Key Takeaways

- Every HOA reserve study combines physical analysis, financial analysis, and long-term planning.

- Special assessments are preventable when adequate reserves are funded consistently.

- Governing documents, state laws, and fiduciary duty make reserve studies non-negotiable for HOA board members.

- Best practices include working with a reserve study professional, reviewing the reserve study report annually, and aligning with your fiscal year and HOA budget.

- Solume is the only all-in-one HOA management platform that directly connects your annual budget, reserve fund balance, and existing reserve study, helping communities simplify updates, save money, and protect property values.

If you serve on a Condo Association or HOA Board of Directors, you’ve probably had this thought at some point: Are we financially prepared for what’s coming down the road? Whether it’s a roof replacement, resurfacing the swimming pool, or a parking lot overhaul, every community faces major repairs eventually. The question is whether your Homeowner Association is ready, or if you’ll be scrambling to issue special assessments that leave everyone frustrated.

That’s where the Condo or HOA reserve study comes in. Done right, it’s your community’s road map. Done poorly, or ignored, it’s a ticking time bomb.

What is an HOA Reserve Study?

Understanding the Basics

At its core, a Condo / HOA reserve study is both a financial analysis and a physical analysis of your community. It looks at the association’s assets, your roofs, siding, pool, clubhouse, roads, and other significant components, and answers two key questions:

- How much life expectancy do these assets have left?

- How much money needs to be set aside to handle them responsibly?

A proper study helps your HOA plan for major repairs and capital improvements in a way that ensures adequate reserves. Without it, boards are essentially flying blind.

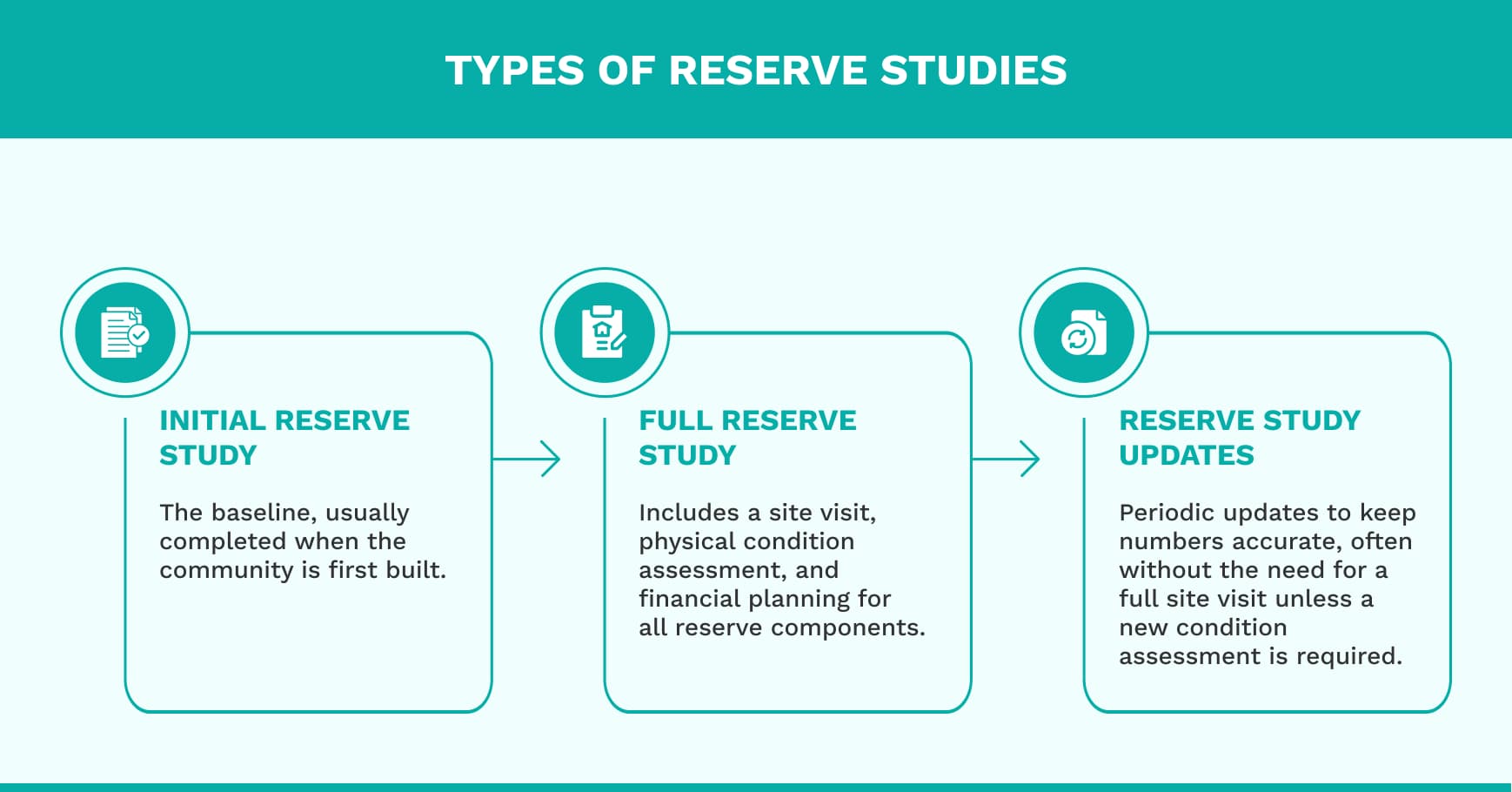

Types of Reserve Studies

There are three main types of reserve studies every HOA board member should know: the initial reserve study, the full reserve study, and reserve study updates. If you live in a condo association, these are often referred to as a condo reserve study or a structural integrity reserve study (SIRS), but the purpose is the same: planning for major repairs and capital improvements.

Think of it like going to the doctor: sometimes you need a full physical, sometimes just a check-up.

In addition, some states (like Florida) now require a Structural Integrity Reserve Study (SIRS). This is similar to a traditional condo association reserve study, but it specifically focuses on structural and safety-related components: roof, foundation, load-bearing walls, plumbing, electrical, and other critical systems.

The key difference:

- A standard reserve study looks at all major components of the community — from swimming pools to parking lots.

- A SIRS zeroes in on the physical condition of structural elements that directly affect safety and habitability.

- For many HOAs and condominium associations, that means you may need both: a broad reserve fund study for financial planning and, if required by state laws, a SIRS for compliance.

A SIRS is typically performed by licensed professionals. Solume doesn’t perform SIRS; we have a network of partners and provide the software to help you manage the documentation, schedules, and funding impacts—and coordinate with your reserve study professional when a new site visit or visual inspection is required.

The Reserve Study Process: Key Steps Explained

Physical and Financial Analysis

A credible reserve study starts with a site visit to visually inspect major components and their current condition. From there, a reserve study professional evaluates the lifespan and remaining useful life of each asset.

This isn’t just about spotting cracks in the pavement or rust on a pool gate. It’s about projecting forward: how long until this needs replacement, and how much will it cost? From that, the financial planning begins. You end up with a reserve fund balance recommendation—what the HOA should be setting aside year by year.

Deliverables for HOA Communities

The finished product is more than a checklist. Your Condo or HOA receives a comprehensive reserve study report, an updated component inventory (when applicable), and detailed recommendations for reserve contributions. This isn’t just paperwork. It’s the foundation of your operating budget and your annual budget planning. It’s a blueprint for how your community will handle its biggest financial responsibilities. A well-prepared reserve study typically includes:

- Component Inventory: A detailed list of all major components the HOA or Condo Association is responsible for — roofs, siding, parking lots, elevators, swimming pool systems, clubhouse equipment, and more. Each item is documented with square footage, type, and replacement history.

- Current Condition & Remaining Useful Life: A physical condition snapshot of every component, combined with estimates for lifespan and remaining useful life. This helps the board see which assets are healthy and which are approaching end-of-life.

- Life Expectancy & Replacement Costs: Projected timelines for when each component will need major repairs or full replacement. These estimates include today’s costs, plus inflation-adjusted numbers, so the HOA doesn’t underestimate how much money will be needed years down the road.

- Financial Analysis & Reserve Fund Balance: A clear picture of the association’s current financial condition. This section compares the existing reserve fund balance with what’s actually needed, helping the board measure funding levels and identify shortfalls.

- Funding Plan / Annual Contributions: Specific recommendations for how much money should be contributed annually to the reserve fund. This connects directly to your annual budget, ensuring the operating fund and reserve fund are aligned. This is exactly why it is necessary to have an all-in-one platform that connects your budget, your reserve study, and your vendor procurement process together.

- Capital Improvements Road Map: A schedule that lays out when major projects will hit, like roof replacement or pool resurfacing, and how the HOA can prepare financially without special assessments.

- Reserve Study Report Summary: A simplified version of the study, often used for board meetings and homeowner communication. It highlights the big-picture and long-term financial planning decisions without overwhelming the board in technical detail.

Why Your HOA Needs a Reserve Study

Enhancing Financial Health and Property Values

Reserve studies aren’t just “nice to have.” They protect your association members from the sticker shock of special assessments. A well-maintained reserve fund improves financial stability, supports future repair planning, and keeps property values high. Buyers want confidence that the HOA has financial health and isn’t one storm away from chaos.

Fiduciary Duty and Governing Documents

Serving on the board of directors means you carry a fiduciary duty. Your governing documents—and in many cases, state laws—require the board to conduct reserve studies and keep adequate reserves. Ignoring this isn’t just risky; it’s negligent.

Impact on HOA Communities

When reserves are managed correctly, every property owner makes a fair share contribution. That means capital improvements like roof replacement or a swimming pool upgrade don’t become a crisis. Instead, they’re simply another line item in the HOA budget—handled smoothly, without financial strain.

Best Practices for Conducting a Reserve Study

Reserve studies aren’t one-size-fits-all. The best practices apply across homeowners associations and even large-scale condo association reserves, which often involve more complex components like elevators or parking structures.

Working with Reserve Study Professionals

Boards should always consider working with Professional Reserve Analysts or a certified reserve study specialist. The Community Associations Institute and the Association of Professional Reserve Analysts both maintain directories of trusted experts.

A reserve study professional brings deep experience with types of properties ranging from suburban HOAs to urban condominium associations. They can conduct reserve studies on-site or consult as you update your existing reserve study.

Regular Updates and Compliance

Most state laws now require reserve study updates every few years (see our state-by-state breakdown). But updating doesn’t always mean paying for a new full reserve study. If you’ve resurfaced the pool deck or replaced a clubhouse roof, that update can be entered into your reserve study management system without another costly visual inspection.

At every board meeting, the reserve study report should be reviewed and aligned with your annual budget and fiscal year planning. That’s how you keep the numbers real—not aspirational.

Using Solume to Simplify Reserve Study Processes

This is where technology changes everything. Traditional HOA management company software keeps your annual budget in one silo and your reserve fund study in another. That disconnect is exactly why so many boards end up scrambling.

How Solume Benefits Your HOA

Solume’s Reserve Study features bring both sides together. With comprehensive budgeting tools for reserve contributions and detailed valuation estimates for major repairs, you can see in real-time how today’s choices affect tomorrow’s funding levels.

Think of it like having a budgeting tool and a reserve professional on the same dashboard. Financial planning becomes easier, faster, and far more accurate.

Most HOAs today are forced to use disconnected systems: one for the reserve fund study, one for the annual budget, and another for vendor procurement. That fragmentation is exactly why boards end up with funding gaps, special assessments, or projects that stall. Solume brings it all under one roof:

- Reserve Study Management → Track major components, update your existing reserve study, and see real-time funding levels.

- Budget Integration → Connect reserve planning directly with your operating budget and annual budget. No silos, no double entry.

- Vendor Procurement → When the reserve study says “roof replacement in 2027,” you can immediately pull bids, compare vendors, and award contracts — all inside the same platform.

That’s the power of an all-in-one system. Boards aren’t just doing financial planning in theory. They’re preparing, funding, and executing in practice.

Customized Solutions for Community Needs

Solume also adapts to community needs. Whether you’re a Homeowner Association in New Jersey, a condo board in New York, or an HOA in the Sunbelt, you can store the provider’s compliant reserve study report, track state laws deadlines, and share funding plans with homeowners, thus meeting all reserve study requirements.

And yes, Solume even makes usability painless with features like new window navigation, so board members and property managers can quickly jump between operating budget numbers, reserve components, and reserve study updates—no more Excel gymnastics.

Maintaining HOA Financial Stability in 2026 and Beyond

The truth is simple: homeowners' associations that fail to conduct reserve studies eventually lean on special assessments. That creates tension, distrust, and often drops property values.

But communities that do their due diligence, fund reserves properly, and use tools like Solume stay ahead of the curve. HOAs can model their future repair costs, display funding levels to association members during board meetings, and maintain community assets without surprises.

That’s not just compliance, it’s leadership.

If you’re still unsure about how reserves really work, check out our guide: Confused About HOA Reserves?