Key Takeaways

- HOA Financial Statements are the backbone of transparency and accountability for Condo and HOA Board Members.

- Financial Statements include four primary reports: the Balance Sheet, Income Statement (P&L), Cash Flow Statement, and Statement of Income.

- Accurate financial records protect Homeowners Associations from mismanagement, ensure compliance with state laws, and give residents confidence in how their money is managed.

- Technology like Solume now makes managing condo and HOA financial statements, budgets, and reserve accounts simpler, faster, and more accurate.

What Are HOA Financial Statements and Why They Matter

Every Condo and HOA Board Member has (or should have) one shared responsibility: to protect the community’s financial health. HOA Financial Statements are the set of reports that show exactly where the money comes from, where it goes, and what’s left over. These documents give a full picture of the association’s financial condition, guiding smart decisions about maintenance, dues, and long-term planning.

HOA Financial Statements are not just paperwork—they are the story of the community’s finances told through numbers. For Homeowners Associations, these reports provide insight into income sources, expenses, and reserves that fund future repairs. When accurate and current, they give residents confidence and board members control.

Core Components of HOA Financial Statements

Balance Sheet

The association's Balance Sheet provides a snapshot of the association’s financial position at a specific date. It lists current assets, fixed assets, liabilities, and equity—in simple terms, what the association owns and owes. This statement helps boards track bank accounts, reserve fund balances, and Accounts Payable.

Income Statement

The Income Statement (also called the Profit and Loss Statement) summarizes income and expenses over a specific period. It reveals whether the association is operating at a profit or a deficit. Tracking trends here helps board members identify areas to reduce spending or adjust HOA fees.

Cash Flow Statement

The Cash Flow Statement tracks how cash moves in and out of the association’s bank account. It’s vital for identifying timing issues—when dues are collected versus when major bills are due—and for maintaining adequate cash reserves to meet obligations.

Statement of Income

An Income Statement and a Statement of Income are often used interchangeably, but technically, the Income Statement provides a summary of money coming in and money going tou (revenues and expenses) over a period, showing profit or loss, while the Statement of Income can be a more detailed version of the same data, itemizing revenue streams and expense categories for clarity.

This document is a detailed breakdown of income sources and expenses. It ensures financial transparency for community members, showing how assessments are allocated across operations, reserves, and Capital Improvements.

Together, these reports form a complete view of the association’s financial management—a living dashboard of its health and sustainability.

Ensuring Financial Transparency for Homeowners Associations

Compliance with State Laws and Governing Documents

Some states are very strict on their requirements; other states are less regulated (read about state requirements here). Most states, however, require Homeowners Associations to maintain detailed financial records in line with governing documents and state regulations. Failure to do so is not just irresponsible; it can lead to penalties, legal disputes, or loss of community trust. Boards must store essential documents like bank statements, insurance policies, and annual audits to prove compliance.

Provides community members with access to financial information

Whether we like it or not, transparency builds trust when it comes to Condo and HOA financials. Board Members should make monthly financial reports and interim financial statements available to homeowners upon written request. Regular reporting helps residents understand how assessments are used and ensures alignment with the annual budget.

Tracks the association’s financial condition over a specific period

Accurate financial statements track performance over each fiscal year, showing how funds are allocated for common areas, Major Repairs, and reserves. This consistency protects the association from surprises and supports better decision-making in future budgets.

Roles and Responsibilities of Condo and HOA Board Members

The Role of the HOA or Condo Treasurer

While in most cases each board member might have eyes on the financials, the Treasurer serves as the point person for all financial matters within the community. They prepare and present reports to the Board of Directors, coordinate with Certified Public Accountants and HOA management companies, and communicate the community’s financial position to residents. The Treasurer also needs to review bank statements, verify transactions, and ensure that budgets and financial statements are accurate and current. Acting as a bridge between financial professionals and the community, the Treasurer helps maintain clarity, accountability, and trust in every financial decision.

Managing the HOA’s Financial Health

All Board Members act as financial stewards. Their responsibilities include reviewing Accounts Payable and receivable reports, approving expenses (sometimes having a Dual-Signature Policy), and verifying Payable Reports. Every financial decision should reflect the board’s fiduciary duty to the community. Maintaining strong reserve accounts ensures funds are available for large-scale repairs and Capital Improvements.

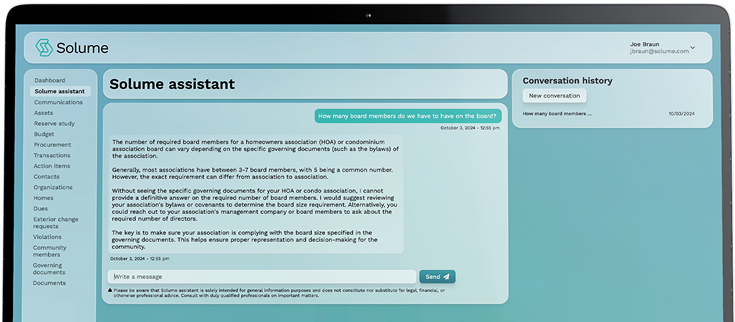

Boards should conduct regular financial reviews at board meetings, working with a Certified Public Accountant when necessary. Solume simplifies this process by giving every authorized user—Board Member, HOA management company, or CPA—real-time access to budgets, reports, and audit trails.

Importance of Accurate Financial Records

Good recordkeeping keeps an association out of trouble. Every financial transaction must be recorded in the general ledger and supported by documentation like check numbers, bank reconciliations, or Work Orders. Proper tracking of Accounts Payable, accounts receivable, and account balances ensures no money is lost or misused.

Accurate records also make annual audits smoother and help the board respond quickly to homeowner questions about spending or reserve balances.

Best Practices for Financial Management in HOA Communities

Promoting Financial Stability and Compliance

Strong financial management comes down to process and discipline. Boards should:

- Follow Accounting Principles and the Accrual Accounting method.

- Work with a Certified Public Accountant for accurate financial reporting.

- Conduct an reserve studies every few years to update the long-term funding plan.

- Provide community members with monthly or quarterly reports for transparency.

Solume makes this easier by automating many of these steps. The platform connects budgets, expenses, and reserve data into one central system. Board Members can monitor spending, compare past years, and forecast future costs without the headache of always trying to get one sent to you from the accountant or property manager.

Maintaining Association Records and Legal Compliance

Every HOA or Condo association must keep organized association records, including membership lists, financial reports, and all financial correspondence. These documents ensure legal compliance but also protect the board from liability.

Using Solume’s centralized platform, associations can store master records, upload invoices with invoice numbers, and keep a clean digital trail for every financial activity. This feature eliminates manual filing and keeps the board audit-ready.

How Solume Simplifies HOA Financial Management

Streamlined Operations for HOA Board Members

Solume was built to fix what's broken in community management. Among other features, it gives Condo and HOA boards a clear view of the association’s finances, eliminating the frustration of juggling spreadsheets or waiting for reports from an HOA management company. Solume offers:

- A centralized hub for all financial activities and reporting.

- Automated tracking of management fees, Accounts Payable, and Cash Disbursements Ledgers.

- Real-time tools for monitoring reserve fund balances and cash flow.

By giving the board control and visibility, Solume makes financial operations transparent and efficient.

Enhancing HOA Community Management with Solume

Solume doesn’t replace your accountant—it empowers them. Certified Public Accountants and property managers can log in to access reports, validate accounting records, and verify data in real-time. This transparency strengthens trust between boards, management companies, and homeowners.

Solume also connects financial reporting with other essential functions like reserve study planning, dues collection, and vendor management. With integrated Account Delinquency Reports and digital Work Orders, the platform streamlines every part of financial management.

Key Takeaways on HOA Financial Statements

- HOA Financial Statements provide the clearest window into a community’s financial position.

- Following best practices ensures accuracy, compliance, and financial stability.

- Boards that embrace tools like Solume manage their association’s financial records without the necessity of multiple software platforms.

- Transparent reporting and organized documentation protect the association’s assets and reputation.

- Good financial habits lead to stronger communities, healthier budgets, and lasting trust between boards and homeowners.

Understanding HOA Financial Statements: 10 FAQs Every Board Should Read

Understanding HOA financial statements isn’t just about reading numbers. It’s really about seeing the full story behind how your community is managed. Whether you’re a new Condo or HOA Board Member or simply a homeowner trying to make sense of your association’s finances, these questions cover the essentials and go deeper into what really matters: trust, accuracy, and transparency.

1. What are HOA financial statements and why are they important?

Think of financial statements as the community’s pulse. They tell you if your association is healthy or headed for a heart problem.

These aren’t just reports for your CPA to file away—they’re the roadmap for every decision you make.

At a minimum, these statements show how much money came in, how much went out, and what’s left in the bank. But the real story is in the patterns. Are you collecting dues on time? Overspending on vendors? Sitting on reserves that aren’t earning interest?

When those questions go unanswered, small problems grow legs. Clear, consistent financial statements turn guesswork into accountability. That’s how strong communities stay that way.

2. What are the main components of HOA financial statements?

Every community—big or small—runs on four key financial reports. If one’s missing, you’re only seeing part of the picture.

- Balance Sheet: Shows what the association owns, owes, and keeps in reserve.

- Income Statement (Profit and Loss): Tracks how much came in and how much went out during a specific period.

- Cash Flow Statement: Reveals how money actually moved—not what’s promised or projected, but what hit the account.

- Statement of Income: A deeper breakdown of income and expenses that helps spot trends before they become trouble.

Most boards treat these like formalities. Smart ones treat them like instruments—they listen for anything off-key.

If the Balance Sheet doesn’t match the bank statement, or the Cash Flow shows more going out than coming in, it’s time to look closer. That’s not paranoia—that’s stewardship.

3. How often should Condo and HOA financial statements be reviewed?

Every month. No exceptions.

Here’s the reality: the most financially stable communities are the ones that treat their financial statements like a heartbeat—checked regularly, understood deeply.

When boards wait until year-end or the next audit, they’re not managing—they’re reacting.

Monthly reviews help spot overspending early, compare actual results to the annual budget, and keep every board member in sync. Quarterly summaries are fine for homeowners, but internal reviews should happen monthly without fail.

And don’t just read the numbers—interpret them. A financial statement isn’t the end of the conversation; it’s the beginning of accountability.

4. Who’s responsible for preparing and reviewing HOA financial statements?

The board of directors carries ultimate responsibility, but the treasurer is the point guard. They translate financial data into something the board—and the community—can actually understand.

The treasurer works with your Certified Public Accountant (CPA) or HOA management company to prepare reports, verify accuracy, and ensure the books stay compliant with state laws and your governing documents.

Good boards also build in dual-signature approvals or review thresholds for large expenses. That small habit protects both money and trust.

Platforms like Solume make that workflow easier by giving CPAs, managers, and board members shared access to the same financial dashboard—no back-and-forth emails, no missing reports, just clarity.

5. How do Condo and HOA financial statements help prevent fraud or mismanagement?

Transparency kills corruption.

When every expense, transfer, and bank statement is visible, there’s no place for misuse to hide.

Most HOA “fraud” stories don’t start with bad people—they start with bad systems. Maybe one person controls all payments. Maybe bank reconciliations don’t happen. Maybe nobody cross-checks Accounts Payable or vendor invoices.

Strong boards build friction into the process on purpose. Require dual signatures. Store records where multiple people can see them. Review financials every month.

It’s not paranoia—it’s prevention.

6. What should board members look for when reviewing financial statements?

If you only glance at the numbers, you’ll miss the story they tell.

Here’s what to look for:

- Compare actuals against the budget every month.

- Check that reserve fund transfers happened on schedule.

- Match bank account balances to your Balance Sheet.

- Review Payable Reports to verify invoices are legitimate and approved.

If expenses spike, dig deeper. If income dips, ask why.

When boards stop asking questions, that’s when small issues turn into six-figure problems.

7. How can technology simplify financial management?

Technology doesn’t replace responsibility—it amplifies it.

Modern tools like Solume bring every financial process into one dashboard. You can review Balance Sheets, Income Statements, and Cash Flow Statements in real time instead of waiting weeks for reports.

That means no more chasing your manager for numbers or guessing how much is left in reserves. Solume gives the board members, CPAs, and management company access to the same truth at the same time.

It’s accountability made simple—and it’s exactly what modern communities expect.

8. How do HOA financial statements differ from regular business financials?

Businesses chase profit. Associations protect value.

That’s the key difference.

While both follow Accrual Accounting and Accounting Principles, HOAs and Condo Associations operate as nonprofits focused on maintaining common areas, protecting financial stability, and planning for Major Repairs through reserve accounts.

Think of it like this: a business measures success by its bottom line. A board measures it by how well it preserves property values and avoids special assessments.

Both require precision, but only one is built on collective trust.

9. How should boards handle discrepancies or missing information?

First rule: don’t panic—verify.

When something doesn’t add up, compare your general ledger, bank statements, and Payable Reports. Most issues come down to timing or data entry, not dishonesty. But if you can’t reconcile the difference, involve your CPA or management company immediately.

The longer you wait, the harder it is to find the source.

Transparency delayed is accountability lost.

10. What can homeowners learn from reviewing HOA financial statements?

Homeowners deserve to know where their money’s going.

When associations share clear, accurate financials, they replace suspicion with confidence.

A homeowner who sees the numbers understands why dues change, where funds are allocated, and how well the association reserves are managed. That awareness builds trust—and trust builds stronger communities.

Every healthy association runs on the same principle: transparency isn’t optional. It’s leadership in practice.

Expert Takeaway

Financial statements are more than paperwork and formality. They’re proof of work and proof of integrity. They show how a community handles responsibility, money, and trust.

Boards that embrace transparency, use clear reporting, and adopt platforms like Solume don’t just meet standards—they set them. They make smart financial decisions visible and predictable.

That’s how good communities stay good. And how great ones last.