Managing the finances of a HOA or Condo Association is no small feat. For many board members—especially volunteers without a background in accounting—it can feel like an uphill battle. But there’s a simpler way. Managing HOA or Condo association finances doesn’t require an accounting degree, but it does require a smart approach.

In this guide, we will go through 7 actionable steps that don’t just keep you ahead of the HOA finances but also help you build a community that thrives!

Key Expenses for a Financially Sound HOA or Condo Association

Budgeting for an HOA or Condo Association isn’t just about crunching numbers or tracking down overdue dues. It’s about managing a complex web of responsibilities—from anticipating maintenance needs to navigating unexpected expenses—all while keeping the peace with your neighbors. Before getting right into the tips, you must first understand the key expenses of the HOA finances. Bear in mind that a well-prepared budget will help you preserve community amenities and services. Here are all the critical expense categories you should consider:

- Maintenance and Repairs: This category includes the regular upkeep of shared spaces like landscaping, pools, and buildings.

- Utilities: Include costs for essential services in common areas, such as water, electricity, gas, and trash removal.

- Insurance Premiums: Keep up with your insurance premiums as it covers property damage, liability and other risks.

- Administrative Costs: Even for small Condos or HOAs, administrative expenses are often overlooked. Many associations rely on two or three different software tools to manage budgets, ARC requests, and still using personal emails—but the right software centralizes all of it, saving time and reducing costs.

- Reserve Fund Contributions: Allocations for future major repairs and replacements, such as roofing, paving, or structural components.

Planning for these expenses helps prevent financial shortfalls and ensures your community runs smoothly.

Simplify Finances with 7 Simple Tips

Now that you know what expenses to manage, let’s take a look at 7 simple tips that can help you manage it all without confusing yourself with numbers.

1. Craft a Budget That Works for You

Why It Matters:

It is very important to get off on the right foot. And with a solid budget, you can set up a clear guide for your finances. Once you finalize the budget, you can manage the spending, prepare for any unexpected costs, and reduce the possibility of special assessments. Moreover, you’ll be able to get an ongoing view of your community’s financial health.

What to Do:

- Separate Operating vs. Reserve Funds: It is a great idea to create two separate budgets, one for the operating costs and one for the reserve funds.

- The operating budget covers day-to-day expenses like utilities, landscaping, and insurance.

- The reserve budget sets aside funds for long-term projects such as roof replacements or pool renovations.

- Plan for the Unexpected: It is always a good idea to allocate 5–10% of your operating budget for emergencies. For example, if there is a sudden roof leak you can easily use the operating budget for emergencies without ever imposing a special assessment.

Review and Revise Regularly: Stay on top of your budget every quarter at a minimum so you can catch any discrepancies early on and make changes or allocations as needed.

2. Master Reserve Studies

Why It Matters:

A reserve study is a vital tool that helps HOAs plan for long-term financial stability. It assesses your community’s needs and creates a roadmap for future repairs and replacements.

What to Do:

- Update Annually: Key components of your community have a lifespan. Regularly review them and make adjustments to your reserve funds accordingly.

- Share Findings: Homeowners may not understand complex data, so it is best to use clear visuals like charts and graphs to explain reserve needs to homeowners.

A comprehensive reserve study includes:

- Component Inventory: A detailed list of all common area elements that require periodic maintenance or replacement, such as pool components, parks or playground equipment, fences, signage, and other shared amenities.

- Condition Assessment: Evaluations of each component’s current state and estimated useful life—essentially, how many years before something needs to be repaired or replaced. You might hear this referred to as a component’s remaining life, a critical detail for planning and budgeting effectively.

- Cost Analysis: Accurate estimates for repair or replacement expenses.

- Funding Plan: A strategy outlining how much to reserve annually to meet future obligations.

To get the most out of a reserve study, conduct a full review every three to five years and update it annually. Solume is the only all-in-one platform that integrates your reserve study directly into your community management system, giving you a real-time view of your financial health. Sharing these insights with homeowners builds trust and transparency while keeping your board ahead of potential challenges.

Please note: Some states require that a qualified reserve study professional conduct the reserve study. It's essential to adhere to your state's laws and regulations regarding reserve studies to ensure compliance and accuracy. (Read the State by State guide for reserve studies)

3. Streamline Your Financial Management with AI and Automation

Why It Matters: Smart tools are there to make things easier for you. Why invest your time in multiple apps for dues collection, databases, and maintenance requests when it can lead to errors and wasted time? Instead, centralize your financial data in one system to simplify management and improve accuracy.

What to Do:

- Centralize Everything: It may take some time and effort to transition to a single platform, but it is worthwhile.

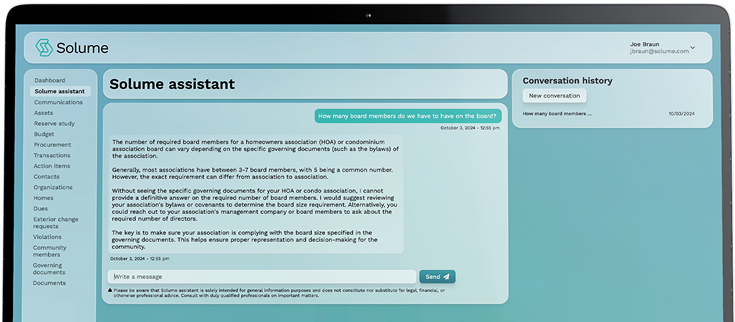

- Evaluate Options: Multiple tools out there offer various services, so it is best to evaluate your options and use demo trials or tutorials before you decide. Some platforms focus on dues collection, while others on managing architectural requests. Solume is the premier AI-powered software that centralizes everything.

- Ensure Data Security: Data security is a valid concern and you must choose platforms with robust security features to keep sensitive financial information safe and accessible.

4. Reduce Late Payments with Automation

Why It Matters: Not collecting dues on time can completely disrupt the cash flow and can create unnecessary tension with community members. Therefore, a good solution is to automate the payment process.

What to Do:

- Automate Reminders: With automatic reminders, you can set up friendly, automated payment notifications via email to keep dues on schedule.

- Offer Payment Methods: Rigid payment options can create unnecessary headaches for both residents and board members. By offering multiple ways to pay—whether through Venmo, ACH, debit/credit cards, or traditional checks—you make dues collection easier, faster, and more convenient for everyone. (Psst... Solume allows for all options to be collected and tracked).

5. Avoid These 3 Common Financial Pitfalls

Why It Matters: Financial mistakes are, unfortunately, common for many boards but certain mistakes can cause long-term damage to the community. Therefore, here are 3 common financial problems that can be avoided.

What to Do:

- Ignoring Reserve Funds: With stronger reserve funds, you can avoid the need for special assessments altogether. This way you won’t have to ask the homeowners for any special assessments and face any backlash.

- Poor Record-Keeping: Missing records can set you back greatly, so it is crucial to keep records of every transaction. Better yet, implement a systematic, preferably digital, filing system.

- Overlooking Small Expenses: Smaller expenses can pile up to huge sums. Record and audit every small expense so they aren’t accumulating.

6. Communicate Finances Clearly

Why It Matters: Homeowners should trust the board to make informed decisions and clear and transparent communication can be the solution. If residents are aware of where and how funds are allocated, they will be more willing to support financial decisions.

What to Do:

- Host Quarterly Finance Webinars: You can set up quarterly finance webinars to keep residents informed and even promote dialogue.

- Provide Regular Updates: Send newsletters or even emails that summarize financial highlights and upcoming needs so that everyone remains informed.

7. Use Technology to Save Time

Why It Matters: It takes a lot of time to enter data and track individual transactions. However, you can automate routine processes and have all of it go on while you're at the pool.

What to Do:

- Automate Repetitive Tasks: Be open to using tools that handle dues collection, invoice tracking, and report generation. With automation, you can not only speed up the tasks but also improve accuracy.

- Update Systems: You may already have tools to help you with basic tasks but they may not be efficient enough - or completely disconnected from other tools. Solume offers one platform for every HOA task - powered by AI.

How Solume Can Help

Finances can be one of the most challenging aspects of HOA management, and the board needs all the help it can get. This is where technology comes in. Solume is a platform designed to streamline HOA financial management by:

- Centralizing Financial Data: Keep all your financial information in one place, from dues collection to expense tracking, providing a clear overview of your community's financial health.

- Automating Key Processes: Save time and reduce errors by automating repetitive tasks like payment reminders, report generation, and even reserve study tracking.

- Improving Communication: Facilitate transparent communication with residents by easily sharing financial reports and updates through a user-friendly portal.

Conclusion

Conquering HOA finances is not about working harder, but smarter. If you implement these 7 steps, you can automate tedious tasks, avoid costly mistakes, and finally focus on the other more human aspects of HOA management. Use technology to your benefit and streamline processes that eat up time and energy.

If you’d like more easy-to-follow budgeting tips and a simple template to jumpstart your reserve study, click here for our free guide. You’ll feel more in control, even if you’re not a financial whiz.