Bookkeeping isn't often a word that stirs much excitement. But if you’re part of a Condo or small HOA board, bookkeeping is one of the most crucial parts of your community’s stability. It’s what keeps lights on in the clubhouse, bills paid on time, and homeowners confident that their dues are being handled responsibly.

Most small associations don’t have full-time accountants or property management companies managing their books. That’s where simple, consistent bookkeeping makes the difference between a board that reacts to problems and one that prevents them.

Key Takeaways

- Accurate bookkeeping protects your HOA from financial surprises and ensures compliance.

- The right software streamlines bookkeeping and saves hours of manual work.

- Small HOAs can manage their finances as efficiently as large communities with Solume’s all-in-one platform.

- Financial transparency builds trust and strengthens community relationships.

Why Bookkeeping Is Vital for Small HOAs

Understanding Financial Obligations

Every HOA, no matter how small, has legal and fiduciary responsibilities. Bookkeeping ensures accurate financial transactions, organized financial records, and full compliance with tax filings and annual budgets. It also gives your board members a clear line of sight into where the money’s going and why.

Good bookkeeping is also the key to financial transparency. When homeowners understand how their dues are spent, trust grows. (Let's be honest - when things open on time or look good). When they don’t, gossip emerges. Accurate books make it easy to track everything—from Accounts Payable to reserve funds—and ensure that each dollar supports the community’s goals.

How Financial Transparency Helps HOAs

Financial transparency doesn’t just build trust; it creates engagement. When members see the board managing funds responsibly, they’re more likely to vote, volunteer, and participate. Transparent financial statements also help in decision-making during board meetings, ensuring everyone operates from the same data.

For example, a well-maintained balance sheet can show whether the HOA can afford that new fence or if the reserve funds are too low to cover future repairs. Knowledge leads to more informed (smarter) decisions, and smarter decisions protect the value of every home.

Essential Financial Tools for HOA Management

The Role of Bookkeeping Software

Manual spreadsheets might work for a year or two—but eventually, mistakes happen. That’s why small HOAs benefit from bookkeeping software that handles bank account reconciliation, balance sheet creation, and financial reporting automatically.

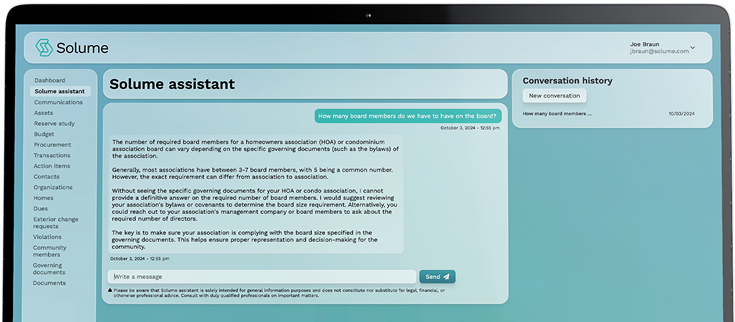

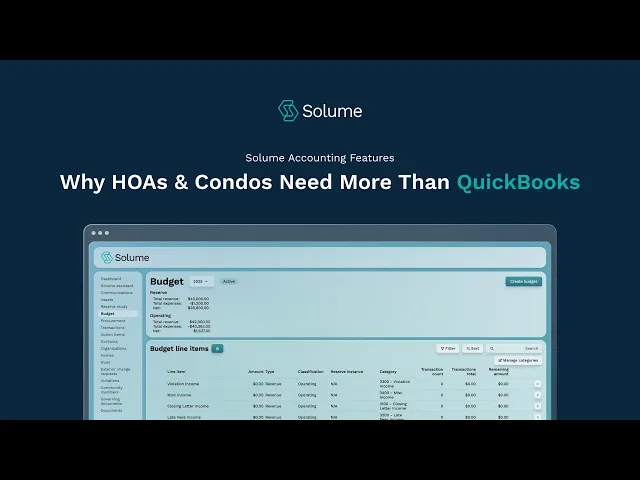

Many small associations use tools like QuickBooks because they’re familiar. But the issue with traditional accounting tools is that they treat bookkeeping as a side function, not part of the HOA’s daily management. Solume changes that. It’s the only HOA management software designed to make accounting a built-in feature of community management. Everything connects—financial data, reserve fund management, dues collection, and even work orders.

Key Features to Look For

When evaluating bookkeeping software, look for features that make your board’s life easier:

- Expense tracking and payment processing for vendors and contractors.

- Built-in support for tax documents and financial reporting.

- Secure integration for bank statements and credit cards.

- Strong data security (Solume hosts data on AWS for top-level protection).

- Reliable customer support that actually knows HOAs.

The right software turns bookkeeping from a constant headache into something that quietly runs in the background—steady, accurate, and easy to trust.

Best Practices for HOA Financial Operations

Good bookkeeping is about rhythm; doing the right things consistently over time. Here are a few best practices every Condo or small HOA should follow:

- Track Accounts Receivable, Accounts Payable, and maintenance costs consistently.

- Reconcile bank statements monthly to catch discrepancies early.

- Keep a detailed chart of accounts so financial records are easy to navigate.

- Maintain and monitor reserve funds for capital projects or future repairs.

- Collaborate with property managers or a bookkeeper for accuracy and oversight.

A reliable bookkeeping rhythm gives your associations confidence and control. It also keeps the board compliant with state laws, tax filings, and reporting standards.

How Solume Simplifies HOA Financial Management

Advantages of Solume for Small HOAs

For small HOAs, financial management can feel overwhelming. Solume simplifies it. The platform brings together bookkeeping services, reserve fund management, and day-to-day financial operations into one clean condo or HOA software.

Whether you’re handling vendor payments, preparing your annual budget, or reviewing your financial statements, Solume streamlines every step. Solume can fully replace tools like QuickBooks for community accounting while also serving as an all-in-one management platform. Instead of juggling separate systems for finances, maintenance, and communication, boards can handle everything—from accounting and reserves to work orders and member updates—in one place.

Boards can even create side-by-side budget scenarios to forecast unexpected costs or plan future capital projects. That level of visibility was once only available to large communities—but now small HOAs can operate with the same precision.

Why Solume Is the Right HOA Management Solution

Solume isn’t just software; it’s support. Emotional support 😂😩😂😩? Our customer service team is based in the U.S., and we partner with property managers and bookkeeping professionals who know the industry inside and out. From setup to training, the experience is designed to eliminate the learning curve most platforms struggle with.

Other property management software may offer piecemeal solutions. Solume is a complete ecosystem. HOA management software that unifies financial reporting, reserve fund tracking, and community management under one secure, intuitive platform.

Maintaining Financial Health in Your HOA

Strong bookkeeping means more than staying organized—it’s how you maintain your community’s financial health long-term.

Boards that invest in proper bookkeeping services and accounting tools save money in the long run by avoiding late fees, tax errors, and unnecessary maintenance fees. They also make tax season painless, since all financial transactions, bank statements, and supporting documents are already in order.

If your HOA or condo association is struggling to stay on top of financial records, it may be time to upgrade. Solume gives you the control, accuracy, and visibility your community deserves.

Good bookkeeping isn’t about perfection—it’s about consistency, clarity, and confidence. With the right tools, your HOA or condo association can run like a business and feel like a community.

Top FAQs About Bookkeeping for Small HOAs (Answered)

1. What does bookkeeping for a small HOA actually involve?

Most small HOAs think bookkeeping means "balancing a checkbook." It’s not. It’s recording every transaction that shapes the HOA’s finances and linking those transactions to the community's needs. Dues, maintenance fees, vendor payments, insurance, and utilities—each line tells a story about how your board manages the entire community.

Good bookkeeping helps HOA board members make informed decisions, reduce financial risk, and maintain trust among homeowners. Poor bookkeeping leads to confusion, frustration, and tough questions no one wants to answer at the annual meeting.

2. Do small HOAs really need a bookkeeper, or can volunteers handle it?

Volunteer bookkeeping works until it doesn’t. It’s not about trust—it’s about continuity. Every time a treasurer moves, burns out, or forgets their login, the next person inherits disorganized records.

You don’t need a full-time accountant, but you do need consistency. That’s why many small homeowner associations hire Accounting Services or use software like Solume to automate record-keeping, improve accuracy, and simplify tax preparation. Keeping reliable financial information accessible is what separates healthy communities from chaotic ones.

3. What’s the difference between bookkeeping and accounting in an HOA?

Bookkeeping records what happened. Accounting explains what it means. Bookkeeping captures every invoice, deposit, and payment; accounting interprets that data to show whether your HOA is solvent and sustainable.

Bookkeeping handles bank statements, Accounts Payable, and Accounts Receivable. Accounting produces your Balance Sheet, Income Statement, and financial reporting. Both are vital to sound financial planning. Even without a CPA, small HOAs can maintain accurate accounting with a strong system and consistent recordkeeping.

4. How should small HOAs manage their bank accounts and reserve funds?

Every HOA should maintain two accounts: an operating fund for daily expenses and a reserve fund for future capital projects. Mixing them invites risk.

Reserve funds are for roofs, roads, and structural repairs—not landscaping or new furniture. When you dip into reserves for short-term fixes, you’re gambling with the future. Protect those funds through clear documentation and regular reconciliation to ensure financial health across fiscal years.

5. What bookkeeping method should a small HOA use—cash or accrual accounting?

Cash accounting is simple: you record money when it moves. Accrual accounting is smarter: it records them when they’re earned or owed. Accrual accounting gives boards a more realistic picture of cash flow and long-term obligations, especially for large projects or multi-year budgets.

For most small HOAs, accrual accounting makes it easier to see the true financial position, but simplicity sometimes wins for self-managed boards. Choose the method that aligns with your financial matters and ensures accurate reporting capabilities.

6. How often should financial statements be reviewed by the board?

Monthly. Waiting until the year-end report is asking for surprises.

Review the Balance Sheet, Income Statement, and Cash Flow Statement regularly. Verify that payments were processed, dues were received, and reserve funds match the plan. When HOA Board members review these reports consistently, they strengthen financial transparency and improve decision-making across the entire community.

7. What’s the most common bookkeeping mistake small HOAs make?

No documentation. Missing invoices and mystery charges cause mistrust fast. Every transaction should have a record—a receipt, a work order, or a digital note of approval.

Modern boards use expense management tools to track payments, automate approvals, and connect bank feeds to avoid manual data entry errors. The more organized your bookkeeping, the smoother your audits, reports, and tax returns will be.

8. What software should small HOAs use for bookkeeping?

QuickBooks can handle small business accounting, but it doesn’t fit how HOAs operate. You can track bank accounts and produce financial statements, but it won’t manage member dues, vendor bids, or maintenance requests.

Solume was built for this. It replaces QuickBooks and legacy HOA management companies by combining accounting features, integration capabilities, and reserve study tools into one modern solution. With expense tracking, payment processing, and automated reporting capabilities, it delivers ease of use and security measures designed for community associations.

9. How can small HOAs prevent fraud or misuse of funds?

Build internal controls. Require dual signatures or approvals for every major expense. Reconcile bank accounts monthly and keep those reports accessible to multiple board members.

Solume strengthens these safeguards with digital tracking that ensures every transaction is visible. Transparency deters misuse and protects the association’s reputation. Whether managing a small HOA or larger communities, clear policies and consistent oversight make all the difference.

10. When is it time to upgrade from spreadsheets to professional bookkeeping software?

When the numbers start controlling you instead of the other way around, if you’re spending hours matching invoices or sending payment reminders, that’s time you’ll never get back.

Professional bookkeeping software automates payment tracking, expense management, and budget tracking—reducing time wasted on repetitive data entry. Once your HOA grows beyond 20 homes or manages significant reserve funds, upgrading becomes an important task in maintaining accurate accounting and financial stability.

Expert Takeaway

Bookkeeping isn’t about perfection—it’s about precision and predictability. Small HOAs and condo associations don’t need corporate finance teams; they need a system that simplifies financial planning, supports secure data, and provides confidence in every number.

That’s exactly why Solume exists: to bring clarity, security, and control to small and large HOAs alike. Its integrated accounting features, user-friendly design, and strong security measures make it one of the best HOA accounting software platforms for real communities.

When your financial records are clean, your team can focus on what matters most—maintaining a community that runs smoothly and feels like home.