Key Takeaways

- Accurate financial management is essential for HOAs, covering dues, assessments, reserve accounts, and vendor payments.

- Board members remain accountable for reviewing Income Statements, Balance Sheets, and reconciliations.

- Modern accounting tools simplify record-keeping, automate updates, and enhance financial reporting accuracy.

- Professional HOA accounting software services strengthen transparency, planning, and internal controls.

- The right management partner ensures smooth operations, clear reports, and fewer financial surprises.

- Solume helps HOAs by simplifying access to financial data, tracking accounts receivable, and monitoring reserve funds.

For some homeowner associations, “accounting” still means maintaining Excel sheets and periodically reconciling them with bank accounts. Additionally, some HOAs still preserve physical copies of the records without a soft copy backup, which often proves problematic when they need to refer to older records. It is not only time-consuming but also frustrating, with many loopholes.

We know HOA accounting is more than just paying bills. It’s about maintaining the community’s financial records and necessary data, such as completed repair costs, available reserve funds, and other common areas, which are not neglected. In today's time, boards have better options, from clear financial reports to tools that update the general ledger instantly and catch errors almost immediately.

Solume helps homeowner associations simplify accounting for HOAs with clear and precise financial reports. Let's understand it better with the help of an example. Let's say a community is struggling with late HOA fees and unclear reserve account balances. It turned to Solume, which implemented precise bank reconciliations, tracked reserve fund projections, and provided HOA financial statements that gave the board of directors full visibility into the association’s finances. By combining accounting best practices with user-friendly tools, Solume enables HOA boards and community managers to make informed decisions and effectively manage the HOA’s finances.

Understanding Accounting for HOA and Its Importance

If you’ve ever been an HOA board member, you already know the job isn’t just about voting on landscaping or the pool schedule. Much of it involves financial management, ensuring that every dollar collected in HOA fees is accounted for and spent where it should be.

When accounting practices are solid, you can see exactly where the HOA’s finances stand. Repairs get scheduled without panic, the reserve account grows as planned, and members trust that their assessments aren’t being wasted.

What is HOA Accounting?

Think of a homeowner association as a small business. Money is generated from property owners' monthly or quarterly assessments, as well as special assessments, and is used for services such as landscaping, insurance, legal fees, and the upkeep of common areas.

Every payment to a vendor, deposit into the reserve account, or late fee from a resident is a financial transaction. These are logged in the general ledger, which serves as the master record of all accounting transactions. Without it, you can’t prepare accurate financial reports, such as the Income Statement or Balance Sheet, and without those, no one knows the community’s true financial position.

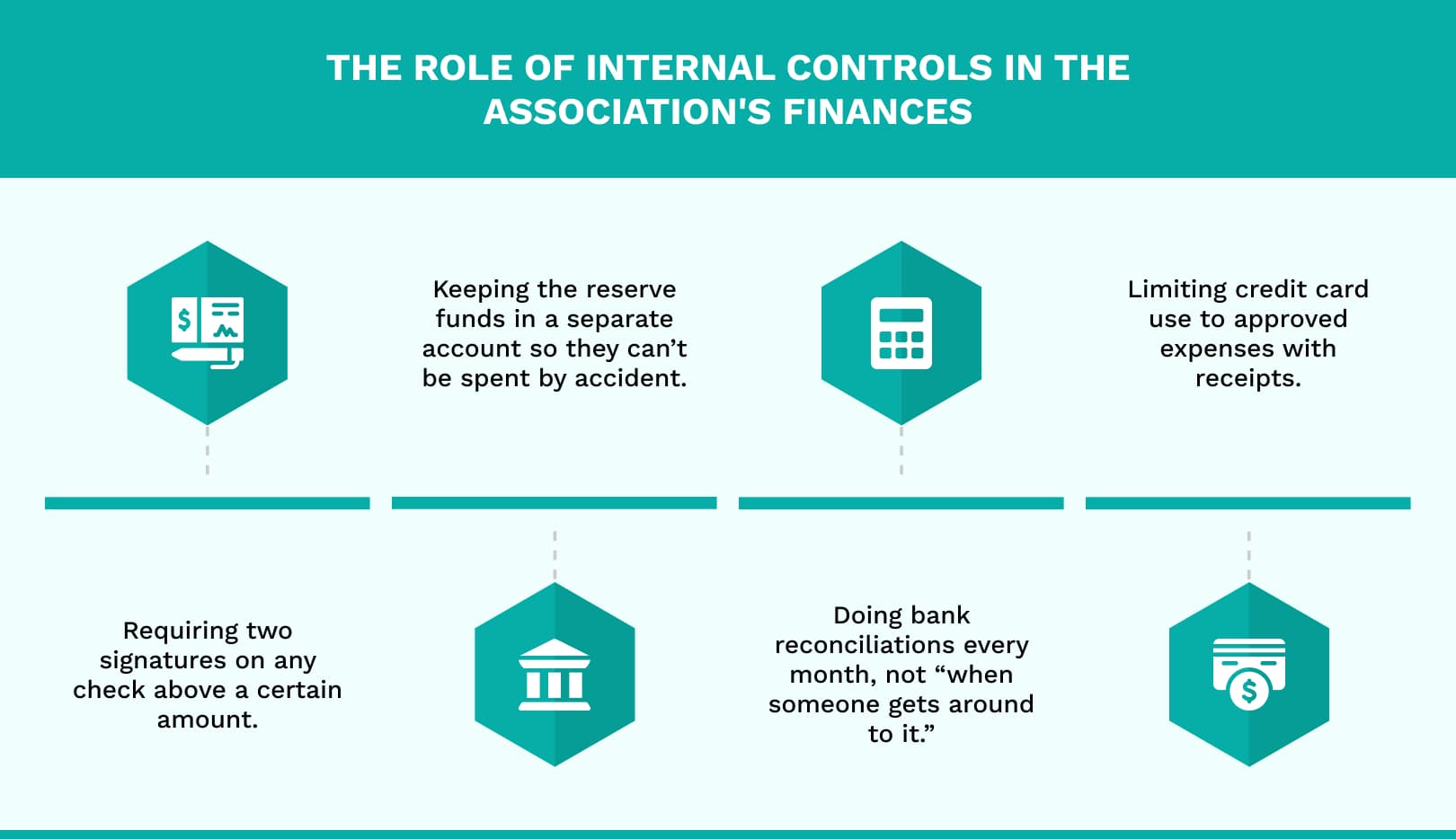

The Role of Internal Controls in the Association's Finances

Internal controls are safeguards that protect an association’s finances. They don’t have to be complicated, but they do have to be consistent. For example:

These steps prevent errors and fraud.

Responsibilities of HOA Board Members and Property Managers

The board of directors has a fiduciary duty to safeguard the HOA’s finances. But oversight is far easier today thanks to new-generation accounting tools that centralize data.

For example, forensic accounting provides hard-coded records of who approved vendor payments or highlights low reserve account balances before they become problems. This proactive approach helps avoid costly surprises, such as special assessments, and keeps the association’s finances stable.

When board members, property managers, and advanced financial systems work in sync, decisions are made more efficiently, vendors are paid on time, and common areas remain well-maintained without last-minute budget scrambles.

Why Accounting Principles Matter?

If an HOA skips proper accounting principles, it’s like trying to run a community event without knowing who’s bringing what. You might end up with five trays of cookies but no drinks, or worse, a half-funded reserve account when the roof needs replacing.

Strong accounting principles make sure the HOA’s finances tell the same story to everyone: the board of directors, HOA members, property owners, and even a Certified Public Accountant during an audit. Without that consistency, financial records can get messy, and trust in the HOA management company or board can quickly erode. It's essential to have all the records and other relevant data in one place to avoid confusion and save time.

Adopting Generally Accepted Accounting Principles (GAAP)

In the United States, HOAs usually follow Generally Accepted Accounting Principles. GAAP is the standard framework that ensures association accounting is transparent and accurate.

Following GAAP helps HOA board members meet their fiduciary duty and makes decision-making far less risky.

For example, GAAP ensures that:

- Income is recorded when it’s earned, not just when it is deposited into the bank account (important for tracking Prepaid Assessments).

- Operating funds stay in a separate account from reserve accounts, so there’s no accidental borrowing.

- HOA financial statements, like the Balance Sheet, Income Statement, and cash flow statements, are easy for non-accountants to understand.

- The general ledger is kept up to date in real-time, with bank reconciliations performed regularly.

Identifying the Best Accounting Method: Cash, Accrual, or Modified Cash Basis

Not every HOA uses the same accounting method. Choosing the best accounting method depends on how detailed a picture the board wants of the HOA’s financial position. HOA accounting services and Certified Public Accountants can guide boards in picking the right method for their community.

- Cash Basis of Accounting: Records transactions only when money moves in or out of the bank account. It’s simple but can give a false sense of security if large bills haven’t been paid yet.

- Accrual Method: Records financial transactions when they happen, even if payment hasn’t been made. It gives a more accurate view of net income and accounts payable, but requires careful record-keeping.

- Modified Cash Basis: A mix of the two. Often used by self-managed associations or smaller condominium associations to keep operating funds simple while using accrual accounting for reserve accounts and special assessments.

Ensuring the HOA’s Financial Health with Proper Accounting Practices

Good accounting practices protect the HOA’s financial health year-round. That means:

- Performing monthly bank reconciliations to confirm that the account balance matches the records.

- Separating reserve funds into a dedicated savings account and updating the reserve study regularly.

- Tracking accounts receivable to prevent late fees from becoming unmanageable.

- Review the Accounts Payable Report and Cash Disbursements Ledger daily if needed.

When internal controls are in place and financial data are accurate, it helps HOA board members avoid last-minute special assessments and keep common areas well-maintained. This will further ensure the HOA’s finances remain stable, regardless of what comes up.

Essential HOA Financial Reports and Records

Managing an HOA involves maintaining a clear understanding of the association’s finances. Proper HOA financial statements and financial records make it easier for the board of directors and HOA board members to know exactly where the association stands and plan for the future.

Balance Sheet: Tracking the Financial Position of the Association

A Balance Sheet shows what the HOA owns and owes at a given time. This includes operating funds, reserve accounts, prepaid assessments, and bank accounts. Liabilities, such as upcoming bills, accounts payable, or pending special assessments, also appear here.

Maintaining an accurate general ledger and performing regular bank reconciliations ensures all financial transactions are recorded correctly. This transparency enables everyone to understand the HOA’s financial position, making it easier to plan for expenses in common areas.

Income Statement: Analyzing Net Income and Financial Activities

The Income Statement shows how much money the HOA earns and spends over time. It tracks HOA fees, income from special assessments, and expenses such as management fees and maintenance. The final net income figure indicates whether the association is running within its budget.

Keeping a close eye on the Income Statement helps the board of directors make smart decisions. If expenses exceed income, the HOA may adjust HOA fees, delay projects, or reallocate funds from the reserve account.

Cash Flow Statements: Understanding Cash Disbursements and Cash Method

The Cash Flow Statement tracks money coming in and out of the HOA’s bank account. It records cash disbursements, online payments, and receipts from property owners. Knowing the availability of cash is critical for effective financial management and day-to-day operations.

Even with a positive Income Statement, delayed accounts receivable can affect cash flow. Reviewing the Cash Flow Statement helps HOA board members and the community manager plan for upcoming expenses and ensure bills are paid on time.

Other Important Records

Other records that help maintain financial clarity include:

- Check Register for issued checks

- Accounts Payable Report to track obligations

- Updated reserve study for long-term planning

- Regular bank reconciliations to match the general ledger

Using proper accounting practices and internal controls ensures the HOA stays transparent and accountable. Accurate reporting enables HOA members to see how their HOA fees are utilized and supports better decision-making by the board of directors.

Best Practices for HOA Record Keeping and Transactions

Maintaining Accurate Financial Data

Accurate accounting for HOAs starts with a system that captures all financial transactions in the general ledger. Keeping separate accounts for operating funds, reserve accounts, and other designated purposes ensures that HOA financial statements reflect the true financial position.

Regular bank reconciliations are critical. They help confirm that account balances match records and reduce errors. Tracking prepaid assessments, late fees, and special assessments enables the board of directors and HOA members to understand the flow of funds, which supports the association’s finances.

Ensuring Proper Financial Management

When you regularly monitor savings account activity and operating fund transactions, a quick overview always provides a clear view of liquidity. Efficient handling of online payments and credit card transactions ensures timely collections and accurate financial records.

Updating the general ledger, reconciling accounts payable, and tracking HOA fees regularly helps the HOA Board Member or community manager make informed decisions. These practices enhance the HOA’s financial oversight and contribute to maintaining the HOA’s financial health.

Managing Self-Managed Associations Effectively

Challenges for Self-Managed HOAs

Self-managed homeowner associations face unique challenges in maintaining accurate financial records. Balancing fiduciary duty with daily financial services requires careful oversight of financial transactions, accounts payable, and accounts receivable.

Without external support, legal fees and management fees must be closely monitored to prevent overspending. Understanding modified accrual accounting, also known as the modified accrual basis of accounting, helps self-managed associations track prepaid assessments and special assessments, thereby maintaining clarity in the HOA’s finances.

Tips for Financial Success

When you engage a Certified Public Accountant, they are qualified to provide you with professional guidance on various accounting matters, such as association accounting, bank reconciliations, and preparing HOA financial statements as per Generally Accepted Accounting Principles (GAAP).

Training HOA board members and community association managers can ensure the team oversees operating funds, reserve accounts, and manages HOA fees effectively. By establishing strong internal controls and structured decision-making processes, you safeguard the association’s finances and support the long-term financial health of the HOA.

Choosing the Right HOA Management Software

Benefits of Professional HOA Accounting Software

A professional HOA management software does more than track dues; it acts as a financial partner for your community. Key benefits include:

- Comprehensive service coverage: From budgeting and vendor contracts to reserve studies, professional companies manage tasks that volunteer boards often struggle to keep up with.

- Data-driven insights: With accurate reporting, boards can make informed decisions about maintenance schedules, capital improvements, and long-term financial planning.

- Regulatory compliance: Management companies ensure adherence to local laws and accounting standards, minimizing risk for the association and board members.

By centralizing operations, they reduce administrative burden while enhancing transparency for homeowners and board members alike.

Ensuring Accountability and Financial Health

Maintaining financial health is about prevention, not just reporting. Experienced HOA managers bring systems that:

- Track financial activity in real time, highlighting unusual spending or overdue payments.

- Standardize processes for dues collection, vendor payments, and reserve fund allocation.

- Provide customized dashboards and reports that clearly show the community’s cash position, projected expenses, and reserve status.

With these tools, boards can act proactively, preventing funding shortfalls and maintaining trust among homeowners.

Choosing the Right HOA Management Software

For most homeowner associations, the challenge isn’t just managing the community; it’s keeping finances organized, records accurate, and board decisions well-informed. That’s where a management software like Solume comes in.

Here’s how Solume helps HOAs handle the day-to-day while giving board members better visibility:

- Financial clarity in real-time – Instead of waiting for monthly summaries, boards can view updated Income Statements, Balance Sheets, and the general ledger whenever needed. This makes it easier to see the balance in the reserve account or whether expenses align with the annual budget.

- Simplified transactions – Solume’s system makes tasks like bank reconciliations, preparing the Accounts Payable Report, and tracking accounts receivable seamless. Even HOA fees, late fees, or special assessments can be recorded automatically, reducing manual work.

- Better decision support – When questions arise, such as whether to use the operating fund, move money into a savings account, or consider a reserve study, the platform provides the data boards need to act with confidence.

By streamlining reporting, transactions, and compliance, Solume helps HOA Board Members spend less time on bookkeeping and more time focusing on maintaining common areas and planning for the community’s future.

Benefits of Professional HOA Accounting Services

Hiring HOA accounting services is less about “outsourcing paperwork” and more about making life easier for the board of directors and HOA members.

Take something simple, collecting HOA fees. Without help, the board or property manager might spend hours chasing down late payments or updating the general ledger. A professional service automates reminders, records payments instantly, and flags overdue accounts receivable before they snowball into a cash flow problem.

Or consider the Balance Sheet. Instead of receiving a confusing spreadsheet once a quarter, professional systems provide the board with a clear snapshot of the reserve account, the operating fund, and the amount of money available for upcoming projects. These services also help with long-term planning. A reserve study isn’t just a requirement; it’s a roadmap. By tying it directly to your financial reports and updating it alongside the Income Statement, modern tools make sure big-ticket items (like pool resurfacing or elevator upgrades) don’t catch the association off guard.

Ensuring Accountability and Financial Health

What really makes professional HOA accounting software valuable isn’t just accurate numbers; it’s accountability and transparency. Homeowners want to know where their dues go, and the board of directors needs confidence in the data before making decisions.

For example, let’s say your bank account shows plenty of funds, but the Check Register hasn’t been reconciled in months. Without proper oversight, you might overlook double payments to a vendor or uncollected prepaid assessments. A good service runs bank reconciliations automatically, so errors are identified immediately, rather than six months later during an audit.

Different accounting principles also matter. Some self-managed HOAs adhere to the Cash Basis of Accounting, but this can conceal unpaid invoices. Professionals often use the accrual method or a Modified Cash Basis so the financial records reflect what’s really happening. That makes the Income Statement and Balance Sheet more reliable, and decisions like whether to raise HOA fees are based on facts, not guesses.

Why Choose Solume?

Running an HOA is already a lot of collecting dues, paying vendors, and keeping up with maintenance. What is often overlooked is the financial aspect: reconciling bank statements, ensuring the reserve fund is adequately funded, and producing reports that are comprehensible to all board members.

The result? HOA board members spend less time on bookkeeping and more time making decisions that matter, like improving common areas or planning long-term projects.

FAQs About HOA Accounting with Solume

1. How does Solume help with late or missed payments? If a homeowner misses an HOA fee, Solume immediately shows it in accounts receivable. Instead of discovering months later that dues weren’t collected, the board can follow up quickly and keep cash flow steady.

2. Our HOA still works on paper checks. Can Solume handle that? Yes. Every payment, whether it’s a check, online payment, or credit card charge, is recorded in the general ledger and tied to the correct check number or bank transaction. That makes the Check Register always up to date.

3. Does Solume make financial reports easier to understand? Absolutely. Instead of receiving a 40-page packet at the end of the quarter, Solume provides board members with a clean Income Statement, Balance Sheet, and cash flow snapshot as needed. It’s written in plain language, so you don’t need to be an accountant to know if the HOA’s finances are on track.

4. How does Solume help avoid sudden special assessments? By linking directly to the reserve account and comparing balances to your reserve study, Solume shows whether future projects (like roof replacements or pool resurfacing) are adequately funded. If they’re not, the board can adjust dues in advance instead of surprising homeowners later.

5. Can Solume work with outside accountants or CPAs? Yes. Many HOAs simply export Solume’s financial reports and share them with their Certified Public Accountant during audits or tax season. Because the data follows Generally Accepted Accounting Principles (GAAP), there’s no need to reformat or re-enter numbers.