Key Takeaways:

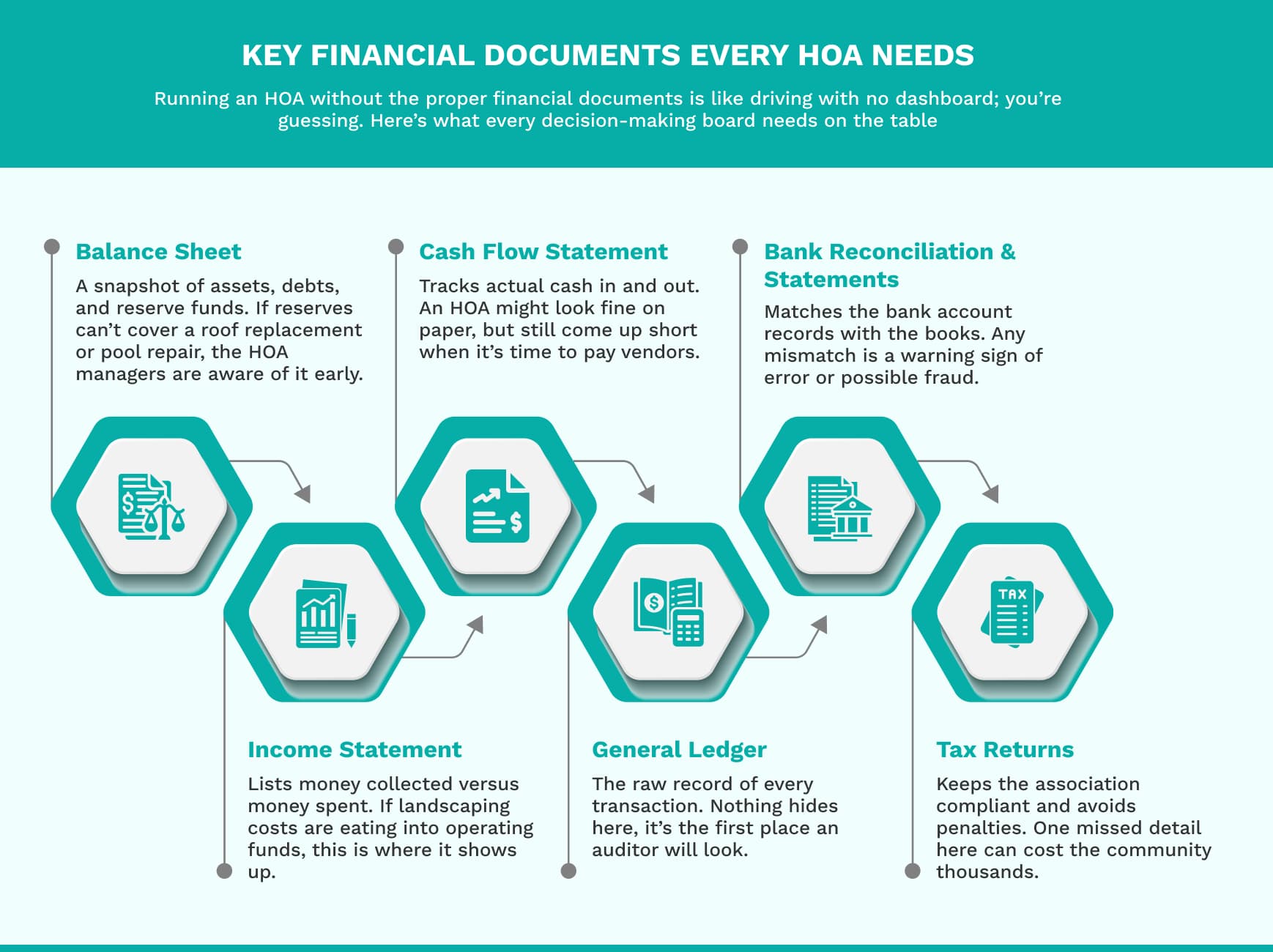

- HOA boards must manage finances like a business, with accurate balance sheets, ledgers, reserve planning, and tax filings that are essential.

- Rising costs and new compliance rules make financial accuracy and transparency more critical than ever.

- Clear financial records protect property values and build homeowner trust.

- Best practices include secure processes, centralized reporting, and professional oversight to avoid errors and fraud.

- Modern HOA accounting software like Solume gives boards real-time visibility, automated error checks, and reserve fund tracking, removing the burden of manual bookkeeping.

The landscape of HOA management accounting has undergone significant changes in recent years. Inflation is increasing vendor contracts. New digital reporting rules from states are also in place. Homeowners want more transparent finances. Because of these changes, mistakes are less acceptable. In 2025, boards need to manage their community’s money like a small business. This includes balance sheets, general ledgers, reserve fund allocations, and tax filings. These documents must be clear and detailed enough to withstand a forensic audit.

While most homeowner association (HOA) board members are volunteers and not professional accountants, this can lead to challenging situations that may compromise both compliance and property values.

Solume is not just another accounting software, but a platform that helps homeowners' associations automate routine tasks, such as tracking reserve funds, reconciling bank statements, and updating the general ledger, while keeping reports like the balance sheet and income statement at the board’s fingertips. No more waiting for “up to two weeks” for the management company to send you a simple report.

With all the information available in real time, it eliminates the need for quarterly reviews to understand financial standings, allowing HOA board members to stay updated year-round about the finances.

Solume gives HOA boards a clear, real-time view of their budgets and transactions, without waiting for quarterly reports or outside updates. Because the platform connects financial data directly to the community’s reserve study, boards can see not only today’s balances but also how upcoming repairs or long-term projects will affect reserves. This transparency helps communities stay financially steady and make confident decisions without relying entirely on outside management.

The Essentials of HOA Management Accounting

What is HOA Management Accounting?

HOA management accounting refers to the organized method of monitoring, reporting, and evaluating the financial status of a community. Unlike standard bookkeeping, it emphasizes association accounting standards, enabling each HOA Board Member to effectively oversee reserve funds, operational costs, and financial dealings with accountability. State laws also play a crucial role in shaping HOA accounting.

Why It Matters in 2025 and later?

As maintenance costs rise and regulations change, boards need tools that ensure clear records with accurate financial information to inform prompt decisions.

Benefits of Professional HOA Accounting Services

Professional HOA accounting services go beyond bookkeeping; they protect the HOA’s finances and improve daily operations:

- Accurate oversight: Updated balance sheets, income statements, and bank reconciliations reduce errors and prevent disputes.

- Efficient accounts payable: Vendor invoices and maintenance requests are processed promptly, minimizing delays.

- Smarter reserve planning: Reserve funds are tied to real projects, ensuring upgrades and repairs don’t surprise members with sudden fees.

- Cost-saving controls: Automated checks flag duplicate payments, unusual activity, and compliance gaps in governing documents.

What many boards don’t realize is that you don’t have to hire a full property manager just to keep the books straight. If finances feel overwhelming or no one on the board is confident handling them, you can outsource the accounting to a bookkeeper or CPA. It’s a practical, cost-effective way to get financial oversight without the added expense of full management services.

Why Financial Records Are Crucial?

For any homeowners association, accurate financial records are the foundation of good governance. They do more than track numbers:

- Maintain HOA’s finances

- Assist in making informed decisions and can budget for repairs, plan long-term projects, and avoid special assessments.

- Build trust with community members through transparent reporting.

- Organized records simplify tax returns, tax preparation, and adherence to governing documents.

How These Statements Impact HOA Management?

- Strong hoa management accounting relies on more than just collecting dues; it’s about using financial records to guide real decisions. Each HOA financial statement plays a role in keeping the community accountable and prepared.

- Ensuring financial oversight for long-term planning. A transparent balance sheet and income statement show whether the HOA’s reserve funds can cover future roof, pool, or road projects. This level of financial oversight helps every HOA Board Member and board of directors plan for the long term without last-minute fee hikes.

- Managing accounts payable and maintenance requests. When accounts payable, work orders, and maintenance requests are tracked through the general ledger and verified with bank reconciliations and bank statements, vendors receive timely payments, and errors are minimized. This keeps HOA managers and property managers aligned with best practices in association accounting.

Allocating reserve funds for common areas and upgrades. Whether upgrading common areas or setting aside funds for emergencies, accurate use of the cash flow statement ensures that HOA members and community members understand how their money is being used. This builds trust, supports financial planning, and ultimately protects property values.

Best Practices for HOA Financial Management

Optimizing HOA Operations

Strong HOA financial management isn’t about adding more reports; it’s about making everyday processes run smoothly. Many associations now rely on HOA management software to handle dues, vendor payments, and budgeting in one centralized location, thereby reducing the errors that often occur with spreadsheets. Security also matters. Protecting bank accounts with dual sign-offs or encrypted systems ensures compliance with governing documents and shields the community from fraud. Even routine tasks, such as work orders and bookkeeping services, benefit from being centralized, providing board members with clear visibility without the need for extra paperwork.

Professional Services vs. Self-Management

Not every community needs the same setup. Smaller, self-managed associations may find it beneficial to keep things in-house if their expenses are predictable and straightforward. However, once multiple vendors, reserve funds, and larger budgets are involved, working with an HOA management company often becomes the more sensible choice. Professional accountants can identify issues in the financial records immediately, which can avoid costly affairs in the long run. They also implement tighter controls and fewer financial surprises, which is more effective.

The Impact of HOA Accounting on Communities

Sound HOA financial management, which regularly addresses repairs, upgrades, conducts regular checks, and maintains the common areas, directly impacts the quality of life for residents. Clear communication builds trust, reducing disputes and increasing overall satisfaction within the community.

Accurate accounting doesn’t just balance the books; it aids in better decision-making for HOA managers, condo associations, and the board of directors. Up-to-date financial records help in financial planning, simplify tax preparation, and aid in forecasting long-term needs with fewer surprises. With the right processes in place, day-to-day operations, such as handling work orders and maintenance requests, can run smoothly, allowing managers to focus more on strategic goals rather than putting out fires.

Strengthening HOA Finances with the Right Tools

HOA boards don’t always need to rely on management companies to keep their finances in order. With the right software, boards can take control of day-to-day accounting while also keeping an eye on the bigger picture.

Solume connects budgets directly to the community’s reserve study, the long-term plan that shows what major repairs or replacements (like roofs, roads, or pools) will cost in the future. This means boards always know not just where their money stands today, but how current spending affects tomorrow’s obligations.

Because everything is tracked in real time, from transactions to reserve balances, boards can make smarter decisions, avoid unnecessary outsourcing, and stay compliant with confidence.

Solume: Giving HOA Boards Control Over Their Finances

Solume is a software that provides boards of directors, association managers, and self-managed associations with a transparent view of their community’s finances.

Boards can log in to Solume and instantly see:

- Automated bank reconciliations that help in flagging discrepancies in advance.

- Clear accounts payable tracking, so invoices, work orders, and vendor payments don’t get missed.

- Reserve fund monitoring enables boards to accurately determine the amount set aside for upcoming repairs, upgrades, or emergencies.

- Real-time financial statements are accessible without the need for an accountant’s translation.

For HOA boards, this means better oversight and accountability. For management companies, it means fewer manual tasks and faster reporting. And for community members, it means confidence that dues are being managed responsibly.

FAQs

- How does Solume support long-term HOA financial planning? By linking reserve funds to real projects and forecasting expenses, Solume helps HOAs prepare for major repairs, upgrades, and emergencies without surprise assessments.

- What kind of reports can Solume generate? HOA boards can easily access balance sheets, income statements, cash flow statements, bank reconciliations, and reserve fund reports, all in clear, board-friendly formats.

- Does Solume improve communication with homeowners? Yes. With accurate, up-to-date financial statements and reserve planning insights, boards can share information confidently, reducing disputes and building trust with community members.

- Is Solume secure for sensitive HOA financial data? Absolutely. Solume uses advanced security measures to safeguard financial transactions, ensuring compliance with governing documents and protecting sensitive homeowner data.