Key Takeaways About HOA Budget Template

- An HOA budget template gives Condo and Homeowners Associations a framework to create a clear, transparent financial plan.

- Reviewing previous years and analyzing financial reports helps avoid a budget shortfall and ensures accountability.

- Accurate planning prevents special assessments by properly funding reserves for major repairs and capital improvement projects.

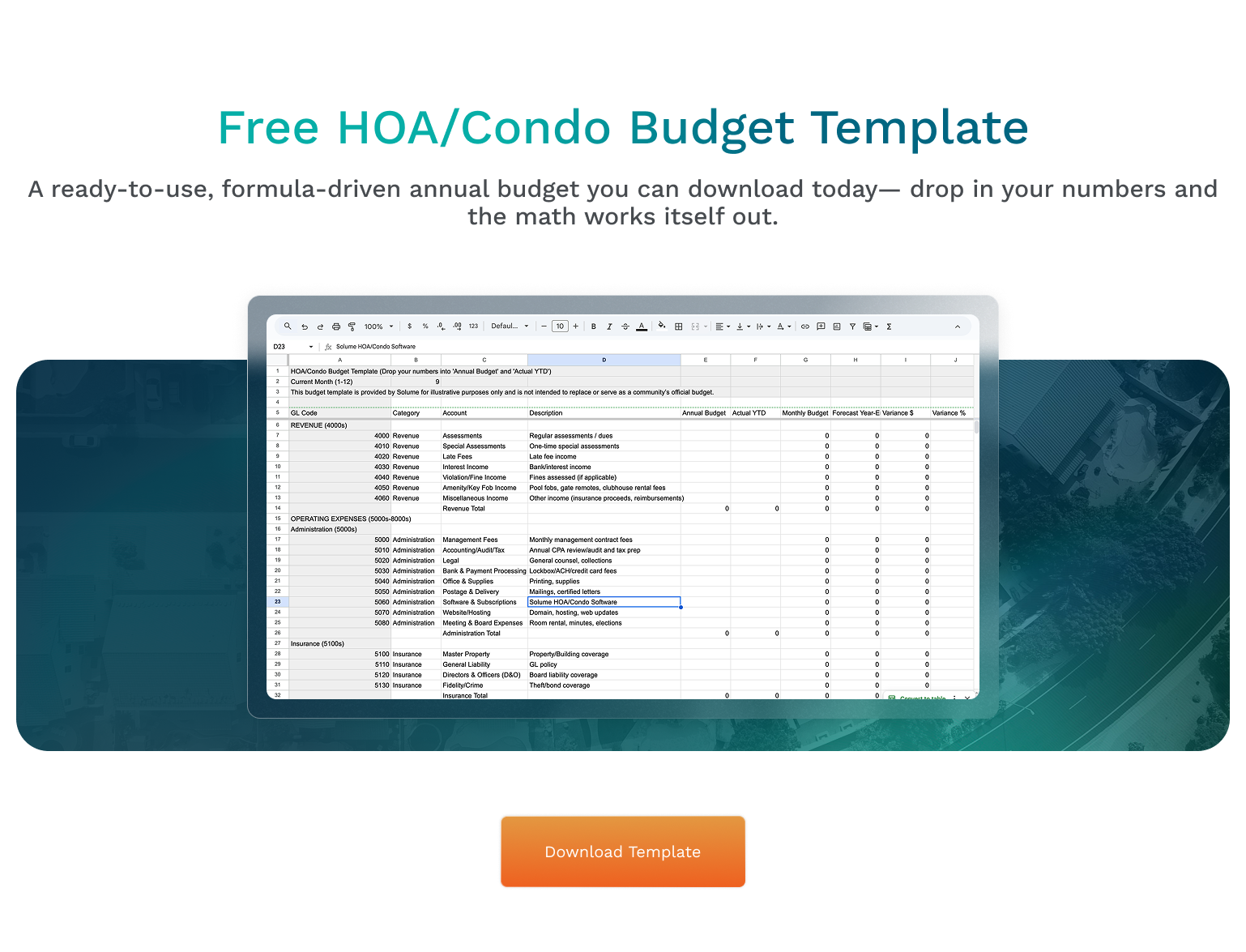

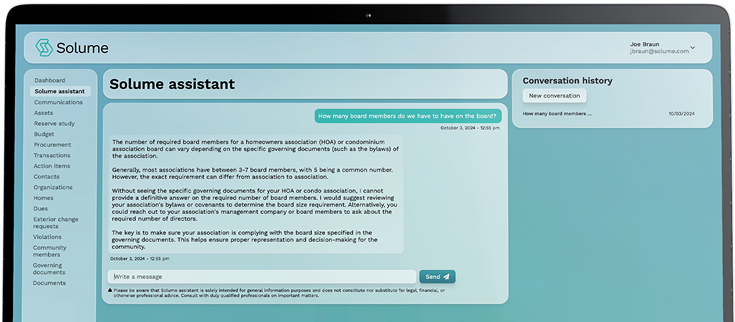

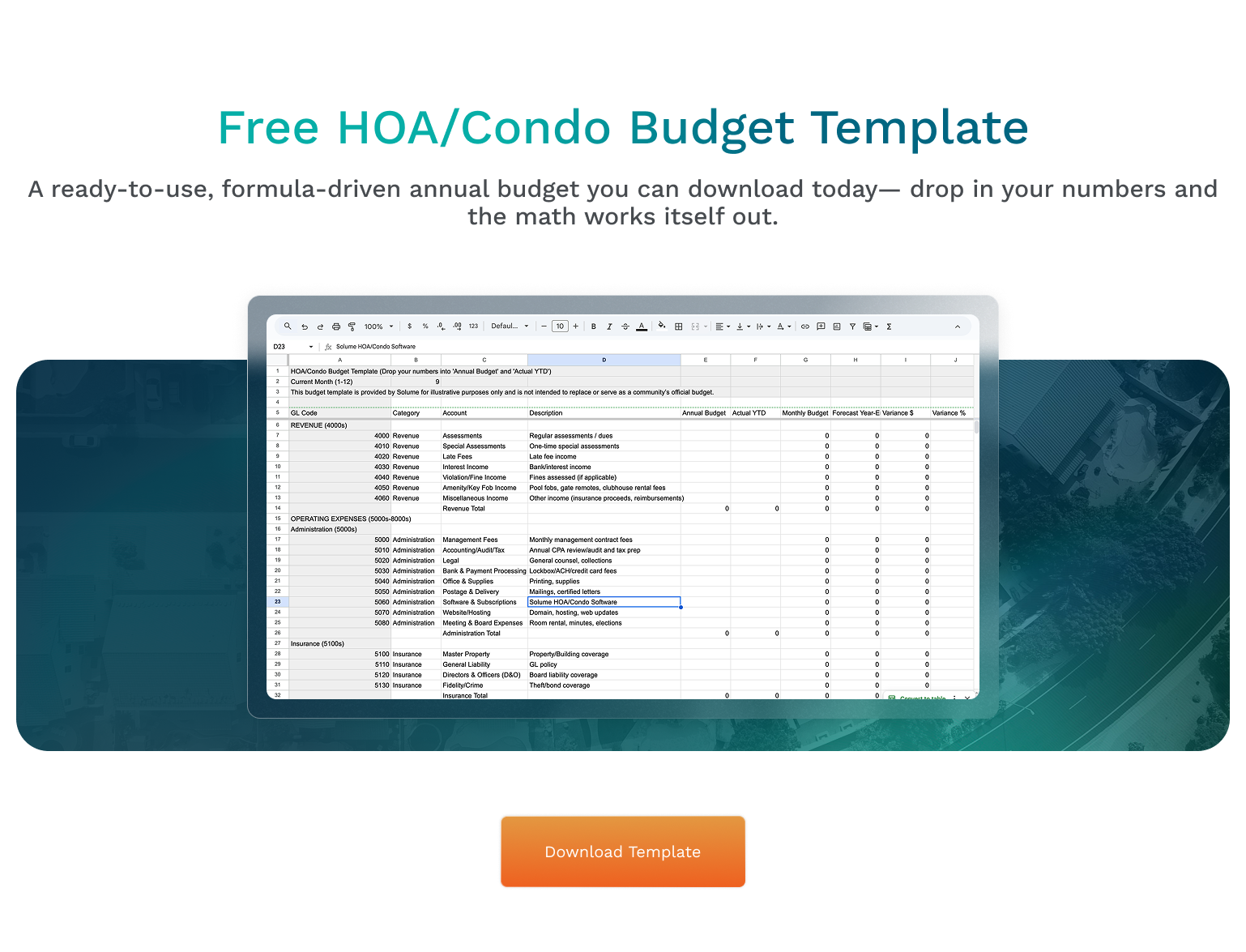

- Using a Free HOA Budget Template or an Excel template can help small associations stay organized, but advanced tools like Solume connect reserve studies, vendor contracts, and financial statements in one platform.

- HOA boards should prioritize community needs over wants, ensure compliance with state laws and CC&Rs. Communities are increasingly using AI-driven tools to monitor these ever-changing state laws and ensure compliance, giving boards greater confidence that they remain up-to-date. and build trust through transparency at the annual meeting.

What Is an HOA Budget Template and Why Does Your Community Need It?

An HOA budget template is more than a spreadsheet. It’s a tool that ensures your Condo or Homeowners Association manages its money with transparency, accuracy, and foresight. At its core, it helps communities:

- Track operating expenses like administrative expenses, utility costs, and maintenance expenses.

- Plan for reserve fund contributions to cover major repairs and capital improvement projects.

- Avoid the dreaded special assessments that catch owners off guard.

For every community association, having a proper budget is a legal requirement as much as it is good governance. A clear template ensures compliance with CC&Rs, state laws, and other legal requirements, while protecting the financial health of your community.

Essential Elements of an HOA Annual Budget

Key Line Items to Include in the Budget

An HOA annual budget typically includes several moving parts that boards must carefully evaluate. The operating budget handles the routine costs of running the association: administrative expenses, insurance, vendor contracts, utility costs, and ongoing maintenance expenses for common areas. The reserve study and related reserve funding cover large-scale items like roof replacements, paving, and other capital improvement projects, helping avoid sudden special assessments. And then there are contingency line items: funds set aside for emergencies, natural disasters, or unexpected expenses.

Even when an item might eventually be covered by insurance, it is best practice to keep funds available in case payment is delayed or coverage is denied. The principle is simple: be as prepared as you possibly can for the things you know about so you can respond to the things you don't. Communities often overlook items such as rising insurance costs, inflation on landscaping or trash collection contracts, or long-term infrastructure issues like drainage systems. Factoring these in makes the budget more realistic and sustainable.

- Operating budget: covers administrative costs, utility costs, maintenance costs, and legal fees.

- Reserve funding: for roof replacements, paving, or other major repairs.

- Special assessments: sometimes needed for natural disasters or other unexpected expenses.

A proper budget anticipates these line items instead of leaving them as surprises.

Analyzing Past Budgets and Financial Statements

To improve each year, boards must take a careful look back at their finances. This means analyzing what worked, what went over budget, and where the community may have underspent. By studying the numbers, boards can see trends in costs, prepare for the impact of inflation, and make smarter plans for the next cycle. In practice, boards must analyze:

- Income statement: shows income vs. expenses.

- Balance sheet: reflects account balances and assets.

- Cash flow: reveals whether the community can cover bills and save.

Learning from past budgets and previous years ensures boards don’t repeat mistakes that cause a budget shortfall. Accurate financial statements and financial reports are the guardrails that keep spending aligned with income sources.

Step-by-Step Guide to HOA Budget Planning

Setting Community Goals and Preparing for the Coming Year

Every budget starts with clear community goals. This is where the board president, board treasurer, budget committee heads, and even a task force come together. If present, they may collaborate with the community manager or HOA manager to:

- Identify income streams, including HOA dues, fees, and other revenue. These sources should always be itemized, but boards should avoid relying on unpredictable streams like violation fines or clubhouse rentals to balance the budget. If the revenue never materializes, the community will face a shortfall. A conservative approach—counting these as possible offsets rather than guarantees—ensures the budget is realistic and resilient.

- Leverage technology for automated dues collection so boards always know who has paid and who hasn’t, with updates available in real time.

- Project reserve contributions into the reserve account to prepare for the coming year. This is best done under the guidance of a Reserve Study professional, though some communities elect to do their own capital reserve study.

Allocating Expenses and Balancing the Budget

Next comes the balancing act. This stage is where theory meets reality: boards have to decide how to allocate the limited resources of the association in a way that protects the community long-term. It’s not just about plugging in numbers; it’s about weighing priorities, ensuring the reserve study is funded, and making sure everyday services are covered without leaving owners exposed to sudden special assessments. Boards must:

- Review vendor contracts carefully—many include fine print with automatic escalation clauses, where rates rise 5% or more each year without added value or clear justification. This is especially common with management companies, and because they often oversee the budget, boards may not even notice the slow increase. Be vigilant and factor in insurance costs, insurance premiums, and landscaping costs with a critical eye. For example, in North Carolina, storms and hurricanes have driven insurance premiums higher, forcing boards to plan proactively. Ignoring these realities is a fast track to instability. (See our related post on the insurance crisis).

- Plan for snow removal, trash collection, and emergency repairs.

- Anticipate fee increases or changes in utility rates.

This is where boards make tough financial decisions. Wants must give way to community needs. For example, repainting tennis courts to pickleball might sound appealing, but if a water retention wall is at risk, addressing it first is a higher priority, not just a rule of thumb for responsible planning.

Best Practices for Financial Management in Homeowners Associations

Tips for Financial Stability and Success

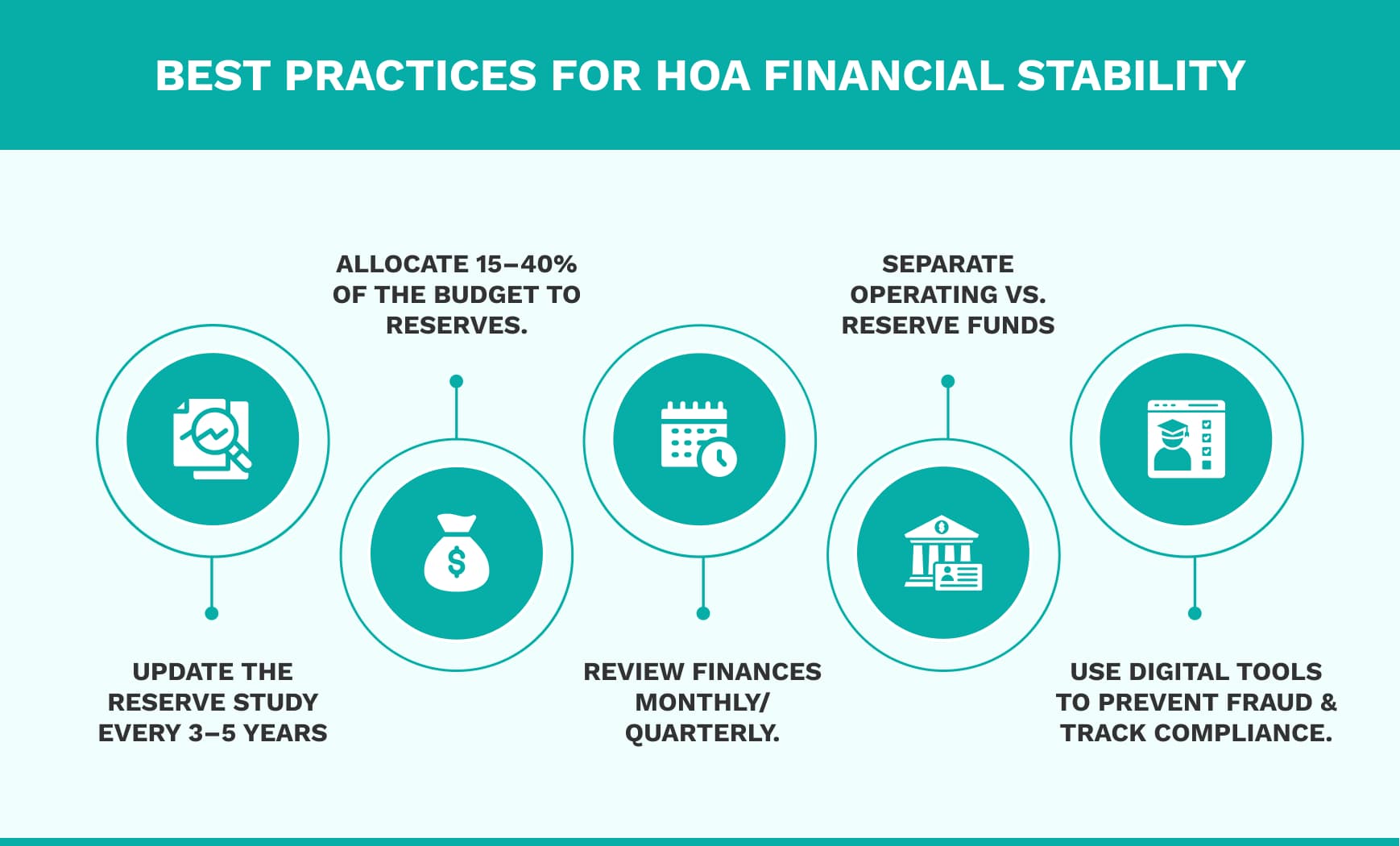

Strong associations follow best practices like these, and it’s worth pausing to explain why. Financial stability doesn’t come from a single decision but from a system of habits that keep the board focused on long-term health. Reserve studies should be updated every three to five years so projections for repairs stay current, and many experts recommend setting aside 15–40% of the total budget for reserves, depending on the size of the community and its amenities.

Regular review of financial reports—monthly or quarterly—helps boards catch overspending or hidden cost increases early. Internal controls, like separating who deposits dues from who approves invoices, protect against fraud. And never mix reserve and operating funds; even a temporary “loan” from reserves can leave the community exposed when major repairs come due. With that in mind, here are some concrete practices to put in place. To illustrate: imagine a board that updates its reserve study every three years. They can point to actual numbers showing when the roof is due for replacement and exactly how much needs to be in the reserve.

Contrast that with a board that hasn’t updated its study in a decade—when the roof fails early, they’re forced into a special assessment. Real-world scenarios like these remind boards that planning isn’t theory, it’s protection for their neighbors.

- Accurate record-keeping for accounts payable and all receipts.

- Free templates are useful for workshopping ideas of the budget, but communities should move beyond an Excel template if they want to stay in compliance and truly manage the community. Solume’s platform not only organizes numbers, it ties them to reserve studies, vendor contracts, and financial statements. Starting with a Free HOA Budget Template is good for brainstorming, but maybe not the best for ongoing management.

- Adding items to the board meeting agenda specifically for reviewing finances.

With Solume, boards can attach invoices, contracts, and photos to every transaction, creating an auditable trail that simplifies financial management and compliance. Think of a scenario where a board discovers in February that vendor costs have crept up beyond what was approved in the budget. A system like this doesn’t just store receipts—it gives early warnings so the board can act before the shortfall grows. These kinds of practical examples illustrate how strong habits and the right tools directly protect a community’s financial stability.

Adhering to State Laws and Legal Requirements

Every budget must align with state laws and CC&Rs. Increasingly, communities are also using AI-based tools to track changing regulations and ensure compliance, giving boards real-time awareness of requirements that could affect their budgets.

How Free HOA Budget Templates Benefit Your Community

Streamlining Budget Processes and Day-to-Day Operations

A Free Template can simplify day-to-day operations in small but important ways, especially for self-managed communities just getting organized. It gives boards a starting point to capture key categories before moving into more advanced systems. Specifically, it can help by:

- Organizing line items for clarity.

- Helping smaller associations plan reserve fund contributions.

- Creating predictability in the year’s budget for the next year.

For simple planning, a Free HOA Budget Template works well. But once you fold in reserve studies and long-term planning, spreadsheets fall short. That’s why thousands of communities are using platforms like Solume to integrate budgets, reserve studies, and vendor contracts. Saving on management fees allows boards to reinvest into repairs and avoid special assessments.

Finding the Right Template for Your HOA

Looking for a Free HOA Budget Template? We provide one at community.solume.com. It’s customizable for community needs, maintenance expenses, and even large-scale capital improvement projects. For Association Members who want confidence in their numbers, it’s a good idea to start with a template, then move into a system that supports long-term planning.

Achieving Financial Success with an HOA Budget Template

The real goal isn’t just to fill in numbers—it’s to create financial stability and transparency. Reviewing the year’s budget at the annual meeting shows homeowners that the board is accountable. Tools like Solume give boards clarity on when reserve contributions need adjusting, when an income statement signals trouble, or when a budget shortfall is on the horizon.

Outside service providers like FirstService Residential often promise to “do your budget for you.” But here’s the insider truth: vendor choices often benefit managers, not homeowners, creating conflicts of interest (see HOA management insider secrets). Boards regain control when they use platforms like Solume, where every RFP and vendor contract is documented, removing the fog of kickbacks and hidden deals.

Final Word

No one joins an HOA board to become an accountant. But as an HOA Board Member, creating and sticking to a financial plan is the most powerful way to safeguard property values and protect your neighbors. Use a Step-by-Step Guide, start with a Free HOA Budget Template, and build the habits of financial discipline. Then, consider platforms like Solume that tie budgets to reserve studies, financial reports, and record-keeping tools, all designed to prevent special assessments and protect the future of your community.