Key Takeaways on HOA Reserve Funds

- HOA reserve funds are the community’s savings account for future financial obligations, covering major repairs and replacements without relying on a special assessment.

- The difference between an operating fund and a reserve account should not be confused: operating covers daily expenses, and reserves protect against large-scale projects.

- A professional reserve study gives boards the data to project costs, funding levels, and useful life of community assets,helping avoid shortfalls.

- Well-managed reserves protect property values, ensure lender confidence, and provide residents with peace of mind.

- Solume’s platform helps boards model multiple funding plans in real time, tying budgets, vendor procurement, and reserves together in one place.

What Are HOA Reserve Funds and Why Are They Essential?

The Role of HOA Reserve Funds

For a homeowners association, HOA reserve funds are not optional; they are the backbone of financial health. Think of them as the community’s long-term savings account. Unlike an individual homeowner who saves for a new roof or appliance, associations must plan for deeper, often unseen systems and shared spaces: water retention areas, parking decks, community pools, and clubhouses. Even windows in a condo tower fall into this category. These aren’t cosmetic upgrades like nicer landscaping, but critical assets that require significant planning and funding. Reserve funds exist to:

- Maintain community assets such as tennis courts, parking lots, or the community pool.

- Pay for major repairs like roof replacement, paving, or mechanical systems.

- Meet future financial obligations without calling for sudden special assessments.

Without adequate reserves, associations put themselves at risk of insolvency. In Florida, for example, condo owners have been hit with assessments exceeding $80,000 per unit. These high costs have led to fire-sale pricing, where owners sell units far below value, dragging down property values for everyone.

Difference Between Operating Funds and Reserve Accounts

Reserve accounts are not "play money" for the board to spend at will; they represent the core financial commitment (and fiduciary responsibility) to preserve the community’s shared resources. Educating residents about this distinction is vital: operating funds keep the lights on today, while reserves protect tomorrow. A well-run association separates its finances into two key buckets:

- Operating fund: covers day-to-day expenses, daily expenses, and maintenance costs (utilities, cleaning, and administrative work).

- Reserve account: a dedicated bank account for large-scale projects, major renovations, and unexpected expenses.

Confusing the two undermines financial stability and leads to shortfalls that put the community at risk. A healthy reserve fund ensures the amount of money needed for future repairs is set aside, while the operating fund manages the community’s day-to-day operations.

How HOA Reserve Studies Ensure Financial Health

The Importance of a Professional Reserve Study

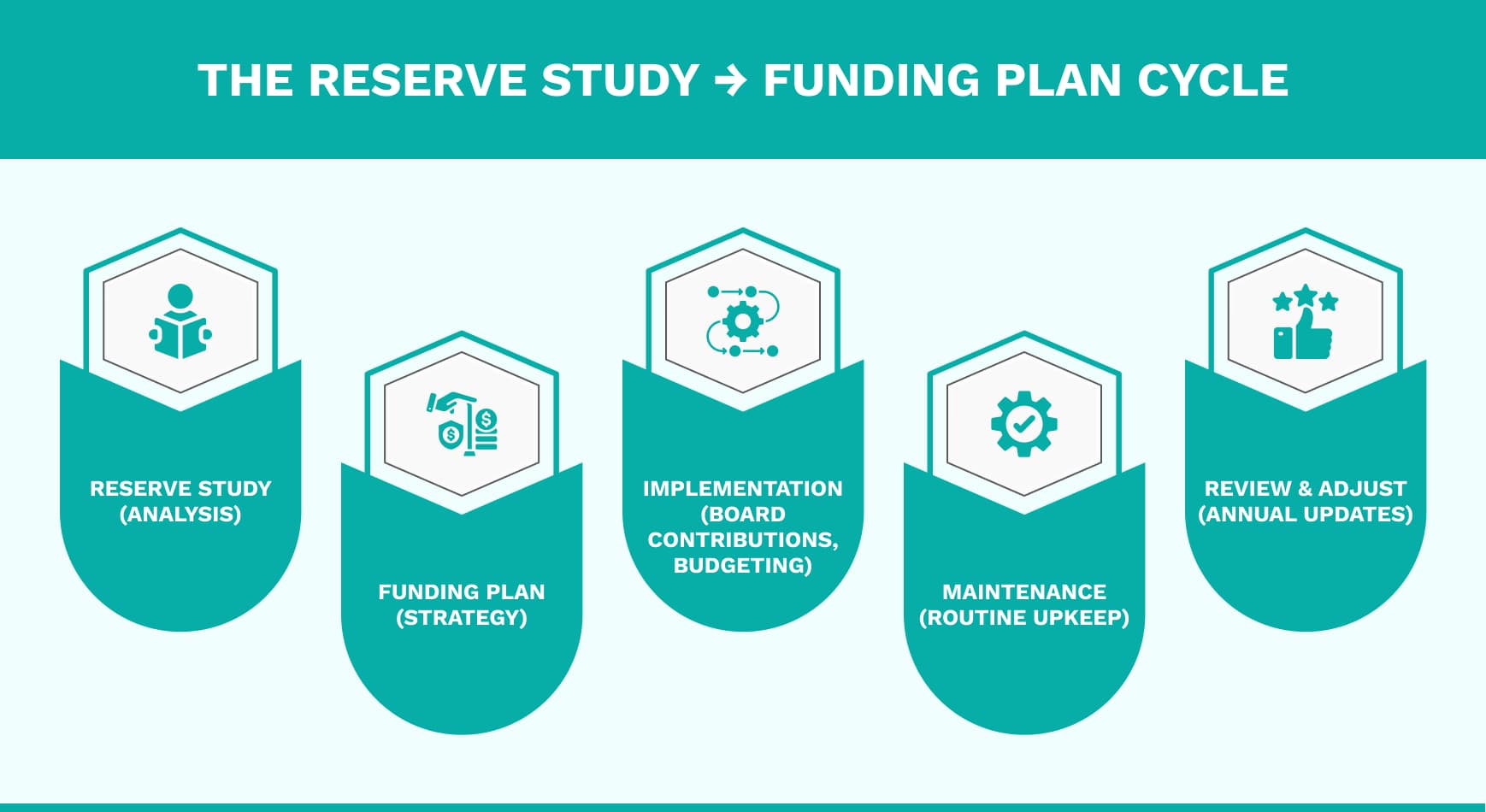

Every HOA Board Member should understand that a professional reserve study is the foundation for sound financial planning. It has two critical parts: a physical analysis — inventorying all common area components (roofs, parking decks, pool decks, community clubhouse, water retention systems, windows, garages, etc.), evaluating their current condition, estimating both their useful life and remaining life, projecting replacement costs; and a financial analysis — measuring what the reserve account currently holds, forecasting future replacement or repair costs, and developing a funding plan so that your reserve funds will cover those costs without resorting to shortsighted cuts or surprise special assessments. A professional study often includes structural evaluations of elements that aren’t obvious (hidden damage, waterproofing failures, corrosion), because those are the failure points that can lead to expensive or even dangerous crises. For example, in the Surfside, Florida, condominium collapse, FOX 4 News Fort Myers, Miami Herald, and WLRN reported on the pool deck and parking deck — cracked concrete, failing waterproofing, water pooling — issues raised years before the building partially failed. buildingmavens.com+3WLRN+3Miami Herald+3

A reserve study provides:

- A breakdown of reserve needs based on the useful life of assets.

- Guidance on the funding level required to cover replacement costs.

- A roadmap for avoiding reliance on additional funds or emergency assessments.

An HOA Reserve Study isn’t just paperwork; it is the community’s financial blueprint for protecting residents and assets. It shows how much money is needed and when, allowing the board of directors to set a sustainable funding plan.

Collaboration with Reserve Analysts and Specialists

This is where expertise matters. A reserve analyst examines the useful life of roofs, elevators, or pool pumps. A Reserve Specialist recommends best practices for achieving an adequate reserve.

Solume does not conduct reserve studies directly, but we work with a network of reserve study professionals who provide the actual studies. The platform integrates seamlessly with their work. Communities can import numbers and test different funding plans in real time, connecting their reserve study with vendor procurement and budget management.

Managing HOA Reserve Funds Effectively

Best Practices for Reserve Funding

Managing reserves is more than setting aside enough money; it is long-range planning that you can actually manage. This is where Solume is different. Solume is the only all-in-one platform that lets boards manage the entire reserve study process in one place, from building and comparing multiple funding plans to tying those plans directly to vendor procurement and the annual budget. Reserve studies often project future financial obligations over 20 to 40 years, and static spreadsheets get stale quickly. Solume is dynamic. Change a cost, a project year, or a contribution level, and your forecasts, cash flow, and risk indicators update instantly. Even a novice HOA Board Member can see how today’s contributions affect the next decade, which years carry higher risk, and what adjustments would prevent a shortfall. The platform also connects decisions end-to-end, so when an RFP is approved or a project is deferred, your reserve plan and budget stay aligned. That clarity leads to better decisions, fewer surprises, and a healthier HOA’s reserve fund. Learn more here.

Boards should:

- Keep reserves in a separate savings account or dedicated bank account for cash reserves.

- Allocate the amount of money needed to cover future repairs and replacement costs.

- Build a funding plan that is reviewed on an annual basis.

A healthy reserve fund avoids the scramble of sudden assessments. It’s a good practice to audit funding plans regularly and adjust contributions when needed.

Routine Maintenance and Preventing Wear and Tear

Reserves work best when paired with regular maintenance. By addressing wear and tear early, the community avoids premature failures. For example:

- Scheduling pool repairs and servicing pool pumps.

- Tackling major landscaping projects on a regular basis.

- Keeping up with routine maintenance to extend the useful life of systems.

Preventing breakdowns reduces reliance on reserves for avoidable costs.

Working with Professionals for Financial Management

Associations should also seek outside expertise:

- Consult a tax professional about the tax implications of reserves. Are HOA reserve funds taxable? The answer varies, and guidance avoids penalties.

- Consider engaging property management or community management services. But beware: too often, an HOA Management Company takes control of budgets and vendor choices. This leads to conflicts of interest and rising management fees. Solume empowers boards to self-manage or co-manage, saving those fees and investing back into reserves.

- Collaborate with Community Association Managers who take reserve studies seriously. Surprisingly, many don’t, even though it is one of the most important parts of responsible leadership. Boards should also anticipate rising insurance premiums, which in many states are increasing faster than inflation and can quickly strain reserves if not planned for.

Legal and Financial Considerations for HOA Reserves

Compliance with State Laws and Governing Documents

Reserves must follow the association’s governing documents and state laws. Each state sets different requirements, on everything from mandatory reserve funding levels to disclosure rules. Notable examples include California, Florida, Hawaii, Nevada, Oregon, Virginia, and Washington, which have clear reserve study requirements, with others like Colorado, Connecticut, and New Jersey also setting specific standards. Boards should stay up to date with these evolving standards (see our guide on reserve study state requirements).

(BTW, Solume's AI Assistant helps with compliance. Compliance and best practices protect HOA finances and demonstrate accountability to association members.

Tax Implications of HOA Reserve Funds

The tax implications of reserves are often misunderstood. Boards should ask: Are HOA reserve funds taxable? The IRS generally views them as funds for their intended purpose, but rules vary. Consulting a tax professional ensures compliance.

Good boards consider tax strategy part of long-term financial management.

Social Media and Community Awareness

Sharing Information on Facebook and Other Platforms

Modern boards can improve transparency by meeting owners where they are, online. Using Solume's reserve study feature during board meetings, or even Facebook share options, boards can:

- Educate HOA residents and association members about reserves.

- Share updates on funding plans and upcoming large projects.

- Highlight how reserves protect residents' peace of mind.

Promoting Transparency Among HOA Residents

Trust grows with communication. Boards can:

- Provide clear updates on reserve funding and future expenses.

- Explain how much money is in the reserve and why it matters.

- Emphasize how strong reserves safeguard property values and lender confidence.

This openness creates a culture of accountability and strengthens the reputation of a successful community and trustworthy board.

The Value of Proper Reserve Funding for HOA Communities

Proper reserve funding isn’t just about numbers; it speaks directly to the stress every board feels. It’s about the security of knowing you won’t have to knock on your neighbors’ doors for a surprise special assessment, the relief of avoiding tense board meetings where tempers flare over money, and the confidence that you’ve done right by your community. It’s about replacing anxiety with stability. When reserves are managed well, communities:

- Preserve property values by avoiding sudden assessments and keeping homes attractive to buyers and lenders. (Freddie Mac and Fannie Mae maintain lists of communities they won’t finance due to weak reserves.)

- Protect community assets through timely major repairs and large-scale projects.

- Provide residents peace of mind knowing that future financial obligations will be met.

In short, reserves create stability. Investors considering real estate often overlook the financial health of a community. A low home price might look appealing compared to comps, but if the association’s reserve is underfunded, the buyer could inherit looming liabilities.

Final Word

Every HOA Board Member faces the same challenge: how to set aside enough money today to secure tomorrow. The best way is with a disciplined funding plan, informed by a professional reserve study, managed with modern tools. Use Solume to connect your HOA’s reserve fund to budgets, vendor procurement, and reporting. When reserves are strong, so is the community.

Now is the moment to act. Review your current reserves, ask the hard questions about whether you have enough money for future expenses, and take steps to close the gap. The longer a community waits, the harder it becomes to catch up. If you want peace of mind, transparency, and a healthier future for your neighbors, start building that plan today—because tomorrow’s stability is determined by the choices you make right now.