A reserve study is one of the most critical financial tools for any homeowners association (HOA) or condo association, yet most board members and property managers either don’t know how to read it—or worse, don’t use it to its full potential. If you want to avoid financial disasters, special assessments, and unhappy homeowners, you need to understand how to interpret and apply your reserve study correctly.

In this guide, we’ll walk you through exactly how to read a reserve study, what key numbers you need to pay attention to, and how to leverage it for smart financial planning.

What Is a Reserve Study and Why Does It Matter?

A reserve study is a long-term financial planning tool used by HOAs, Condo Associations, and property management companies to estimate the costs of major repairs and replacements of common area assets. Think of it as your community’s roadmap to financial stability—if you follow it correctly, you’ll have enough money set aside for big-ticket expenses like roofing, pavement, pools, and elevators.

A related but distinct type of study is the Structural Integrity Reserve Study (SIRS), which focuses specifically on evaluating the structural components of buildings—such as foundations, load-bearing walls, and balconies—to ensure long-term safety and compliance with local regulations. While traditional reserve studies cover a broad range of assets, a SIRS is often mandated after incidents like the Surfside condominium collapse in Florida to prevent catastrophic structural failures. However, both studies ultimately serve the same core purpose: ensuring financial preparedness for necessary repairs and replacements. Some states, including Florida, require these (read more).

But here’s the problem: Most reserve studies are delivered in static PDFs that HOAs and Condo Associations skim through once and then ignore. Big mistake. Without actively engaging with your reserve study, your community is flying blind, and that’s a recipe for budget shortfalls and unexpected assessments

What’s Inside a Reserve Study?

A well-prepared reserve study consists of a few key sections. Here’s what you need to know:

Executive Summary

This is the TL;DR (too long; didn’t read) of your reserve study. It provides a quick snapshot of your community’s financial health, reserve balance, and recommended contributions.

Key Takeaways:

- Does the reserve fund balance look healthy?

- Are current reserve contributions keeping up with future expenses?

- What’s the funding recommendation, and is it realistic?

Reserve Component Inventory

This section lists all major assets that require funding, their estimated lifespan, and projected replacement costs—essentially, anything that is collectively owned by and the responsibility of the association.

Key Takeaways:

- What assets or amenities are included, and are any missing?

- Are estimated useful lives realistic based on past maintenance?

- Are cost projections updated for current inflation rates?

Useful Life & Remaining Life

Every item in your reserve study has an expected useful life and an estimated remaining life. This tells you how soon each component will need repair or replacement.

For example, if your reserve study indicates that your community’s asphalt roads have a useful life of 20 years but only 3 years remaining, you know that repaving will be necessary soon. If funding has been inadequate, this could result in a sudden and significant expense. Understanding these timelines allows for proactive financial planning rather than reactive crisis management.

Key Takeaways:

- Which components are near the end of their lifespan?

- Are some items aging faster than expected?

- Are maintenance schedules being followed to extend useful life?

Estimated Replacement Costs

This is where the numbers get real (gulp 😬). Your reserve study estimates the future cost of replacing each component. However, these estimates are not static—several factors, including inflation, material shortages, and global economic conditions, can dramatically impact costs over time. For example, recent tariffs on aluminum have significantly increased the price of materials, which in turn raises the cost of replacing items such as fencing, railings, and structural components. Understanding these variables ensures that reserve funding remains sufficient even in the face of unpredictable market fluctuations.

Key Takeaways:

- Are cost estimates aligned with real-world pricing?

- Has inflation been factored in appropriately?

- Does the funding plan adjust for rising costs over time?

Funding Models: Cash Flow vs. Component Funding

Most reserve studies use one of two funding models:

- Cash Flow Method: Money is pooled, and as long as the reserve account doesn’t hit zero, you’re “fully funded.” Essentially, this means that there are enough funds to cover the anticipated expenses for that particular year, but it does not necessarily mean that each individual component has dedicated funding. While this approach helps maintain liquidity, it can leave communities vulnerable if costs unexpectedly rise or if a major repair is needed sooner than expected.

- Component Funding: Each individual asset is fully funded separately, ensuring money is available exactly when needed. This means that if a roof replacement is scheduled for 10 years from now, the reserve fund already has the full amount set aside for that specific project. While this approach provides greater financial security for major expenses, it often requires higher annual contributions compared to the cash flow method. Additionally, it minimizes the risk of unexpected shortfalls but can result in overfunding if projected costs decrease over time.

Key Takeaways:

- Does your reserve study use cash flow or component funding?

- Is your current funding model adequate to prevent deficits?

- What would happen if unexpected repairs arise sooner than planned?

How to Use a Reserve Study for Planning

Here’s where most HOAs get it wrong: They treat the reserve study as a report instead of a living financial tool. This leads to outdated projections, surprise expenses, and poorly planned assessments.

Common Pitfalls in Reserve Study Planning

- Only updating the study every few years. Best practice? Track it frequently and update it annually.

- Using a static PDF instead of a dynamic tool. A reserve study locked in a PDF file doesn’t adjust to real-time spending and unexpected repairs.

- Ignoring the study until a major repair is due. By then, it’s too late to course-correct without raising dues or hitting homeowners with special assessments.

How Solume Fixes This Problem

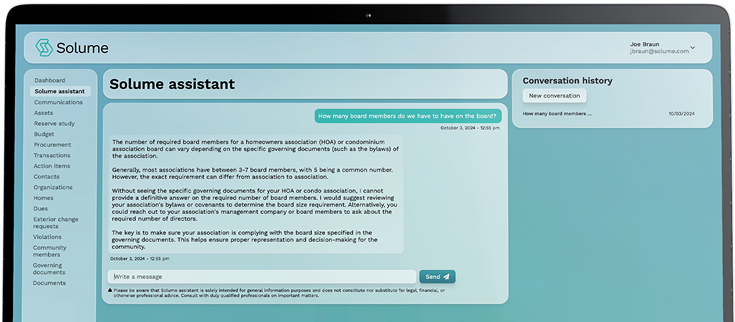

Unfortunately, 99% of reserve studies are delivered as PDFs, which are only partially helpful. They provide a static snapshot of your HOA’s finances but lack real-time tracking, predictive modeling, and easy accessibility for board members.

That’s where Solume comes in.

Solume transforms your reserve study into a dynamic, interactive tool. Instead of flipping through a lengthy document, Solume lets you:

- Track real-time reserve fund balances and project shortfalls before they happen.

- Adjust funding contributions dynamically based on updated costs and timelines.

- Collaborate with board members and property managers to make data-driven financial decisions.

With Solume, your reserve study evolves with your community’s needs, preventing financial surprises and ensuring long-term sustainability.

Final Thoughts: Stay Ahead, Not Behind

A reserve study is not just a report—it’s a financial roadmap. When used correctly, it protects your community from unexpected expenses, ensures a stable financial future, and keeps homeowners happy by avoiding unnecessary special assessments.

Key Takeaways:

- Read your reserve study regularly. Don’t just skim it once every few years.

- Plan beyond just the next big expense. Look at the long-term trends.

- Move away from static PDFs. Use tools like Solume to make your reserve study dynamic and actionable.

Want to see how Solume can help you take control of your reserve planning? Schedule a demo today and future-proof your HOA’s finances.

Interested in ethical and sustainable investing principles for your HOA or personal portfolio? Read more about ESG vs. SRI vs. impact investing here.