Rising Premiums: A Massive Problem

Condo associations across the country are facing steep insurance premium spikes. When surveyed recently, 91% of community associations reported that their insurance costs increased at the last renewal, and nearly 17% saw premiums double or more. Many associations have even lost access to insurers, with 20% reporting that one or more carriers pulled out, forcing them to seek coverage from expensive surplus-line insurers www.advocacy.caionline.org.

Rising insurance costs are leading to higher monthly HOA dues and putting pressure on association budgets. Condominium fees increased approximately 20% between 2022 and 2024, mainly due to insurance price hikes, according to programbusiness.com. These increases make it more difficult for owners to afford their homes and can discourage potential buyers, affecting property values and sales.

Board members are grappling with this new reality. For example, a California condo community in a wildfire-prone area saw its annual premium jump fourfold – from around $40,000 to over $170,000 – when most insurers declined to offer coverage due to wildfire risk. The board had to raise residents’ dues by a maximum of 20% just to cover the new policy. In another case, a retired couple in Colorado decided to sell their condo and rent after watching their HOA fee climb to $399 per month and expecting further increases from insurance and maintenance needs. These stories underscore that soaring insurance costs are not an isolated issue – they are affecting condo communities nationwide, from high-rise towers to townhome complexes.

TL;DR (Too Long; Didn't Read): Watch the YouTube Video

Why Condo Association Insurance Costs Are Increasing

Multiple factors are driving up condo association insurance premiums. Understanding these causes can help boards address them:

- More Severe Weather & Catastrophes: Climate change is contributing to more frequent and intense disasters, and insurers are paying out record claims for hurricanes, wildfires, floods, and hailstorms. In recent years, extreme weather events that were once rare have become common, pushing insurers into a “hard market” where they charge more and tighten underwriting hilbgroup.com. For example, hurricanes in Florida and Louisiana and wildfires in California have caused billions in damages, leading insurers to raise rates dramatically or even withdraw from those markets nar.realtor. Large carriers like State Farm, Allstate, and Farmers have pulled back in high-risk states (e.g. stopping new policies or non-renewing many existing ones in California and Florida) due to the difficulty of charging enough to cover potential losses. Fewer insurers mean less competition and higher premiums for those remaining. The global reinsurance market (insurers’ insurance) has also been hit by worldwide catastrophes, driving costs up for local insurance companies and, in turn, policyholders. All of this means condo associations in disaster-prone areas are seeing skyrocketing premiums to account for future catastrophic claims.

- Inflation and Rebuilding Costs: Sharp inflation in construction and materials has greatly increased the cost to rebuild or repair property damage. Even without a disaster, many policies are adjusting to higher appraised values for buildings. If a condo’s insured replacement cost hasn’t been updated for a few years, a new appraisal can double the insured value (due to inflation), and the premium will jump accordingly, hilbgroup.com. Insurers must charge more because any claim payout (for a fire, roof damage, etc.) will cost them more to settle in today’s dollars. The past few years saw home construction costs surge, so homeowner insurance premiums rose ~20% from 2020–2022 on average (far above inflation), with another ~6% increase expected into 2025. This trend hits condo associations especially hard if they have large buildings – a higher replacement cost means higher premiums to maintain full coverage.

- Aging Buildings and Deferred Maintenance: Many condos are now decades old, and deferred maintenance has become a serious concern. Insurers are increasingly wary of older buildings with outdated infrastructure that hasn’t been kept up. A condominium with old roofs, original plumbing, or structural wear-and-tear is at higher risk for leaks, water damage, fire, or even structural failures. Insurance brokers note that aging condos with deferred maintenance make insurers nervous about potential water pipe bursts and other damage, leading them to either charge steep rates or decline coverage. In short, the worse shape a building is in, the more of a risk it poses. If an association has a history of frequent minor claims (e.g. repeated water leak incidents), insurers interpret that as a sign of underlying issues and fear a larger loss is looming. This was evident in Hawai‘i, where one 10-story condo building “riddled with water claims” saw its insurer refuse renewal; the association had to find a new policy on the secondary (non-admitted) market, and the annual premium jumped from about $30,000 to $200,000, then to $375,000 over a few years hawaiibusiness.com. Poor maintenance not only raises premiums but can lead to losing coverage altogether. The tragic Champlain Towers South collapse in Surfside, FL in 2021 – where long-deferred structural repairs contributed to a building failure – underscored the dangers of neglect. In its aftermath, insurers and regulators nationwide began scrutinizing condo maintenance and repair reserves much more closely buildingreserves.com.

- Fewer Carriers and Market Turmoil: The property insurance industry is in a hard market cycle, meaning many insurers have reduced capacity or exited certain markets. When major insurers exit, associations often must turn to surplus-line or state-backed insurers that charge higher rates and offer less coverage. For instance, in California’s wildfire zones, dozens of communities have only one or two insurers willing to consider them, resulting in quotes several times higher than prior years. In Florida’s crisis-prone market, insurer insolvencies and pullouts have forced more associations into Citizens (the state’s insurer of last resort) or other high-cost options. Nationwide, more than a dozen insurance companies have gone insolvent since 2019 due to catastrophe losses and financial strain nar.realtor. The remaining companies have imposed stricter underwriting – they might refuse buildings with certain risk factors (e.g. older high-rises lacking updates) or only offer renewals with hefty premium increases. Unfortunately, this means condo associations are caught in an environment of high risk and diminished supply of insurance, which inevitably drives up prices. As one insurance expert warned, if trends continue, the highest-risk areas could even become uninsurable in the private market (though government or specialty insurers may step in at a cost).

States Hit Hard by Skyrocketing Premiums

Insurance costs are rising everywhere, but some states are feeling the crunch more acutely due to their exposure to natural disasters and market conditions:

- Florida: Florida’s condo associations are at the epicenter of the insurance crisis. After back-to-back years of costly hurricanes (Ian, Idalia, and others), insurance premiums have more than doubled for some Florida communities. Several insurers have pulled out of the state entirely, and those remaining have drastically raised rates to offset hurricane losses and a once-abusive litigation environment. This has forced many associations to turn to surplus-line carriers or Citizens Insurance, often at higher cost and with coverage limitations. Florida’s situation is so dire that the state legislature convened special sessions to reform insurance laws in 2022–2023, yet rates continue climbing. Meanwhile, the Surfside tragedy spurred new laws requiring older condos to undergo structural inspections and reserve funding, which has triggered large special assessments for repairs in many buildings. Owners in some Florida condos are seeing one-time assessments of tens of thousands of dollars per unit to fund mandated structural improvements and reserves. Combined with soaring insurance premiums and property taxes, the total cost of condo ownership is becoming prohibitive for some retirees and middle-income owners. There’s also a financing squeeze: over 1,400 Florida condo associations have been “blacklisted” by Fannie Mae (ineligible for conventional loans) due to insufficient reserves or repair issues. This means buyers can’t get mortgages in those buildings, putting further pressure on property values. In short, Florida’s coastal location and aging building stock create a perfect storm of high risk and high cost – a crisis that board members must navigate carefully.

- California: Wildfires and insurance retreat have slammed California communities. Insurers now rank California as one of the riskiest states due to massive wildfires in recent years. Many large carriers (State Farm, Allstate, Farmers) have stopped writing new homeowner policies in the state’s high-risk areas, and some are non-renewing existing policies. Condo associations in wildfire zones have seen premium spikes of 300–400% in a single year. For example, a condo HOA in Orange County, CA received a renewal quote that was four times its 2022 premium because almost a dozen insurers refused to even bid on the risk. That new policy also came with a major limitation: only $2 million of coverage for wildfire damage out of $70 million in property coverage, a reflection of how wary insurers are of wildfire losses. California also faces earthquake risk (standard policies don’t cover quakes unless a separate policy is purchased), but wildfire has been the main driver of recent insurance woes. The state’s insurance commissioner has imposed temporary rules to keep insurers from abandoning customers, yet the trend of withdrawals and rate hikes continues. Condo boards in California must plan for difficult insurance renewals, especially if their property is in or near wildland areas.

- Hawai‘i: In 2023–2024, Hawaii emerged as an unexpected hotspot for insurance problems. Although Hawai‘i has fewer frequent disasters, the global rise in catastrophe losses and a major local event – the Maui wildfires of 2023 – sent shockwaves through its insurance market. Insurers, suddenly viewing Hawaii as a potential “wildfire state,” dramatically raised rates. Many condo associations in Hawai‘i saw 300% to 600% increases in their master policy premiums in one year. A few unlucky buildings faced near-unimaginable jumps of 900% to 1,300%. These skyrocketing costs have forced some condos to accept less than 100% property coverage (because full coverage was unaffordable), which puts owners in a bind – if the building isn’t fully insured, mortgage lenders may refuse to lend on units. In fact, roughly 400 Hawaiian condo associations are now carrying partial coverage, effectively blacklisted by lenders until they restore full insurance. Hawaii’s isolated location also means there are very few insurance carriers in the market. One major insurer recently capped its hurricane coverage limit at $10 million per condo policy, even though replacement costs for many high-rises run in the hundreds of millions. As a result, associations must buy expensive excess insurance layers (sometimes costing $1 million+ in premiums) to fill the gap. All these factors have made Hawaii’s “Condoland” an extreme case of the insurance crunch.

- Gulf Coast and Tornado Alley States: Other regions with high catastrophe exposure are also seeing above-average increases. Louisiana currently has the highest average home insurance rates in the nation – projected around $7,800 in 2024 (up 23% in one year) – due to repeated hurricanes and multiple insurers going bankrupt or leaving since 2020. Texas has faced rising premiums from hurricanes on the Gulf Coast and hailstorms inland. Oklahoma (frequent tornado and hail) and even inland states like Maine and Michigan (which have their own weather and market challenges) were forecasted to see double-digit percentage insurance jumps in 2024. In short, while Florida and California make headlines, many states are grappling with insurance inflation fueled by weather extremes and insurance industry stresses. Board members should stay informed on their state’s insurance climate, as regional factors (from wildfire mitigation regulations to hurricane deductibles) will impact their policy options and costs.

Deferred Maintenance and Insurance: The Critical Connection

Insurers evaluate the condition and upkeep of buildings during underwriting. A condo property that shows signs of neglect – for example, an old roof far past its useful life, decades-old elevators, corroded plumbing, or cracks in the structure – raises red flags. The insurer sees a higher likelihood of something going wrong (a leak, a fire, even a collapse), which means higher expected claims. As a result, the carrier will either quote a very high premium or decline coverage for poorly maintained properties. Many associations are learning this the hard way. In Honolulu, as mentioned, one aging high-rise with a history of water leak claims lost its insurance – no standard carrier would renew it – and the association had to pay over 10 times more for a new policy on the specialty market. Similarly, insurers across the country are asking more questions about building upkeep. They may require inspections or detailed questionnaires about the roof age, the last time plumbing was updated, fire safety systems in place, and any known structural issues.

Preventative maintenance is therefore not just about preserving property values and safety – it’s now part of controlling insurance costs. Board members should invest in fixing small issues before they become big claims. As one risk management guide put it, “Quickly address small issues” – if you repair that minor leak or faulty wiring promptly, you might prevent a major incident that would have generated an insurance claim. Reducing the frequency of claims is key: insurers often say “frequency leads to severity”, meaning multiple small claims can spook underwriters almost as much as one large claim. A proactive board will implement regular inspections and preventive maintenance schedules for critical components like the roof, HVAC, plumbing, electrical systems, and drainage. These actions extend the life of the property and lower the likelihood of insurance claims due to avoidable problems (like a burst pipe from an ancient water heater).

A dramatic illustration of deferred maintenance consequences was the Champlain Towers South collapse in Florida. Years of postponed structural repairs led to tragedy in 2021. In the aftermath, not only did Florida enact strict maintenance and reserve laws, but insurers everywhere took note. Now, underwriters are far more diligent about checking an association’s maintenance history and future repair plans. Some carriers even ask for proof of recent engineering reports or building inspections for older high-rises. Deferred maintenance now carries a financial penalty: associations that haven’t kept up may face steep premium hikes or non-renewals, whereas those that can demonstrate a handle on maintenance might find more willing insurers.

The lesson for boards is clear: Invest in upkeep to invest in insurability. The cost to re-seal a roof or replace corroded piping now may be far less than the compounded costs of water damage, special assessments, insurance claims, and premium surcharges later. Plus, a well-maintained property is safer for residents and preserves the community’s reputation and value. Board members should cultivate a culture of preventative maintenance, not “patchwork after failure,” to keep both the property and its insurance coverage healthy.

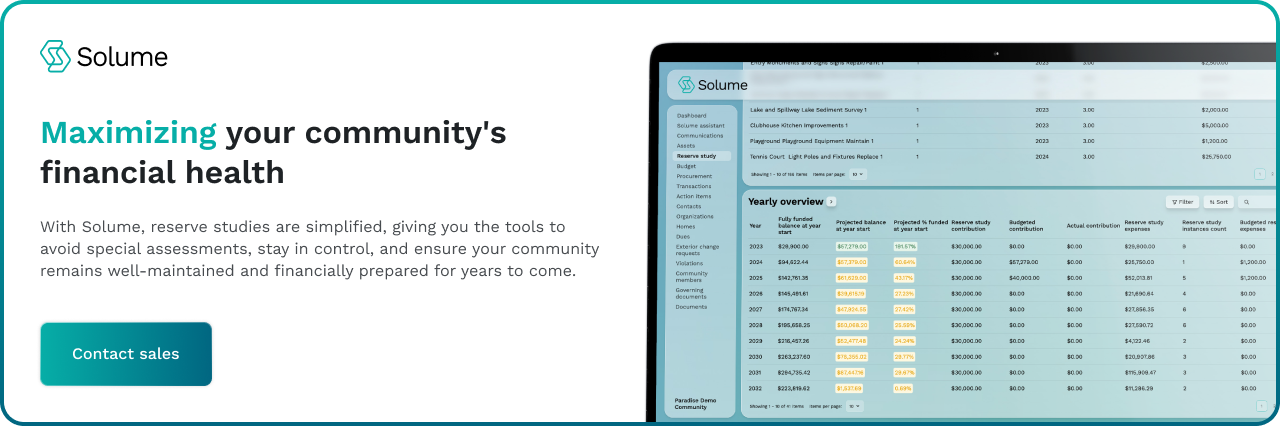

The Importance of Reserve Studies and Structural Integrity

One of the best tools a condo board has to address long-term maintenance is a reserve study – and it turns out reserve studies can also impact insurance. A reserve study is a professional assessment of the common elements (roof, structure, mechanical systems, etc.) that estimates their remaining life and how much money should be reserved for future repairs or replacements. Traditionally, reserve studies were about budgeting for repairs. But today, they are also a signal of financial and structural health that lenders and insurers pay close attention to.

Insurance underwriters increasingly review an association’s reserve study (or the lack of one) when evaluating risk. According to reserve specialists, having a current, professionally conducted reserve study could mean the difference between getting affordable insurance or no coverage at all in the tightening insurance market. Insurers use reserve studies to gauge if a condo is setting aside funds for upkeep and if critical components are on track to be repaired before they fail. An up-to-date reserve study tells the insurer that “this association is proactive, financially stable, and committed to maintenance,” which lowers the perceived risk of future large claims. On the other hand, inadequate reserves or an out-of-date study can be a red flag. Insurance carriers have been known to charge higher premiums or even deny coverage for communities with underfunded reserves, fearing that deferred maintenance will lead to costly disasters. In short, a solid reserve study and funding plan can make your community a better insurance risk.

Reserve studies are also becoming mandatory in more places. In Florida, new legislation enacted after the Surfside collapse now requires a Structural Integrity Reserve Study (SIRS) for condo buildings three stories or higher. By December 31, 2024, every such Florida condo had to complete a SIRS, and starting in 2025, associations can no longer waive or reduce reserve contributions for certain critical structural items (like roofs, load-bearing walls, foundations, waterproofing, and others). The law essentially forces associations to fully fund reserves for structural components so that these elements get repaired on schedule. This has been challenging – many Florida condos historically waived reserves, and now they face large budget increases to meet the new mandate. But the intent is to prevent another tragedy and ensure buildings remain safe as they age. Adhering to a reserve study in this way can also ultimately help with insurance: a building with a properly funded SIRS is far less likely to suffer a catastrophic failure, making it a safer bet for insurers (and a requirement for loan eligibility with Fannie Mae and Freddie Mac as well).

Beyond Florida, other states are considering stricter reserve requirements, and even where not mandated by law, Fannie Mae and Freddie Mac have their own requirements. The federal mortgage giants now often require evidence that a condo has adequate reserves (generally meaning 10% of the budget allocated to reserves or a recent reserve study showing proper funding) for a loan to be approved. They also will not back mortgages in buildings with known structural issues or significant deferred maintenance. This means if a board neglects reserve funding, unit owners may be unable to sell or refinance because buyers can’t get loans – a harsh consequence that boards must consider. The bottom line: maintaining robust reserves isn’t just a best practice – it’s becoming essential for insurance, financing, and the financial health of the community.

For board members, prioritizing regular reserve studies (experts often recommend updating them every 3–5 years) and then following through on funding the reserves is one of the smartest moves to mitigate risk. It sends a message to insurers and lenders that your association is forward-looking and responsible, and it keeps the property in good repair, which, as discussed, prevents many insurance headaches. In practical terms, adhering to a reserve study means you won’t be caught by surprise when a major component needs replacement – and you (and your insurer) can be confident that the roof won’t collapse because you lacked the money to fix it. In contrast, skipping reserve contributions to keep dues low is a false economy that can lead to large special assessments, denied insurance, or worse.

How Solume Helps Associations Strengthen Their Insurance Position

Solume's Reserve Study Management tools are designed to help communities not only comply with legal requirements like Florida’s SIRS mandate, but also to document and demonstrate their proactive approach to long-term maintenance. By providing a digital platform for tracking capital improvement timelines, completed repairs, engineering reports, and funding levels, Solume helps associations build a verifiable history of responsible maintenance.

This kind of transparency and accountability can be a powerful tool when working with insurance carriers because deferred maintenance is a major contributor to insurance rate hikes, communities that use Solume can make the case that their association is well-managed and at lower risk. With a centralized, up-to-date reserve study platform, associations can avoid being lumped in with higher-risk properties during blanket state rate hikes.

In short, Solume not only helps ensure legal compliance and internal planning—it may also serve as a strategic asset to keep insurance premiums in check by offering carriers a clear, defensible record of preventive care and financial responsibility.

What Board Members Should Consider for Insurance Coverage

In this challenging insurance environment, condo board members need to be proactive and strategic about managing their insurance program. Here are key considerations and steps for boards:

- Carry the Right Types of Coverage: Make sure your association has all the essential insurance policies in place. The main types of coverage condo and HOA boards should maintain include:

- Property Insurance (Hazard Insurance): Covers damage to the building structure and common areas from events like fire, wind, hail, burst pipes, etc. This typically insures the roof, exterior, hallways, lobbies, and any common facilities (pools, clubhouses, etc.) owned by the association. Verify that the coverage limit equals the full replacement cost of the property – many lenders (and state laws) require 100% replacement cost coverage. Being underinsured could leave the association unable to rebuild after a disaster and may also violate mortgage requirements.

- General Liability Insurance: Protects the association in case of accidents or injuries on the common property. For example, if a guest slips on an icy sidewalk or someone is hurt by falling debris, liability insurance covers legal fees, judgments or settlements. Boards should ensure their liability limits are high enough (many carry at least $1 million per occurrence, often more) to protect the community’s assets in a serious incident.

- Directors and Officers (D&O) Liability: This coverage is vital for board members. D&O insurance covers the board and committee members against lawsuits alleging wrongful acts, mismanagement, breach of fiduciary duty, or other errors in their decisions. In today’s climate, boards can be sued over special assessments, maintenance decisions, discrimination claims, and more – D&O insurance will pay for the legal defense and any indemnification, so that board members’ personal assets aren’t at risk. Every condo/HOA board should have a D&O policy in place and ensure they understand any exclusions on it.

- Crime / Fidelity Bond: Protects the association’s money against theft or fraud. Most associations handle significant funds, and a fidelity bond (employee dishonesty coverage) will reimburse losses if someone embezzles HOA funds or scams the association. Many states or governing documents actually require a fidelity bond equal to a certain percentage of the association’s reserves and operating funds. This coverage gives peace of mind that the community’s funds are safeguarded from internal theft or financial misconduct.

- Workers’ Compensation: If the association has any employees (maintenance staff, etc.), workers’ comp insurance is usually legally required. Even if you have no direct employees, some states mandate a workers’ comp policy for condo associations or a minimum policy in case volunteers get injured. Verify your state’s requirement. Workers’ comp covers medical bills and lost wages if an employee is injured on the job, thus shielding the association from those claims.

- Flood or Earthquake Insurance (if needed): Standard property insurance policies do not cover flood damage or earthquake damage. If your property is in a FEMA-designated flood zone or a high-risk earthquake region, the board should strongly consider obtaining a separate flood insurance policy or earthquake policy. For example, condos in coastal Florida or along rivers may need flood coverage to protect against storm surge or flooding (sometimes this is required by lenders). Likewise, condo buildings in California or other seismic zones might carry a master earthquake policy to cover major seismic damage (though expensive, it can be crucial in a quake). These disaster-specific policies can be expensive, but board members must weigh the risk – going bare could mean total loss of the property with no recovery funds.

- Umbrella Liability: An umbrella (excess liability) policy provides an additional layer of liability coverage above the primary liability and D&O limits. Given today’s high litigation awards, many associations purchase, say, a $5 million umbrella that would cover catastrophic incidents (like a multi-million-dollar lawsuit from an injury or an extensive property liability claim). Umbrella insurance is relatively cost-effective and can protect the association from the rare but devastating lawsuits that exceed base policy limits.

- Tailor Coverage to Your Community: Every association is different. Review your governing documents to see what insurance the association is obligated to carry versus what owners must insure individually. Condo master policies generally come in three flavors: “bare walls” (covering only the structure and common elements, owners insure all interior finishes), “single entity” (covers structure plus standard unit fixtures but not upgrades), or “all-in” (covers even unit-level improvements). Make sure your policy type aligns with your bylaws and that unit owners know what they need to insure themselves. For instance, if you have a bare-walls policy, owners need robust HO-6 policies to cover drywall, flooring, cabinets, etc., inside their units. The board should communicate these nuances to avoid gaps. Additionally, consider amenities or special circumstances: if your association has features like a marina, a boiler plant, or a childcare facility, there may be specialized coverages (e.g. boiler & machinery insurance, marina liability) to add. An experienced insurance broker can help identify these needs.

- Regularly Review and Update Policies: Insurance is not a “set and forget” item, especially in this volatile market. Boards should review coverage annually with their insurance agent or broker, ideally a few months before renewal. Confirm that your building’s replacement cost is updated so you’re not underinsured (many brokers will do an appraisal or inflation update each year). Also, ensure that any changes in the property or operations are accounted for – for example, if you built a new playground or started renting out the clubhouse for events, notify your agent to adjust coverage. Keeping the insurer informed helps avoid surprises; failure to update values or property changes could result in huge jumps at renewal when the insurer eventually adjusts it. One noted issue is that, with recent inflation, some associations didn’t realize their property values had surged – they were caught off guard by doubling premiums when insurers updated their valuations (hilbgroup.com). To avoid this, maintain open communication with your insurer/broker throughout the year.

- Budget for Premium Increases: In the current climate, boards should expect insurance costs to rise each year and budget accordingly. It’s prudent to build a cushion for insurance in the annual budget – some associations project 10-20% increases to be safe, depending on their region and loss history. In a national survey, more than half of communities said they had to raise dues or levy a special assessment to cover an insurance premium spike programbusiness.com. To prevent emergency measures, incorporate anticipated increases into your planning (e.g. gradually increasing contributions to the insurance budget line, or maintaining a contingency fund). Also, consider timing: if your policy renews mid-year, a sharp rise could hit unexpectedly. Boards may want to get quotes early or lock in multi-year pricing if available. While you can’t control the insurance market, you can prepare your community for its effects so that essential coverage is never in jeopardy due to lack of funds.

- Explore Higher Deductibles or Alternative Options: One lever to control premium cost is the policy deductible. Higher deductibles (the out-of-pocket amount the association pays on a claim) usually mean lower premiums. If your community has strong reserves and can comfortably cover a larger deductible, it may make sense to raise deductibles to save on annual premiums. For example, increasing the property policy deductible from $5,000 to $25,000 could yield a significant premium discount. However, this strategy only works if the association can truly afford to pay that deductible when a loss happens – otherwise, you’re trading short-term savings for potential financial strain after an incident. Some associations also consider captive insurance programs or pooling with other associations as creative ways to lower cost, though these are complex and require professional guidance. Always discuss the pros/cons with your insurance advisor before making such moves.

- Mitigate Risks to Lower Premiums: Work on risk management improvements that can make your community safer – insurers may reward these efforts. Depending on your area’s risks, this could include projects like installing a monitored fire alarm or sprinkler system, adding security cameras and lighting, hardening the building against windstorms (hurricane shutters, fortified roofing), or clearing brush to create a wildfire defensible space. Some insurers offer credits or lower rates if you meet certain loss prevention criteria (for instance, Florida insurers giving wind mitigation credits for buildings that have updated roof attachments or impact-resistant windows). Even if direct discounts are modest, these mitigations reduce the chance of a large loss, which in the long run helps keep premiums down. A simple but often effective step is requiring unit owners to have their own insurance – specifically, encourage or mandate that each owner carry an HO-6 policy with Loss Assessment coverage. Loss assessment coverage on an owner’s policy can pay that owner’s share of an HOA deductible or special assessment after a major insured loss. If all owners carry it, the association might opt for a higher master policy deductible (knowing owners have coverage for it), thereby lowering the master policy premium. Likewise, by updating your bylaws or rules, you can shift certain responsibilities to owners (for example, require owners to maintain their own plumbing fixtures or HVAC units, and make them liable if lack of maintenance there causes damage). Updating older governing documents to clearly delineate what the association covers vs. what owners cover can prevent the association’s insurance from being used (and premiums affected) for avoidable, unit-specific issues. As the Hilb Group advises, distributing risk more fairly – so that careless unit owners’ actions don’t drive up costs for everyone – is an important part of controlling premiums.

- Consult Professionals and Compare Quotes: Don’t go it alone. Engage an insurance broker or agent who specializes in community associations. They can not only shop the best rates among multiple carriers, but also advise on coverage nuances and risk management moves. Given the volatility, it’s wise to seek quotes from multiple insurers each year (or use a broker who can) to ensure you’re still getting a competitive rate. Be mindful that the lowest price isn’t everything – consider the financial strength of the insurer (you need them to be solvent when a disaster strikes) and coverage terms (a cheap policy that, for example, excludes wind or has a very low sub-limit on certain perils might not truly protect you). Boards should also involve their attorney and reserve engineer when needed, especially if updating bylaws for insurance reasons or planning major upgrades that could affect insurance. It really takes a team approach – including an insurance broker, attorney, reserve specialist, property manager, and the board – to navigate these challenges successfully.

- Communicate with Your Members: Lastly, keep your residents informed. Insurance costs and maintenance projects are complex topics, but transparency can help owners understand why their assessments might be rising. Consider holding an insurance workshop or sending a summary to owners about the association’s insurance program: what coverages you have, recent changes in premiums, and how the board is addressing it. When owners realize, for example, that premium spikes are a nationwide issue driven by storms and inflation, and that the board is actively working to mitigate costs through maintenance and shopping coverage, they are more likely to be supportive. It’s also worth educating owners about their personal insurance – encourage them to get HO-6 policies (if not already required) and adequate coverage so that a disaster doesn’t ruin them financially or lead to disputes with the HOA. Informed and engaged owners can even assist the board by reporting maintenance issues early, complying with risk reduction measures (like shutting off water when on vacation to prevent leaks), and voting for necessary document updates or special assessments that improve the community’s insurability.

Conclusion

Condo association insurance is a pressing concern for boards across the country, as premiums climb to unprecedented levels. The increases are being driven by forces often outside any one community’s control – from climate-fueled catastrophes and high rebuilding costs to insurers retrenching from risky markets. At the same time, the condition and management of each condo building does play a role in how insurers respond. Board members who prioritize maintenance, safety, and sound financial planning can make their communities more resilient in this insurance storm. Ensuring your buildings are in good repair (and proving it through reserve studies and inspections) will help contain insurance costs and prevent nasty surprises. Keeping adequate coverage in place, even when expensive, is vital to protect everyone’s investment – but there are steps to optimize coverage and control costs, from raising deductibles to updating your bylaws for better risk sharing.

Though premiums are rising, knowledge and preparation are a board’s best tools. By understanding why rates are up, board members can better explain it to their communities and plan ahead. By knowing which areas (like Florida, California, Hawai‘i) are hardest hit, they can learn from those examples and advocate for any legislative relief or industry changes that might help. And by embracing practices like regular reserve studies, emergency planning, and professional insurance reviews, condo boards can navigate this challenging environment. The road ahead may include difficult decisions – higher fees, special assessments, or major repair projects – but those steps, however unwelcome, may be necessary to keep the property insurable and safe. In the end, a well-maintained, well-insured condo community is a more stable and valuable one. Board members who guide their associations with that long-term perspective will help ensure that today’s insurance challenges are met responsibly, keeping their communities secure against both financial and physical storms.

FAQ

Q1: Why are condo association insurance premiums skyrocketing across the U.S.?

Condo association insurance premiums are skyrocketing nationwide, mainly due to what's called a "hard market" influenced by several factors. Condo association insurance premiums are really on the rise across the country, and this is largely due to what's known as a "hard market." A big reason for the sharp increase in natural disasters like hurricanes, wildfires, and floods. Insurers have been facing a lot of hefty claims from these events, which were once seen as less likely. This creates significant losses for them, and as a result, they become more cautious and raise their premiums. Many insurance companies are also pulling back from high-risk states, forcing condo associations to look for more expensive insurance through alternatives like surplus-line carriers or state-backed options. On top of that, many condo buildings are getting older and may have suffered from years of neglect, which makes insurers wary of offering coverage since they see these buildings as potential liabilities. To top it off, inconsistent regulations across states have created a fragmented insurance market, leading to varying experiences for different communities.

Q2: Which states are most affected by this insurance crisis, and why?

Several states are feeling the brunt of this insurance crisis more than others, some of which you can probably guess:

- Florida: This state is facing a major crisis, especially after recent hurricanes like Ian and Idalia. Condo premiums have skyrocketed, with some doubling, and many insurers are leaving the market altogether. New regulations after the Surfside tragedy require structural inspections and reserve funding, which can result in hefty special assessments for homeowners that can be tens of thousands of dollars each. Plus, over 1,400 Florida condo associations find themselves on Fannie Mae's blacklist because of low reserves or repair issues, hurting property values.

- California: Known for its wildfires, California has seen devastating premium hikes, some as high as 300-400% for homeowner associations. Many insurers are now either halting new policies or not renewing existing ones in high-risk areas. Wildfire damage coverage can also be surprisingly limited, often only covering a portion of the property value. Earthquake risks add to the concern, but for now, the focus is mainly on wildfires.

- Hawai‘i: The recent Maui wildfires have made Hawai‘i a recent addition to the list of high-risk areas, with some businesses seeing their master policy premiums spike anywhere from 300% to over 1,300%! Many condo associations are finding themselves unable to secure complete property coverage and facing blacklisting from lenders (😡). With limited insurance options and capped hurricane coverage, homeowners often have to rely on costly excess insurance.

- Gulf Coast and Tornado Alley States: States like Louisiana have the highest home insurance rates due to a history of hurricanes. In Texas, premiums are increasing thanks to hurricanes and hailstorms. Other states like Oklahoma, Maine, and Michigan are also experiencing double-digit hikes in insurance costs due to extreme weather conditions.

Q3: What types of insurance coverage are essential for condo and HOA boards to maintain?

It's necessary for condo and HOA boards to have the right insurance coverage, and here are some essential types they should consider:

- Property Insurance (Hazard Insurance): This covers damage to the building and common areas from things like fire, wind, and bursts from pipes. It’s important for the coverage limit to be at least 100% of the full replacement cost, as required by lenders and state laws.

- General Liability Insurance: This protects the association against lawsuits for accidents or injuries that occur on common property, like slips or falls. High liability limits (at least $1 million per occurrence) are important to cover potential legal fees and settlements.

- Directors and Officers (D&O) Liability: Unless your board wants a good challenge, this is crucial for safeguarding board and committee members against lawsuits related to management decisions or mismanagement. It covers their legal defense and can protect their personal assets.

- Crime / Fidelity Bond: This protects the association’s funds from theft or fraud, whether committed by employees or board members (this actually happens more than you'd expect). Many states require this coverage, generally calculated based on a percentage of reserves and operating funds.

- Workers' Compensation: If the association has employees, this is legally required.Some states even require it for associations without direct employees, covering medical expenses and lost wages for injured volunteers.

- Flood or Earthquake Insurance: Regular property policies typically don’t cover these events. If the property falls within a FEMA-designated flood zone or is in a high-risk earthquake area, separate policies are essential, even if they come at a premium.

- Umbrella Liability (Excess Liability): This provides extra liability coverage above the primary policies, serving as a safeguard against significant claims.

By understanding and maintaining these essential coverages, condo and HOA boards can better protect their communities and members. Insurers are facing major losses, making them wary of the high potential for damage and increasing their own reinsurance costs. Consequently, many large carriers are pulling out of high-risk states, forcing associations to turn to more expensive and limited "surplus-line" or state-backed carriers. Additionally, the aging building stock across the country, coupled with years of deferred maintenance and poor reserve planning by many associations, makes insurers more hesitant, viewing these properties as direct liabilities prone to costly issues like burst pipes. The situation is exacerbated by inconsistent and often reactionary state-level regulatory frameworks, creating a "patchwork of laws" that leads to confusion and uneven insurance outcomes.

Q4: How do reserve studies and structural integrity impact insurance and financing for condo associations?

Reserve studies and structural integrity have become critical factors influencing both insurance costs and financing eligibility for condo associations. A reserve study is a professional assessment that estimates the remaining life of common elements (roof, structure, HVAC, etc.) and calculates the funds needed for their future repair or replacement.

Impact on Insurance:

Risk Assessment: Insurance underwriters increasingly review an association’s reserve study to gauge financial stability and commitment to maintenance. A current, professionally conducted study signals that the association is "proactive, financially stable, and committed to maintenance," lowering the perceived risk of future large claims.

Premium & Coverage: Adequate, well-documented reserves can lead to more affordable insurance or even be the difference between getting coverage or being denied. Insurers charge higher premiums or deny coverage to communities with underfunded reserves, fearing that deferred maintenance will result in costly disasters.

Claims Frequency: Proactive maintenance, often guided by reserve studies, helps reduce the frequency of small claims, which insurers view as a red flag ("frequency leads to severity"), thushelping control premiums long-term.

Impact on Financing:

Lender Requirements: Post-Surfside, lenders like Fannie Mae and Freddie Mac scrutinize reserve data more closely. They often require evidence of adequate reserves (e.g., 10% of the budget allocated to reserves or a recent study showing proper funding) for mortgage approval.

"Blacklisting": Inadequate reserves or unresolved structural issues can disqualify a community from conventional loan eligibility. For example, over 1,400 Florida condo associations are "blacklisted" by Fannie Mae, meaning buyers cannot get mortgages, which further depresses property values.

Sales and Refinancing: If a board neglects reserve funding, unit owners may be unable to sell or refinance their properties because buyers cannot secure loans, creating a significant financial bottleneck for the entire community.

Mandatory Requirements: In Florida, new laws require Structural Integrity Reserve Studies (SIRS) for buildings three stories or higher by December 31, 2024, and associations can no longer waive or reduce reserve contributions for critical structural items starting in 2025. This ensures full funding for structural components, preventing catastrophic failures and improving insurability and loan eligibility.

In essence, robust reserve planning, supported by regular reserve studies, demonstrates a responsible approach to property maintenance, which is now essential for securing favorable insurance terms and maintaining marketability for units.

Q5: What are the consequences for condo associations that are "blacklisted" by lenders or carrying less than 100% insurance coverage?

When condo associations are "blacklisted" by lenders or carry less than 100% insurance coverage, it triggers severe financial and market consequences for the entire community and individual unit owners:

Lending Restrictions and Reduced Marketability: Lenders like Fannie Mae and Freddie Mac require 100% coverage and adequate reserves for mortgage approval. If an association falls short, it can be "blacklisted," making units ineligible for conventional loans. This means potential buyers cannot obtain mortgages, forcing them to walk away from deals or requiring cash purchases. This dramatically shrinks the pool of potential buyers, leading to units sitting on the market longer, declining property values, and making it nearly impossible for existing owners to sell or refinance their units.

Financial Instability and Exposure to Risk: Carrying less than 100% replacement coverage means that if a major disaster occurs, there might not be enough funds to rebuild the property. This leaves the association and unit owners vulnerable to significant financial hardship, potentially requiring massive special assessments to cover the rebuilding deficit, or worse, making the property unrecoverable.

Increased Costs and Limited Options: Associations might be forced to seek coverage on the expensive "secondary market" (surplus-line carriers) when standard carriers refuse to insure them. These policies are vastly more expensive and may come with major limitations or higher deductibles, further straining association finances.

Legal and Compliance Issues: Failure to maintain adequate coverage or reserves can lead to violations of state laws, governing documents, and mortgage requirements, exposing the association to potential legal risks and disputes.

In "Condoland," as seen in Hawai‘i with roughly 400 associations carrying partial coverage, this situation directly impacts property values and the ability of residents to engage in basic real estate transactions.

Q6: What proactive measures can condo boards take to mitigate rising insurance costs and improve their community's insurability?

Condo boards can take several proactive and strategic measures to mitigate rising insurance costs and enhance their community's insurability:

Prioritize Preventative Maintenance: Regularly inspect and maintain critical components like roofs, HVAC, plumbing, electrical systems, and drainage. Addressing small issues promptly prevents them from becoming large, costly claims, as "frequency leads to severity." This proactive approach signals to insurers that the association is actively managing risk.

Conduct and Fund Reserve Studies: Obtain a professional reserve study every 3-5 years (or more frequently if significant changes occur) and adhere to its funding recommendations. A current, well-funded reserve study demonstrates financial stability and a commitment to long-term upkeep, which insurers and lenders value. New legislation, like Florida's SIRS law, makes this mandatory for certain buildings, preventing deferred maintenance and ensuring structural integrity.

Carry Comprehensive and Adequately Valued Coverage: Ensure all essential insurance types (Property, General Liability, D&O, Crime/Fidelity, Workers' Comp, Flood/Earthquake if needed, Umbrella Liability) are in place. Critically, verify that property insurance covers 100% of the replacement cost and that liability limits are sufficient.

Regularly Review and Update Policies: Annually review coverage with an experienced insurance broker, ideally months before renewal. Update replacement costs to account for inflation and inform the agent of any property or operational changes to avoid being underinsured or facing surprises at renewal.

Budget for Premium Increases: Anticipate and budget for annual insurance cost increases (e.g., 10-20% cushion) to prevent emergency special assessments or drastic dues hikes.

Explore Higher Deductibles (with caution): If the association has strong reserves, consider increasing policy deductibles to lower annual premiums. This should only be done if the association can comfortably cover the higher out-of-pocket amount during a loss.

Mitigate Risks with Property Improvements: Invest in risk reduction projects based on regional threats (e.g., monitored fire alarms, security cameras, wind hardening, wildfire defensible space). Some insurers offer credits for such efforts, and these improvements reduce the likelihood of major claims.

Update Bylaws and Encourage Owner Insurance: Review and update older governing documents to clearly delineate association vs. owner responsibilities and potentially shift certain liabilities (e.g., for unit-specific plumbing issues) to unit owners. Strongly encourage or mandate that unit owners carry HO-6 policies with Loss Assessment coverage, which can cover their share of a master policy deductible or special assessment, allowing the association to consider higher master policy deductibles.

Consult Professionals and Compare Quotes: Engage an insurance broker specializing in community associations to shop rates and advise on coverage. Also, involve attorneys and reserve engineers when making significant decisions related to insurance or major upgrades. Seek multiple quotes annually to ensure competitive rates.

Communicate with Members: Transparently inform residents about rising insurance costs, the reasons behind them, and the proactive steps the board is taking.Educate owners about the importance of their personal HO-6 policies. Informed owners are more likely to support necessary assessment increases and comply with risk reduction measures.

Q7: How does deferred maintenance directly impact an association's ability to obtain affordable insurance?

Deferred maintenance is a major red flag for insurance carriers and directly contributes to skyrocketing premiums or even denial of coverage. Insurers operate on the principle that "frequency leads to severity," meaning a history of multiple small claims (often stemming from neglected maintenance like minor leaks) makes them wary of larger, more expensive incidents waiting to happen.

When essential systems like roofs, plumbing, electrical systems, and HVAC are not regularly maintained and repaired, they are prone to failure, leading to frequent claims. Underwriters perceive this lack of long-term planning and upkeep as a direct liability. They see an under-maintained building as having a much higher risk of catastrophic failure or significant, costly repairs. As a result, associations with deferred maintenance or a history of related claims are often charged significantly higher premiums (e.g., one Hawaii condo's premium jumped from $30,000 to $375,000 due to being "riddled with water claims"). In severe cases, carriers may refuse to renew policies, forcing associations onto more expensive secondary markets with limited coverage.

The tragic Surfside collapse highlighted the dangers of deferred maintenance, prompting insurers and lenders to intensify their scrutiny of a community's physical and financial health, making a clear, defensible record of preventive care and financial responsibility (often demonstrated through reserve studies and Solume's management tools) crucial for securing affordable coverage.

Q8: What role do technology platforms like Solume play in helping condo associations navigate the insurance crisis?

Technology platforms like Solume play a crucial role in helping condo associations navigate the insurance crisis by providing tools for proactive long-term maintenance planning, financial transparency, and risk documentation.

Specifically, Solume's Reserve Study Management tools are designed to:

Ensure Legal Compliance: Help communities comply with evolving legal requirements, such as Florida's Structural Integrity Reserve Study (SIRS) mandate.

Centralize Documentation: Provide a digital platform for tracking critical information like capital improvement timelines, completed repairs, engineering reports, and funding levels. This eliminates reliance on outdated PDFs and missing spreadsheets, creating a "digital command center" for capital planning.

Demonstrate Proactive Management: Build a verifiable history of responsible maintenance and financial stability. This transparency and accountability are powerful assets when negotiating with insurance carriers.

Build a Defensible Risk Profile: By showcasing consistent, well-managed care and transparent financial records, associations can make a case that they are lower risk, even if they are in a higher-risk region.This allows them to "stand out" from the default risk pool and potentially avoid being lumped in with higher-risk properties during blanket state rate hikes.

Provide Leverage for Negotiations: With strong records of proactive maintenance and a current reserve study, associations gain leverage to push back, negotiate better terms, or at least avoid the steepest premium increases from insurers.

Facilitate Informed Decision-Making: Enable boards to make "better, faster, and more defensible decisions" by providing easy access to all relevant capital planning data, helping them stay ahead of potential hurdles and protecting the community from catastrophic failures.

In essence, Solume acts as a strategic asset to keep insurance premiums in check by offering carriers a clear, defensible record of preventive care and financial responsibility, while also ensuring internal planning and legal compliance.