If you've ever found yourself wondering what a condo association actually does, you're likely staring at a budget, a leaky roof, or a board meeting agenda that feels more confusing than helpful. Whether you're serving on the board, considering joining, or simply a concerned owner questioning where your fees are going, this blog will break it down.

Most condo associations in the U.S. operate as nonprofit corporations. They’re governed by elected volunteer board members and funded almost entirely by the residents themselves. When well-run, they protect property values, maintain shared spaces, and ensure compliance with local laws. When poorly run, they create confusion, debt, special assessments, or worse, total community meltdown complete with lawsuits, people selling their homes just to get out of the mess, and board members threatening each other.

The goal of this blog to to give you insight into what boards really do, why it affects your home values and quality of life, and how to help your boards avoid disaster.

The Purpose of a Condo Association

At its core, a condo association is supposed to be responsible for managing the shared property and running the community with the least amount of problems for everyone involved. This includes both physical infrastructure and the way residents live together, as well as the rules they need to follow.

The Core Responsibilities:

- Maintain common elements (roofs, siding, elevators, landscaping, pools, parking lots)

- Enforce rules (CC&Rs, bylaws, architectural guidelines, and governing laws)

- Set and manage the budget

- Hire vendors for services like maintenance, repairs, or snow removal

- Plan for the future through reserve studies and capital project planning

The association also acts as the legal representative of the entire community. It can enter into contracts, carry insurance, and, in some cases, file lawsuits or place liens on delinquent units.

How Condo Associations Are Funded

Many owners ask: How does a condo association make money? While it does generate income, it's important to understand that a condo association isn’t a business—it’s a nonprofit. Its purpose isn't to maximize profit, but to collect enough revenue to responsibly manage and maintain the community. Any money brought in through monthly dues, fees, or fines is supposed to be reinvested directly into the operation, upkeep, and long-term planning of the property. (This poses a different problem because, unlike the association, property managers are for-profit entities whose objective is to take as much money out of the community as they can.)

Income Sources:

- Monthly assessments (dues): ~92% of association revenue (CAI 2023)

- Special assessments (one-time fees for unexpected expenses)

- Amenity rentals or fees

- Fines for violations or late payments

- Interest on reserve accounts

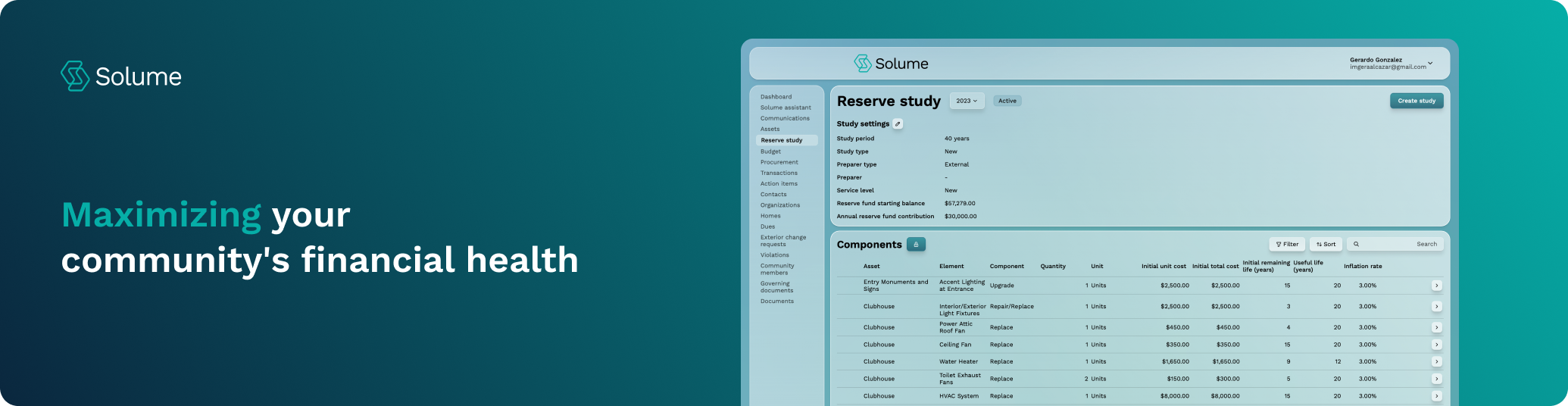

While associations don’t operate for profit, they must operate with financial discipline. Reserves should be built over time, ideally guided by a professional reserve study.

Solume Tip: Solume’s financial management tools make it easy to track assessments, budget forecasts, and spot reserve shortfalls before they become emergency assessments.

What Do Condo Association Fees Pay For?

If you’ve ever looked at your monthly condo fee and thought, “Where is this money actually going?” it’s a fair question—and one a lot of owners are asking.

Condo association fees are one of the most misunderstood parts of shared ownership. And when those fees go up, it’s normal to feel frustrated or confused, especially if you don’t see obvious changes around the building.

Here’s how it works.

Your condo fees typically go into two main buckets: operating expenses and reserve funding.

The operating budget should cover the day-to-day costs of running the community—things like landscaping, cleaning, insurance, minor repairs, utilities, and property management.

The reserve fund is your long-term safety net. That’s where money is set aside for major repairs and replacements, like roof repairs, elevator overhauls, plumbing systems, or resurfacing the parking lot. These aren’t optional—they’re inevitable.

So if your dues are rising, it’s typically for one of two reasons: something is breaking down faster than expected, or past boards didn’t set aside enough money to cover long-term maintenance.

Neither scenario is ideal, but both are fixable.

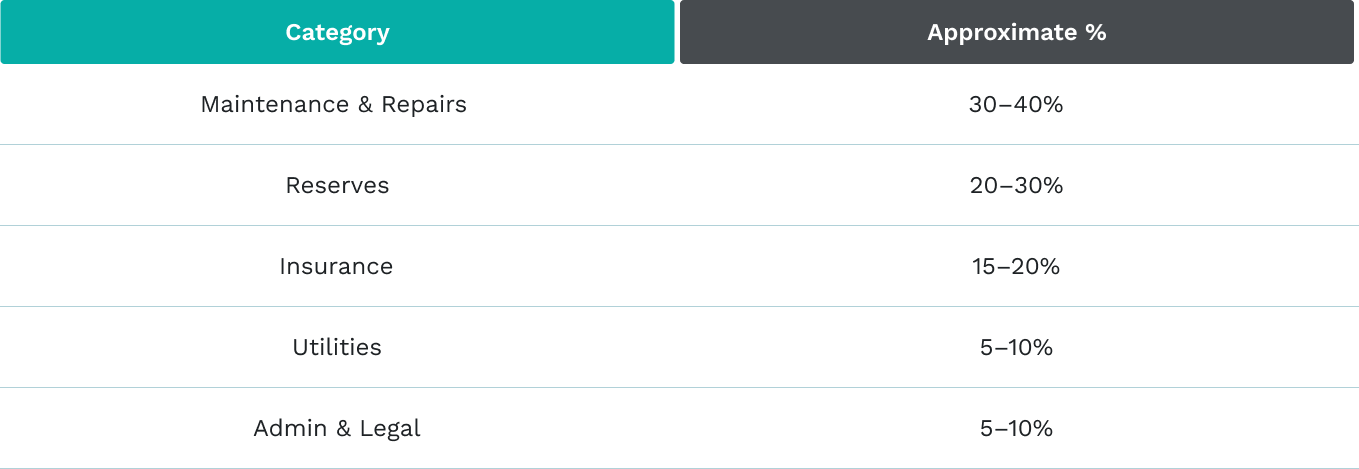

Typical Fee Allocation (Sample Breakdown):

Fees fund both day-to-day operations (mowing, plumbing, cleaning) and long-term capital repairs (roofs, siding, pavement). Without strong planning, associations face steep emergency repairs.

The key is financial visibility and long-term planning. Because when a board doesn’t have the tools to anticipate future repairs, fees stay flat… until they spike. That’s how communities end up with special assessments or emergency repairs that blindside everyone.

Solume helps communities avoid that by turning traditional reserve studies into dynamic, living dashboards. It links your reserve plan to your actual budget, tracks real-time spending, and gives your board the clarity to make better financial decisions before things fall apart. And that’s not even the best part—it’s considerably more affordable than hiring an outside organization to manage your reserves.

Board Responsibilities: What They Actually Do

In most states, condo associations have three core responsibilities: maintain the common property, manage the community’s finances, and enforce the governing documents fairly and consistently.

That sounds simple, but it’s not always straightforward. The governing documents (you know, those documents you may have barely skimmed over) - the CC&Rs, bylaws, and state laws detail out what you can and must do, but they’re often dense, confusing, and easy to misinterpret.

Board Duties:

- Create and manage the annual budget

- Review and update governing documents

- Oversee vendor contracts

- Hire professionals (accountants, engineers, attorneys)

- Conduct and review reserve studies

- Enforce rules fairly and legally

- Communicate clearly with residents

Here’s where things go sideways: some boards overstep—getting involved in disputes they shouldn’t—or enforce rules unevenly, even making things up without due process. Others hesitate to act at all, afraid of legal consequences or resident pushback. And some simply don’t know what their documents allow or require.

In Florida, boards must comply with strict SIRS (Structural Integrity Reserve Study) laws. In California, the Davis-Stirling Act governs financial disclosures and meeting transparency. Other states have similar statutes.

Solume Tip: Solume helps condo boards stay compliant with state laws, track maintenance tasks, and centralize vendor contracts, all in one place.

Who Owns the Condo Association?

Let’s clear up one of the most confusing parts of condo living: who actually owns the condo association?

It might feel like some outside company or the property manager is in charge, but that’s not how it works at all.

No single person or business owns the association. Not the board. Not the management company. Not even your most annoying neighbor at the annual meeting.

The association is collectively owned by the people who own the units. If you own a condo, you’re part of the ownership group. You’re a member of the association by default.

- Board of Directors: Elected to govern on behalf of the owners

- Owners: Automatically members of the association when they buy a unit

- Structure: Usually incorporated as a nonprofit with bylaws and CC&Rs

Board members have authority, but not ownership. They must act on behalf of the collective community.

And this is where it gets a little messy. While owners technically own the association, most communities rely on a board of directors—and often a property manager—to handle day-to-day decisions. That’s not inherently a problem, as long as those decisions are made transparently and within the bounds of the governing documents (including state and federal laws).

But if you’ve ever sat in a meeting and thought, “Wait—do we actually have the power to change this?” the answer is: probably yes. Owners often have more power than they realize—they just need to follow the proper procedures already built into the system.

Why Would Someone Want to Live in a Condo?

You’d think that shared walls, monthly fees, and a long list of "dos and don'ts" would be a dealbreaker.

And yet… for millions of homeowners, a condo isn’t the fallback—it's the ideal.

Why?

Because condo living isn't just about what you get, it's about what you no longer have to deal with.

Pros:

- Maintenance-free lifestyle

- Amenities like pools, gyms, pickleball courts, and clubhouses

- Lower cost of entry in expensive markets (sometimes)

- Built-in community (which, for many this is a con and exactly why the hate the idea of a condo)

Cons:

- Limited control over decisions

- Monthly dues (on top of your mortage)

- Risk of mismanagement or special assessments

According to CAI, 89% of condo owners report a positive experience, but satisfaction drops in communities with poor communication or financial surprises.

If the finances aren’t clear, if maintenance falls behind, or if rules are enforced unfairly—it can go from dream to disaster, pretty quickly.

That’s why we built Solume. It’s software that helps condo boards stay organized, plan for repairs, manage finances, and follow the rules that actually govern the community—so owners aren’t left in the dark or stuck paying for someone else’s oversight. Simply put, Solume is the tool that helps boards become confident they are doing what is best for their community.

Horror Stories and Special Assessment Disasters

When associations fail in planning or transparency, the results can be catastrophic.

Notable Cases:

- Surfside, FL (2021): Structural collapse killed 98 people. Engineers warned of needed repairs years earlier. Reserve funding was insufficient.

- Queens, NY (2023): Condo board accused of mismanaging over $500K in funds. Legal action ensued.

- Chicago, IL (2022): Residents hit with $35K per unit special assessment for facade repairs after years of deferred maintenance.

Solume Tip: Solume helps boards build long-term capital plans, avoid deferred maintenance, and keep homeowners informed—reducing legal risk and resident distrust.

What Smart Boards Do Differently

Smart boards don’t operate in the dark. They lean into clarity and proactive decision-making.

Many of today’s most effective communities are leveraging Solume’s AI-powered features to manage their associations more intelligently and efficiently. Instead of chasing spreadsheets or guessing at timelines, these boards are using real-time data to drive every decision.

Here’s what that looks like:

- AI-powered budget forecasting that adjusts based on actual vendor costs and maintenance trends

- Automated task tracking for maintenance schedules, board deadlines, and compliance issues

- Centralized communication tools that keep owners informed without email overload

- Live dashboards that turn static reserve studies into actionable insights

- One-click document sharing for governing documents, bids, financial reports, and more

The difference between a thriving community and one burdened by special assessments isn’t luck—it’s good planning.

Whether you’re a board member trying to do the right thing or a concerned owner asking the right questions, understanding your association’s responsibilities is the first step to a stronger community.

Want to avoid the next disaster?

Let’s talk about how Solume can help your board simplify financials, plan ahead, and keep your community informed.