If you live in a community with an HOA, chances are you’ve heard the same question more than once: Do we really need a management company? For some boards, professional help is worth every penny. For others, that monthly bill feels like a black hole—money out, frustration in. The truth is, there’s no one-size-fits-all answer. But the decision to go self-managed (or not) is one that can either streamline your operations… or create more problems.

What’s tricky is that most boards are left to figure it out alone. Should we be getting monthly financials? Are we paying too much? Why does it feel like the board is still doing all the work, even though we hired someone? These are the kinds of questions that don’t get answered on glossy brochures or company websites. So we decided to ask someone who knows exactly how the system works—from the inside.

For this blog, we interviewed a seasoned professional with more than 20 years of experience in community management. He’s worked for three of the largest HOA and Condo management firms in the country and currently manages communities across multiple states. Because he’s still active in the industry, we’re keeping his identity anonymous—but what he shares is real. Every quote in this blog comes straight from that conversation: unscripted, unfiltered, and brutally honest.

Whether you're managing a small townhome community or a large master-planned neighborhood, it's tempting to just Google HOA management companies near me and go with the top result. But the real question isn't who's closest—it's who's actually aligned with your board's goals, your budget, and your community’s best interest.

1. How do I know if my HOA needs a management company?

Most HOAs don’t start by asking “Do we need a management company?”—they inherit one. When a new community is built, developers often hand it off to a professional manager on day one. So boards assume it’s required, without ever asking if it's actually helping. The better question is: “Do we need a management company, or do we just need better support in specific areas?”

If things are slipping through the cracks—vendors not getting paid, maintenance overlooked, documents lost—then yes, your board likely needs outside help. But it might not mean full-service management. Sometimes it’s just that board members are deep into their careers, and HOA responsibilities are the last thing on their minds. If no one on your board wants to think about day-to-day issues, then outsourcing might make sense. On the flip side, if your board is active and engaged, you may be paying for services you don’t actually need—especially if the manager is just acting as a middleman and not bringing real oversight or value. The real issue isn’t management or self-management—it’s about capacity, clarity of the roles, and whether the board wants to make decisions or be in the weeds.

"They’re not honestly looking at “do we need this or not?” They're typically thinking, “Do we need this company or another company?”, when the real question should be, “Do we need to outsource management or bring it in-house?””

As our insider put it, "Every community is unique, but it all comes down to time and people." If no one on the board has the time, energy, or follow-through to manage the day-to-day, that’s your signal.

2. What’s the difference between a full-service, portfolio, and a financial-only HOA management company?

There are three main tiers of service:

- Financial-only: This is the bare minimum — they pay the bills and collect assessments. That’s it. No site visits, no service requests, no violation inspections. Just accounting. These roles are often filled by former property managers who now prefer a 9-to-5 desk job and handle as many as 50–80 communities.

- Portfolio managers: This is what most HOAs think of when they hire a "manager." But it’s important to know that portfolio managers are paid a percentage of the contract, often 3–5%. That means the more contracts they take on, the more they earn — which incentivizes them to stack communities, not necessarily to serve better. New managers get stuck with the worst properties, and service tends to go to the loudest boards, not necessarily the ones with the most need.

- Full-service management: In theory, this covers everything — rule enforcement, proactive maintenance, vendor management, communication, and more. But in practice? Boards still end up doing a lot of the work themselves. You may be paying for full service, but getting partial results.

“And they just always find ways to work their way into a situation to create some value for themselves. The more that they can insert themselves, the more they have a justification for charging you for something.

It's almost like government, too, you know, if we can make it a little bit chaotic and we can put a little bit of fly in the ointment here, then we're always there for help. They don't want to solve the problem. We want to keep it just enough where it's not solved. But we can step in and put Band-Aids on it throughout the year.”

Which is why one of the most cutting insider takes from this whole exchange was:

“They’re not solving the problem — they’re just putting Band-Aids on it so you’ll need them again.”

So how much do they charge? Enough to stay in the game — and keep you dependent.

3. How much do HOA management companies typically charge?

At first glance, HOA management fees seem simple. Fees vary, but here's a ballpark: small communities might pay a flat fee of $1,000–$1,500/month depending on location, types of services, and property size, while larger associations often pay $15–$25 per unit, per month. Communities with amenities (like pools, gates, or gyms) usually pay more, especially if those amenities require vendor coordination or staffing.

But here’s the insider reality:

“They get you in really low that first year... because they know whoever they spoke to probably isn’t going to be there in two years.”

That initial “friendly” price is often bait. Once board members rotate off — which is common — the fees quietly balloon. One example from our conversation describes a contract that tripled in price the following year without discussion or board approval. It simply auto-renewed with a built-in increase:

“It just showed up in the contract... No one talked about it. No one knows this happened.”

And it gets worse. Some companies manipulate the budget by deferring maintenance, just to make the numbers look good. And who’s watching for this? The management company is the one paying the bills. They control the budget software. They generate the financials. So if the price hikes get buried in line items — or offset by cutting back on maintenance — nobody notices. At least, not right away.

“They’ll defer maintenance just to make the numbers look good. That way, no one questions why their contract went up. They don’t want to do [maintenance] because they want to make sure they’re coming in under the numbers... Ten years later, things are falling apart.”

So while the price may sound cheap upfront, the real cost can sneak up — quietly, automatically, and with long-term consequences for your community’s health. This is how boards get lulled into complacency. If the pool still works and there’s no special assessment, the assumption is: things must be fine. But often, they’re not. Deferred maintenance builds up quietly. Vendor relationships get diluted. And ten years later, when things start falling apart?

“You really should get a refund because they didn’t do their job… but they just go on to become another management company’s problem.”

The cycle continues. Communities swap one company for another, but the system stays the same — and the hidden costs add up.

4. What should I look for when comparing local HOA management companies?

Most boards go about this question the wrong way.

They compare Company A vs. Company B — red logo vs. blue logo — assuming they all provide basically the same services. But the real insider approach?

Don’t compare management companies to each other. First, ask if you even need a management company at all.

From our interview:

“You need to compare what services you need, not how they look.”

Here’s why: Many large firms bundle services you may not even want — concierge desks, insurance brokering, in-house maintenance staff — simply because those services generate more revenue for them, not because they’re essential to your community.

“All these extra people are just more people they have to feed.”

The bigger the company, the more overhead you’re paying for. Every extra division or corporate layer is a cost you absorb — whether or not it improves your neighborhood.

So instead of comparing management companies like you would compare coffee brands, flip the script. Start with a self-assessment:

Before collecting bids or comparing brochures, ask:

1. What are we struggling to keep up with?

- Are financial reports getting delayed or messy?

- Are service requests falling through the cracks?

- Is no one sure who’s supposed to handle what?

If the answer is yes to any of these, you might need support — but not necessarily a full-service firm. Sometimes you just need a centralized system, a software to help track everything.

2. What specific tasks do we want to hand off?

List them. Be brutally honest:

- Do we just need someone to pay bills and track assessments?

- Do we need help scheduling vendors, but still want to choose them ourselves?

- Or are we looking for total handoff — where someone else runs the show?

This clarity helps you avoid paying for bloated services you won’t use.

3. What level of involvement do we want as a board?

Decide whether your board wants to:

- Be hands-on, reviewing options and making key decisions (but not necessarily handling all the tasks).

- Or be completely hands-off, where someone else runs operations and you rubber-stamp.

4. Who’s truly accountable to us?

A national firm may look polished, but you’re just one line in a spreadsheet to them. A local vendor or part-time bookkeeper may care more — because your business matters to their survival. But they may not have all the systems and tools you need to manage your community's needs.

Bigger isn't always better. Responsive is better.

5. What are the warning signs of a bad management company?

A good management company should deliver monthly financials on time—usually by the 15th of the following month—without you having to ask. If vendors start complaining about late payments, or if maintenance is being deferred (peeling paint, broken gutters, etc.), that’s a red flag.

Other signs? If they don’t follow a reserve study (proactive maintenance), treat you like a nuisance every time you reach out, or seem disorganized (like confusing your community with another), you’ve probably got a problem.

Another issue is disorganization and lack of accountability. Many large firms outsource their customer service or accounting, which means your community could be mistaken for another—especially if your HOA has a common name. As the insider put it:

“I get bills all the time sent to me from other communities… sometimes those bills get paid [by the accounting department]. Nobody notices.”

That’s not just a clerical error—that’s a symptom of a broken system where your HOA funds could be used to pay someone else’s bills, and no one’s double-checking. If your board isn't receiving accurate, timely, and community-specific service, you're not just being underserved—you're being put at financial risk.

Self-Managed vs. Professionally Managed

6. Can a self-managed HOA do just as well without a management company?

Yes, and in many cases, it can actually do better. But only if the right structure is in place.

The key is continuity. Self-managed HOAs often fall apart when board members rotate out and nothing is documented. But if the community uses software to track everything—budgets, violations, maintenance tasks, vendor contacts, reserve study progress—it creates an operational memory that survives turnover. Without a centralized system for organizing information, every board transition becomes a risk. Volunteers often rotate frequently, and many don’t treat it like a serious responsibility. That’s where things fall apart.

“You have to have something that gives you some stability and continuity… like a software or a person… something that’s going to survive all the built-in change.”

When you build that kind of infrastructure, the benefits are enormous. Why?

Because you're not paying a third party to “middleman” everything, the money stays in the community.

“If you have a good system and a good board… the community thrives more because the money is reinvested into the community, not taken out of the community.”

That means more funding for preventive maintenance, reserve contributions, and neighborhood improvements. And because homeowners are closer to the problems (and the solutions), there’s less red tape—no playing phone tag with a property manager who doesn't even live there.

That said, it only works when the board is ethical, functional, and has software to keep a record of everything. Without some kind of consistent oversight—like an attorney, forensic accounting, or documented policies—it’s easy for power-hungry or negligent board members to take over.

So the better question is: Do you have the right system and culture in place? If yes, self-management isn’t just possible; it might be the smartest move you can make.

7. Why do some communities switch away from management companies?

Many communities drop their management company for one simple reason: they’re paying for service they’re not getting.

Boards often feel like they’re still doing most of the heavy lifting—chasing down vendors, answering resident complaints, managing projects—despite paying a management company a hefty fee. As the insider put it, “Why are we outsourcing it if we still end up doing all the work?”

Management companies often present a polished, professional image—with glossy marketing, branded uniforms, and internal vendor systems. But those polished extras come at a cost—and that cost is pushed onto the board, whether the community benefits from them or not.

"They have a certain uniform they have to wear. Guess who pays for that? The board."

The bigger issue, though, is value. Boards look around and realize they’re still coordinating vendors, managing projects, and answering resident complaints—despite paying a company to do all that. And when they ask for help, they’re often met with slow or vague responses.

Then there’s transparency: it’s not always that anything shady is happening, but information is hard to get. Contracts renew automatically. Prices go up without discussion. Financials aren’t clearly explained.

That’s why some communities choose to fire the management company but keep the on-site manager. The person doing the work wasn’t the problem. It was the layers of unnecessary services and opaque billing that made the system feel bloated and misaligned.

And finally, it’s about control. For many boards, especially those frustrated by years of deferred maintenance and rising costs, switching away from a management company is a way to reclaim their budget and reinvest directly into the community.

8. What’s the transition like from a management company to self-managed?

The transition isn't as dramatic as many boards fear—because most of the community’s infrastructure (like vendors, insurance, legal, etc.) usually stays the same.

“Typically, if you leave a management company, you still have your landscaper, your pool vendor, your insurance, your attorney… all those people are still in place. You just don’t have the accounting part.”

The real shift is internal: boards need a system to replace the admin layer the management company provided. That means:

- Figuring out how to collect dues

- Setting up a vendor list

- Establishing where data is stored (digitally or physically)

- Creating a rhythm for financial tracking and reporting

- Building a maintenance and upkeep schedule so routine tasks (like landscaping, repairs, and inspections) don’t get lost in the shuffle

If a board already has engaged members and clear responsibilities, the transition can actually be smoother than expected. The key is thinking ahead about continuity—especially with records and finances—so nothing falls through the cracks.

That’s where modern tools step in. Today, software built with AI and automation can take over many of the routine tasks that used to require a full management company. Instead of juggling spreadsheets, emails, and vendor contacts, boards can run day-to-day operations through a centralized platform—making self-management not just viable, but often more responsive and cost-effective.

10. What tools or platforms can help a board self-manage more effectively?

The secret to effective self-management isn’t just communication—it’s rhythm.

Every community has recurring seasonal needs: budget planning in the fall, landscaping contracts in the spring, pool prep in early summer, insurance renewals before hurricane season. Without a roadmap, boards get caught in a cycle of reacting instead of leading.

“What you need is a roadmap you can follow… so you can have the confidence to know what you’ve done, what you’re doing, and what’s expected of you in the future.”

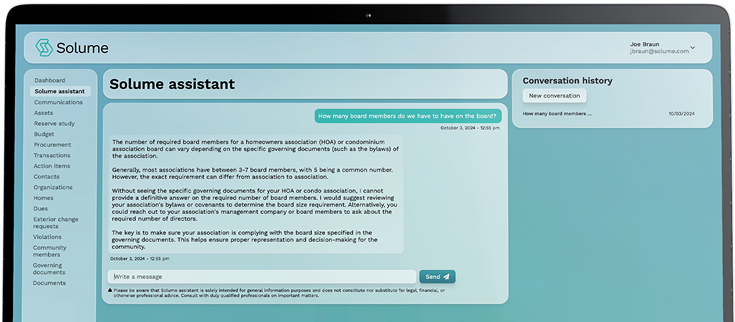

That’s where software like Solume comes in.

Solume is a platform built specifically for HOA and condo boards that want to stay in control without burning out.

What Every Self-Managed HOA Needs in a System (Solume Handles All of These)

- A clear process for collecting dues and tracking payments. Boards need visibility into who's paid, what's outstanding, and how collections are trending—without chasing homeowners manually. Solume automates this and keeps records up to date.

- A reliable way to log and communicate rule violations. It’s not enough to issue warnings—violations must be documented with dates, photos, and outcomes. Solume gives boards a consistent, transparent way to manage this process.

- A schedule and tracking system for maintenance and repairs. Routine upkeep can’t live in someone’s head. A board-run system should track work orders, vendors, and upcoming maintenance tasks. Solume helps schedule and monitor everything in one place.

- Reserve study planning that ties to your actual budget. A PDF is not a plan. Solume connects reserve projections to real numbers, showing what’s funded, what’s behind, and what needs to be adjusted year to year.

- A way to stay legally compliant—and know when you’re not. Board members aren’t lawyers, but they’re still accountable. Solume includes AI tools that flag potential noncompliance with state laws or governing documents and answer common questions.

- Financial reporting that any board member can understand. If you can’t see how your budget compares to actual spending, you can’t lead. Solume generates clear, shareable reports that help boards make better decisions.

- Vendor tracking, contracts, and invoice history in one place. Every board needs a record of which vendors were used, what was paid, and who to call for future work. Solume keeps everything organized and linked to your finances.

- A centralized location for governing documents and board records. Continuity between boards depends on accessible, searchable archives. Solume stores and organizes everything—bylaws, minutes, homeowner data, and more.

- A standardized process for architectural review requests (ARC). Homeowners need to submit requests. Boards need a workflow to approve or reject. Solume gives both sides visibility into where things stand.

- Community communication that doesn’t rely on personal emails. Announcements, updates, notices—boards need a way to broadcast them professionally. Solume includes built-in communication tools that reach homeowners efficiently and keep a record.

And because Solume uses automation and AI to surface deadlines, remind you of compliance issues, and organize every decision in one place, boards don’t have to start from scratch each year.

It’s not just about running your HOA—it’s about finally being able to lead it.