Key Takeaways About HOA Budget:

- An HOA budget is a community’s financial blueprint. It funds common areas, covers operating expenses, and sets aside reserves for long-term repairs — directly influencing property values and financial stability.

- Reserve studies prevent costly special assessments. Without a reserve study, boards underestimate future expenses, forcing surprise assessments that can drive homeowners to sell at reduced prices (a major issue in Florida condos).

- The operating fund and reserves are equally vital. Operating expenses handle utilities, maintenance, and legal fees, while reserve contributions build financial stability for major repairs like roof replacements.

- Management fees and insurance premiums are often underestimated. Some HOA management companies advertise low base fees but bury communities with high administrative costs. Meanwhile, insurance costs in states like Florida and North Carolina can consume a large portion of the budget.

- The proposed budget should be based on real numbers. Boards must analyze current-year expenses, anticipate upcoming costs, and issue requests for proposals (RFPs) for large projects to keep spending competitive and transparent.

- HOA budget planning is governed by laws and documents. Boards must align budgets with state laws, CC&Rs, and the association’s governing documents — ignoring these rules risks fines, lawsuits, and loss of trust.

- Best practices for HOA budgeting focus on foresight. Monitoring cash flow, leveraging financial reports, and updating reserve studies are the foundations of long-term financial stability.

- HOA fees reflect the strength of the budget. Appropriately calculated fees cover operational expenses and reserves, and inadequately calculated fees result in late payment charges, delinquent payment accounts, and emergency special assessments.

- Budgeting directly impacts real estate values. Communities that proactively fund curb and common area upkeep improve the curb appeal as well as the value of the properties within the area.

- The yearly budget must adapt to new realities. Rising insurance costs, updated state requirements (like New York’s condo rules), and evolving community needs should all shape the upcoming year’s budget.

A Homeowner Association isn’t just a legal entity; it’s a financial steward for the community, and the budget is the single most powerful tool it has.

If you’ve ever sat through a heated annual meeting where neighbors argue over rising HOA fees, you know this: nothing sparks emotion in a community faster than the HOA budget. Condo Associations (COAs) feel it too. The numbers on that spreadsheet aren’t just numbers. They dictate whether the roof gets fixed, whether landscaping looks sharp, whether insurance keeps you protected, and whether your property values hold steady—or slide.

The truth? An HOA budget is less about math and more about trust. Get it wrong, and homeowners feel blindsided. Get it right, and the community feels confident about its future.

Let’s break it down.

What is an HOA Budget and Why Does It Matter?

Understanding the Homeowners Association Budget

At its simplest, the homeowners' association budget is the annual financial plan. But don’t confuse it with a household budget. This is a collective financial plan that decides how an entire community lives.

- Covers and maintains the shared facilities: swimming pools, exercise rooms, landscaping, and above-ground or underground garages.

- Keeps the community self-supported with services like utilities, trash collection, and security.

- Plans for and saves reserves for everything from routine needs like trash and snow removal, to long-term needs like roofs and resurfaced parking lots.

Why does it matter? Because the budget is more than the bill payments. It affects property values and the entire financial health of the community. Every community association, whether it’s a large condo tower or a small cluster of townhomes, relies on its budget to keep daily operations running smoothly and long-term projects fully funded.

Miss the mark, and you open the door to special assessments. These can wipe out homeowners financially. In Florida, for instance, ballooning special assessments have forced condo owners to sell at drastically reduced prices.

Key Components of an HOA Budget

Operating Fund and Reserve Contributions

A reserve study helps boards understand exactly how much money should be in the reserve account. Without it, boards risk underfunding, which leads to those dreaded special assessments. Here’s a full breakdown of how reserve studies work and why they matter.

Every annual HOA budget is split into two major buckets:

- Operating fund: covers everyday operating expenses like utility costs, maintenance costs, and legal fees.

- Reserve fund contributions: money set aside for major repairs and replacements (like new windows in a building).

This is where a reserve study becomes non-negotiable. Without one, you’re essentially guessing how much to save. With one, you can see the life cycle of assets and plan contributions accurately. (If you want more detail, download our reserve study guide).

With Solume, boards don’t just get static numbers; they can run scenarios. “What if the roof fails two years early? What if insurance costs climb?” You see how your reserve account will hold up under stress before those surprise special assessments arrive.

A proper budget balances operational necessities for today and for the long term, avoiding sacrificing the community's future for a more comfortable present. For example, a community will want to have new pickleball courts installed, but that is not realistic if the roof on the clubhouse needs to be replaced.

Administrative and Insurance Costs

Here’s where communities often underestimate.

- Management fees: Property management companies may advertise a base fee of 5–7%, but when you factor in hidden "administrative costs," the real figure can swell to 20–30% of the budget. That’s money leaving the community instead of being reinvested into it. While an HOA management company can provide professional oversight, boards should scrutinize contracts closely. Too often, the headline fee looks affordable, but hidden charges drain the budget. Read this tell-all inside scoop on how the industry actually is run.

- Insurance premiums: Rising sharply in states like Hawaii, California, Florida, and North Carolina, they can wreck a poorly planned budget.

- CC&Rs and legal requirement costs: Failing to account for compliance opens the door to lawsuits and fines.

Cutting corners here creates the illusion of a healthy budget. In reality, it’s financial quicksand.

The HOA Budgeting Process Explained

Planning the Proposed Budget

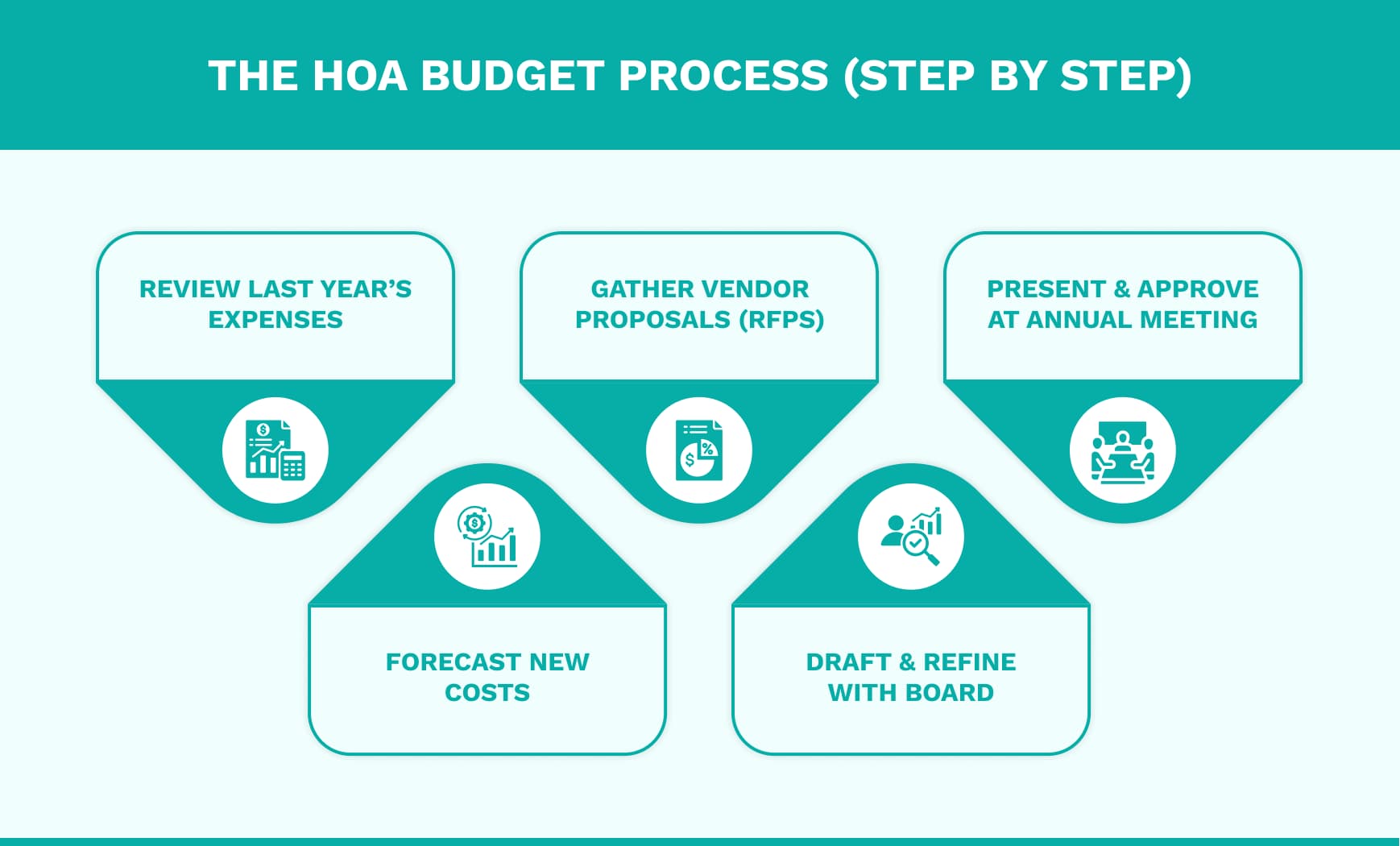

The proposed budget isn’t built on wishes - it’s built on evidence. Start with:

- Reviewing actual expenses from the current year or previous years.

- Adding anticipated expenses for the next year.

- Considering special projects and preparing for emergency repairs.

For large undertakings, boards issue requests for proposals (RFPs) to vendors. Solume simplifies this by managing bids and creating an auditable trail of who said what, when. Stop messing around with missing quotes or single-vendor bids from your brother-in-law's company.

Approval and Presentation by the HOA Board

Once drafted, the board of directors and the HOA budget committee refine the numbers. The board treasurer checks that the income statement and balance sheet align with the plan.

From there, approval must follow state laws and the association’s governing documents. Finally, the budget is presented as the annual budget report at the annual meeting, where unit owners get the chance to ask, “How much money are we really spending—and why?”

Best Practices for HOA Budget Planning

A strong budget doesn’t happen by accident. It comes from discipline and foresight. Some best practices include:

- Keeping track of cash flow and preparing scheduled financial statements.

- Collaborating with an HOA manager or property management firm, but cautiously negotiating contracts to avoid unnecessary administration and other expenses.

- Using reserve studies and financial statements to project long-term needs.

- Boards must check that the association is in compliance with its own rules, state laws, and CC&Rs. More than ever, boards need to understand HOA laws for their state, since compliance management and control—reserve minimums, funding, and disclosure rules, can change between states.

Here’s where many boards make a mistake: they think adding software or tools means increasing the budget. But during the budgeting process, we often help communities integrate Solume within their existing numbers. In other words, no fee hikes, just smarter allocation. During the budget process, boards often discover that better tools or smarter allocations can free up money without increasing fees, turning what feels like a limitation into an opportunity.

How HOA Budgets Impact Homeowners and Real Estate

Transparent accounting, which includes ongoing budgeting and clear communication to owners about the allocation of funds, is a critical pillar for the health of the HOA community.

HOA Fees and Allocations

For homeowners, the budget shows up in one place: HOA fees. Those fees are split between operating expenses and reserve fund contributions. When HOA dues are calculated accurately, they create predictability for owners; when they’re miscalculated, boards are forced to backfill with late fees or special assessments.

When reserves are underfunded, boards scramble—issuing late fees, collections, or special assessments. That cycle kills trust and strains relationships.

Maintaining Property Values and Community Appeal

On the flip side, a well-planned budget doesn’t just cover the bills — it strengthens your biggest asset: property values.

Think about it from a buyer’s perspective. When someone tours a community, they notice details instantly. The entrance sign has chipped paint. The pool deck looks worn. The hallway lights that flicker. These aren’t minor flaws; they’re signals. They tell potential buyers whether this is a community that invests in itself or one that’s slowly declining.

That’s why routine, budgeted investments matter. Things like:

- Landscaping costs: Fresh mulch, trimmed hedges, seasonal flowers. It sounds small, but curb appeal sets the tone before anyone even steps inside.

- Roof replacements: Nothing sinks a deal faster than a looming roof assessment. Buyers ask about reserves, and if the community can’t prove it’s planning for these big-ticket items, they walk away or demand a price cut.

- Common areas: Lobbies, clubhouses, pools, fitness centers. These aren’t just amenities — they’re shared assets that raise the desirability of every unit when they’re well-kept.

This is where the HOA budget directly ties into the real estate market. Communities with solid budgeting attract buyers and keep current owners happy. Communities with weak budgets lose appeal, face higher turnover, and see their values slide.

Here’s the kicker: smart budgeting doesn’t just protect values, it multiplies them. A property that feels well-managed commands higher HOA fees without pushback, because owners can see the return on their money. Contrast that with communities that fail to budget, then scramble with special assessments — owners feel squeezed, buyers get scared off, and prices drop.

A good budget is more than a financial plan. It’s a marketing plan for the entire community.

Preparing the Upcoming Year’s Budget

As the fiscal year winds down, boards must compare the current year’s budget against actual expenses. Did the numbers hold? Were reserves funded as the reserve study recommended?

A yearly budget isn’t just a snapshot of one fiscal cycle; it’s the framework that guides how consistently a community invests in itself year after year.

When boards plan the year’s budget, they can’t just look backward at the current year’s numbers — they also have to account for new laws and external pressures. For example, New York has specific requirements for condo budgets that shape how associations allocate reserves. In states like North Carolina and Florida, it’s skyrocketing insurance costs that drive changes. And everywhere, boards should gather feedback from owners (sometimes as simple as a shared email address) so the budget reflects real community needs.

Adjustments should reflect:

- State laws and regulations: Some state laws, such as that of New York, require a certain amount of predetermined reserve funds, as well as explanation rules that accompany condo budgets. If your community does not meet these legal set boundaries, your community runs the risk of incurring fines, lawsuits, or possibly more, invalidating your entire budget.

- Rising insurance costs: Communities in Florida and North Carolina have been hit especially hard with surging insurance premiums. If last year’s line item hasn’t been updated, you’re already behind.

- Community needs: Did the clubhouse roof start leaking? Did owners request upgrades to security lighting or pool furniture? The budget should evolve with these real-world needs.

- Feedback from owners: A strong board doesn’t operate in a vacuum. Something as simple as a dedicated email address for budget questions or suggestions can give unit owners a voice and build trust in the process.

- Reserve study updates: If your last reserve study revealed gaps in long-term planning, the new budget should increase reserve fund contributions to close them before a crisis triggers a special assessment.

The year’s budget is never “set and forget.” It evolves with community needs, state regulations, and market realities. Smart boards treat the budget as a living document, not a static one.

Final Word

The HOA budget is more than math; it’s leadership. It’s the board showing homeowners, “We’re protecting your investment. We’re planning for the future.”

Whether you’re a first-time HOA board member or a seasoned treasurer, remember this: every line item tells a story. Every choice signals whether you’re safeguarding the community or leaving it vulnerable.

Done right, the budget prevents special assessments, protects property values, and fulfills your fiduciary duty. Done poorly, it fractures trust and forces homeowners into impossible financial corners. For HOA board members and unit owners alike, a well-prepared budget is more than a financial plan.

If you’re serious about getting your HOA or Condo Association budget right, don’t just balance the books; use tools that connect the dots. Platforms like Solume don’t just build a new budget; they tie it directly to your reserve study, vendor contracts, and compliance needs. That’s the kind of financial management that brings clarity, stability, and confidence to your community. At the end of the day, HOA finances are about stewardship—showing homeowners that their money is managed wisely and that the community’s future is secure.