Key Takeaways

- New Jersey recently updated the reserve study law (S3992, enacted August 2025), which now requires a 30-year capital plan and clearly defined funding strategies for all condo associations, co-ops, and most HOAs.

- Every association must maintain an updated reserve study to ensure long-term financial health, reduce the risk of special assessments, and comply with state law.

- A professional reserve study acts as both a financial planning tool and a roadmap for maintaining the community’s structural integrity.

- Boards can now use AI-powered technology, such as Solume’s Reserve Study Management platform, to track updates, project funding needs, and ensure legal compliance.

What Are New Jersey HOA Reserve Study Requirements?

Defining an HOA Reserve Study

A reserve study is a financial and structural assessment that helps homeowners associations and condo boards plan for long-term maintenance and major repairs. It outlines the cost, lifespan, and timing of common elements—everything from roofs and plumbing to parking lots and elevators.

In a traditional reserve study, the data usually comes in a static report or spreadsheet. It’s informative but difficult to apply in practice. Board members have to dig through pages of projections to determine what needs funding and when. A professional Reserve Specialist creates the report, assessing the property’s structural components, estimated remaining useful life, and estimated replacement cost. The final document gives the association a snapshot of its future financial responsibilities.

Solume modernizes this process. It takes a traditional reserve study and transforms it into a dynamic planning tool—an interactive dashboard that lets boards visualize upcoming expenses, test funding scenarios, and monitor progress across the fiscal year. Instead of static numbers, boards get clarity.

Legal Requirements Under New Jersey Statutes

New Jersey’s new S3992 law, signed in August 2025, made reserve studies a legal requirement for condominium associations, cooperative associations, and any homeowners association responsible for maintaining common property. The criteria depend on whether the association owns or manages shared structural components or major building systems. Smaller single-family HOAs with minimal common elements may not fall under the mandate. It mandates that associations:

It mandates that associations:

- Maintain a 30-year capital plan for common areas, property repairs, and replacements.

- Conduct a professional reserve study every five years, with annual reviews and disclosures.

- Identify and fund adequate reserves to cover the estimated cost of major components, including structural, mechanical, and electrical systems.

The law sets clear expectations for when and how boards must stay current. Every association needs to keep its reserve study up to date, accounting for inflation, wear and tear, and any completed projects. Ignoring those updates can put board members at risk under state law and even slow down a real estate sale when lenders or buyers ask to see the association’s financial records.

Here’s what most boards fail to recognize: by the time you realize you’re behind, it’s already costing you more than money. Don’t think of this as just another bureaucratic checklist; it’s about addressing potential problems before they become real (and expensive) ones. When your budget and the community's condition don't align, you’re heading for serious problems. It may take 3-5 years or longer, but they need to be addressed now. When the numbers stop matching the reality of the community, the cracks in the concrete are the tip of the iceberg. The moment you delay, you invite risk. Fixing it later always costs more. I know in most communities, you’re not in the role because you want to be respected by the community. But you also don’t want to be the idiot who didn’t see problems coming or take the time to do the work, especially when all the tools are right in front of you. The board that stays ahead isn’t just compliant; it’s protecting property values, human life, and is in control.

Why Reserve Studies Are Crucial for New Jersey HOAs

Protecting Property Values and Structural Integrity

Can any handyman conduct a reserve study? No. In fact, that’s a terrible idea. A handyman can look at the basic condition of something (for example, wood rot around clubhouse windows), but he/she is likely not qualified to understand the underlying structural issues that might be at risk. Or what a 30-year funding plan looks like for when they will need to be replaced in the future. Take reserve studies seriously. Hire a specialist and/or an engineer, depending on what your community needs.

A professional reserve study preserves both property values and the community’s structural integrity. It’s what keeps roofs from leaking, balconies from failing, and load-bearing walls from weakening. The report provides foresight, letting associations plan future repairs years in advance.

Underfunded reserves are one of the biggest risks to a community’s financial health. When boards delay maintenance or postpone funding, they trade short-term relief for long-term damage. Major repairs like roof replacement or waterproofing can cost hundreds of thousands of dollars if deferred. The new law’s focus on structural integrity reserve studies ensures that these issues are addressed early—before they threaten safety or stability.

Financial Health and Avoiding Special Assessments

Every board of directors knows the stress of a surprise expense. Without proper funding, the only option is a special assessment, which strains homeowners and can lower property values. The annual budget should include consistent reserve contributions based on accurate reserve analysis and reserve funding plans.

Boards that fund reserves properly can:

- Avoid emergency special assessments.

- Plan for long-term maintenance.

- Strengthen their community’s financial stability.

Using Solume, boards can run funding scenarios that show how adjusting contributions affects reserves over time. It helps property managers and treasurers make data-driven decisions instead of reactive ones.

Key Elements of a New Jersey HOA Reserve Study

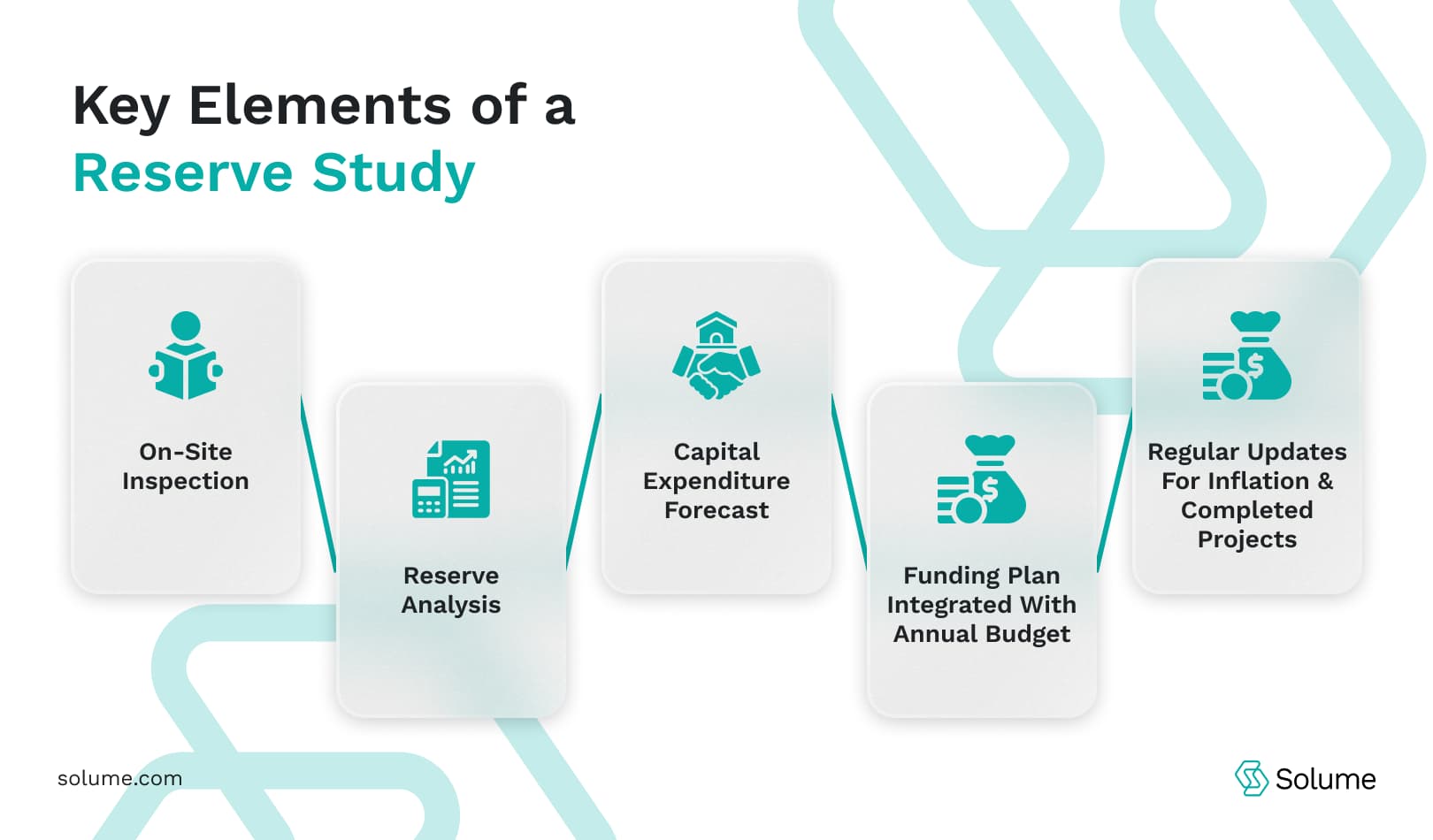

Inspections and Reserve Analysis

Each reserve study company or licensed engineer conducts a detailed site inspection and visual inspection of all common areas. They evaluate major components like roofs, electrical systems, plumbing, elevators, and parking surfaces. These inspections identify deferred maintenance issues and predict replacement timelines. The findings are then analyzed in a reserve funding plan that ties directly to the association’s annual budget.

The inspection process also considers:

- Estimated remaining useful life of each component.

- Estimated replacement cost based on local market rates.

- Capital expenditures are needed for upcoming projects.

Regular reserve study updates keep the plan accurate. Without them, boards risk basing decisions on outdated data, which leads to funding gaps and compliance risks.

Important Reserve Items and Common Elements

A professional reserve study lists all common area components, including:

- Roof replacement, façade repair, and waterproofing.

- Building painting, masonry restoration, and pavement resurfacing.

- Fire protection systems and electrical systems.

- HVAC, elevators, plumbing, and structural supports.

Every reserve item has a projected cost, lifespan, and funding timeline. Together, they form the backbone of the association’s maintenance plan and financial roadmap.

Best Practices for HOA Reserve Planning in New Jersey

Working with Professionals

A professional reserve study isn’t a formality. Think of it as a reality check on its future. Boards should work with a licensed engineer or certified Reserve Specialist familiar with New Jersey’s unique requirements. These professionals try to make sure every detail is accurate and that nothing slips through the cracks. They document what’s required by law and translate it into plain, usable reports for lenders and insurance providers so the board can stay protected and confident in every decision.

Property managers play a critical role, too. They oversee implementation, track expenses, and coordinate updates. When supported by tools like Solume, managers can generate instant reserve study updates, monitor compliance deadlines, and share financial data transparently with residents.

Engaging HOA Boards and Members

Transparency is one of the best practices for maintaining trust. Board members should communicate why funding reserves matter and how they protect homeowners from large, unexpected costs. Use clear visuals and reports to help residents see the long-term benefit.

When big decisions arise—like adjusting reserve contributions or authorizing major repairs—a majority vote may be required, boards should seek legal advice to ensure decisions align with state law and governing documents.

Ensuring Long-Term Success for HOAs in New Jersey and Beyond

New Jersey’s S3992 legislation has made reserve planning a legal necessity, but it’s also an opportunity to lead with foresight. Associations that approach reserve studies as living financial tools—not just paperwork—gain stability, transparency, and trust.

Following best practices for reserve planning ensures every community can maintain its assets, comply with state law, and avoid last-minute crises. Solume helps boards take that further—turning static PDFs into dynamic insights, integrating budgets, fund reserves, and compliance tracking all in one place.

For HOAs and Condo Associations across New Jersey, the message is clear: compliance isn’t red tape—it’s resilience.

If you are looking to learn more about reserve study requirements for other states, we have published a detailed article for different states.