by incorporating reserve study data and projected contributions.

- Transparent Reporting Tools: Provides clear and accessible reports to share with board members and homeowners, fostering transparency.

- Secure Document Storage: Centralized platform for storing reserve studies, bylaws, financial reports, and other essential documents.

Ready to bring clarity and sunlight to your HOA management? Schedule a demo today and see how Solume can transform your community.